An excellent CIBIL rating is essential in at present’s world, whether or not you want it for monetary necessities, to impress a possible employer, or to get higher insurance coverage choices. So, sustaining and checking your CIBIL rating is a needed and wholesome apply. Having CIBIL rating comes with critical advantages. On this write-up, yow will discover out tips on how to verify CIBIL rating free of charge utilizing your pan card. Learn on to study extra about checking the credit score rating and the way necessary a PAN is.

Each financially unbiased Indian need a good credit score rating. It’s extremely useful for each their personal {and professional} life. An excellent credit score rating will solely be achieved by means of fixed apply of borrowing and good reimbursement habits. One among India’s most trusted credit score bureaus is CIBIL. It collects details about your monetary historical past by recording the reimbursement of loans and bank cards after which gives the credit score rating. CIBIL rankings are primarily based on the monetary historical past of every particular person, and there are a lot of methods to get your CIBIL rating by PAN card. You’ll be able to both request your report from CIBIL’s official web site or get it by means of different banks, NBFCs, or mortgage aggregator web sites like Buddy Mortgage. Click on right here to get your free credit score report.

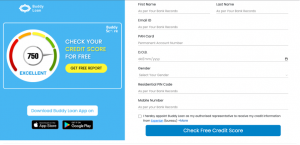

Buddy Mortgage is a web-based mortgage aggregator whose lenders give out loans at a low rate of interest of 11.99%. In addition they have Buddy Rating, a free credit score rating report offering service to make you conscious of your credit score well being or credit score historical past earlier than you apply for a mortgage.

Merely having a CIBIL rating just isn’t sufficient, it ought to be ok for lenders to think about you credit-worthy, however what precisely is an effective credit score rating? Learn on to seek out out extra.

Additionally Learn: Good Credit score Rating However Nonetheless Rejected Mortgage? High 10 Causes For Mortgage Rejections

What is taken into account CIBIL rating?

A CIBIL rating vary is a three-digit quantity that ranges from 300 – 900. The vary gives info on the creditworthiness of a person primarily based on their monetary historical past. The rating you get from CIBIL determines how probably you might be to repay your loans on time. The upper the rating, the higher your probabilities of getting a mortgage authorized even with a decrease rate of interest.

A CIBIL rating mendacity within the vary of 700 – 900 is taken into account one. You will get quicker mortgage approvals, decrease rates of interest, and better mortgage quantities with a rating on this vary. Banks and lenders take into account 750 to be the very best CIBIL rating.

As talked about above, there are a lot of advantages of getting credit score rating, and these are defined under intimately.

Additionally Learn: Know The Totally different Varieties Of Credit score Rating

What are the advantages of CIBIL rating?

Getting emergency funds to make use of while you want them probably the most may be extraordinarily useful. That’s the reason having CIBIL rating is essential. In emergencies, it’s possible you’ll must avail of credit score, and one of many main advantages of CIBIL rating is fast approval of loans. There are a lot of advantages of getting CIBIL rating.

These are:

-

Fast Approvals:

A credit score rating of 750 and above is a superb indicator of how accountable a borrower is. This provides banks and lenders the arrogance to belief such people, thereby giving them fast mortgage approval.

-

Decrease rates of interest and processing costs:

When you may have a excessive CIBIL rating score, you may get comparatively decrease rates of interest in your loans. The decrease the rate of interest is, the decrease the EMI you’ll have to pay. The processing price for the loans may also be considerably decrease. That is due to your creditworthiness as a borrower.

-

Nice credit score means pre-approved loans:

Various banks will supply pre-approved loans to an present buyer with a superb credit score historical past. Pre-approved loans include many advantages, akin to a straightforward software course of, immediate processing, nice rates of interest, and little to no documentation required. The funds can be utilized for any objective. It’s an effective way to get emergency funds at low-interest charges.

-

Longer mortgage tenure and better mortgage quantity:

With CIBIL rating, you possibly can go for loans with an extended reimbursement tenure. This can imply that you should have a lesser burden on the EMI funds to be made every month. You too can get loans of a better quantity with an amazing CIBIL rating. An awesome CIBIL rating signifies that the borrower is accountable and has good reimbursement habits. This provides banks and lenders the arrogance to present them loans of upper quantities.

-

Positively impacts your profession:

Whenever you maintain credit score rating score, recruiters shall be instantly taken with such a candidate. It is because to have credit score historical past, they should be a disciplined and accountable individual with how they utilise their funds. This behaviour will naturally present in different areas of their life too. Therefore, CIBIL rating will positively influence your profession.

-

Extra advantages:

There are a lot of different advantages to having CIBIL rating, akin to getting the next credit score restrict on bank cards and cashback provides. In case you have a excessive credit score rating lenders shall be extra attentive to your requests and queries. You’ll be able to negotiate mortgage options like tenure, EMI, and different extra charges.

Being credit score aware comes with nice advantages, however keep away from being overconfident. Keep away from borrowing credit score too incessantly and from too many alternative debtors, as this may increasingly have a unfavorable influence in your credit score historical past. All the time keep credit score rating and stay aware of your spending habits. With credit score rating, you possibly can take pleasure in many advantages and benefits.

Furthermore, you possibly can verify your CIBIL rating utilizing your PAN quantity! Questioning How? Learn additional to know! Earlier than going additional, let’s have a look at the significance of a PAN quantity!

Additionally Learn: High 5 CIBIL Rating Enchancment Components

Why is a PAN quantity necessary?

A PAN card is necessary as all monetary transactions require a PAN quantity. It tracks cash that comes and goes by means of each particular person’s accounts. The quantity is necessary when paying earnings tax, receiving tax returns, and receiving info from the Earnings tax division. Some makes use of and benefits of a PAN are:

- A PAN card is required while you’re opening a checking account.

- Whereas submitting for IT returns.

- Apply for a brand new mortgage.

- Get new gasoline and phone connection.

- Buy and promote new property.

- Get new debit or bank cards.

- Open a hard and fast deposit account.

- Make insurance coverage premium funds.

- Whereas paying taxes, PAN is required to be quoted.

- It is usually required when paying earnings tax.

- PAN particulars are needed when registering a enterprise.

- A PAN card can be utilized as an id card because it has all the mandatory info like title, date of delivery, and handle.

- Monitoring your taxes may be carried out by means of a PAN card.

- It can’t be misused by anybody else as it’s a distinctive alphanumeric given to every particular person.

A PAN is extremely necessary in monetary transactions; subsequently, it’s essential to have one. It is usually essential when making use of for a brand new mortgage. As a PAN holds major monetary info on all previous transactions, it’s essential when checking to your credit score rating.

Now that you already know the significance of CIBIL rating and a PAN quantity, allow us to have a look at tips on how to verify your credit score or CIBIL rating free of charge utilizing PAN!

Additionally Learn: PAN Card Is So Necessary for Mortgage Approvals!

The way to verify your CIBIL rating free of charge utilizing PAN?

There are numerous web sites on tips on how to verify your CIBIL rating free utilizing your PAN card quantity. Banks with on-line web sites, akin to ICICI Financial institution, supply free CIBIL rating experiences on their web sites. Equally, mortgage aggregator web sites like Buddy Mortgage may also supply to supply a credit score rating utilizing PAN quantity. Beneath is a information on getting a free credit score rating from Buddy Rating.

- Go to the Buddy Mortgage web site and click on “verify free credit score rating.” It’ll take you to a different webpage known as Buddy Rating.

- Enter fundamental info together with

- Identify

- E-mail handle

- Date of delivery

- Gender

- Residential pin code

- Cell quantity.

- PAN card quantity.

- When all of the required fields have been crammed in, and the phrases and situations have been learn, click on on “Verify free credit score rating,” and you’ll obtain the rating.

Checking your credit score rating has turn into a lot simpler now. Common checking will make it easier to keep CIBIL rating; as you already know, CIBIL rating comes with many advantages.

Word: You too can verify your CIBIL rating utilizing the official web site. Nonetheless, you might need to pay both for a month-to-month or annual subscription.

The way to verify the CIBIL rating (With Month-to-month/Annual Subscription)?

A CIBIL rating is a gateway to monetary freedom, so it is very important have one. Understanding your rating will make it easier to get forward in life. With correct information, it is possible for you to to keep up your rating and deal with future monetary emergencies with out stress. The most effective methods to start a wholesome monetary journey is to verify your CIBIL rating repeatedly. There are a lot of methods on tips on how to verify CIBIL rating. Checking your rating from the official CIBIL web site is one in every of them.

CIBIL provides three completely different subscription plans to prospects prepared to maintain monitor of their CIBIL rating. They will additionally get different advantages akin to common credit score experiences, entry to their CIBIL dashboard, a rating simulator that may assist them construct a credit score rating, personalised mortgage provides, and a 24/7 credit score monitoring alert obtainable just for customary and premium subscribers.

The fundamental subscription plan is for 1 month at a price of 550 rupees. The usual subscription plan is for six months at a price of 800 rupees, and the premium plan is for 12 months at a price of 1200 rupees. If you wish to get your CIBIL rating and report from the CIBIL web site, then under is a step-by-step information on tips on how to verify CIBIL rating from the web site:

-

Step 1:

Go to the CIBIL web site: On the official web site, click on on “Get your CIBIL rating,” and it’ll take you to the subscription web page. On the subscription web page, you possibly can scroll down and click on on “Get began,” and you’ll have to create your account.

-

Step 2:

Create your account with CIBIL: To create your account you’ll have to enter all the mandatory info that has been requested. Enter your e-mail handle, title, ID proofs, date of delivery, and cellphone quantity. Upon getting crammed in all the small print you possibly can click on proceed.

-

Step 3:

Confirm your account: It is a needed safety step the place you’re going to get an OTP in your registered cellular quantity. Enter the OTP and proceed.

-

Step 4:

Pay the subscription price: As soon as the account has been verified, you will have to pay the subscription price of your alternative, after which it is possible for you to to view your credit score rating alongside together with your credit score report.

Checking your credit score rating and historical past from CIBIL is straightforward and environment friendly. Nonetheless, it comes with a price. In case you solely need to verify your credit score rating as soon as then you possibly can select the fundamental subscription. Nonetheless, if you must verify your CIBIL rating and report greater than as soon as then selecting the opposite two plans could also be extra useful and cost-effective.

Additionally Learn: CIBIL Rating: Full Kind, What’s CIBIL Rating, The way to Verify CIBIL Rating

In Conclusion

An excellent CIBIL rating can’t be in-built a day, and it takes years of borrowing and common repayments to have an amazing CIBIL rating. To be able to have and keep rating, you have to be well-disciplined and have good monetary habits. An necessary a part of sustaining rating is repeatedly checking it; now you already know tips on how to verify CIBIL rating by yourself. Use Buddy Rating to get your free credit score rating at any time. For any queries or info, please be happy to contact us at data@buddyloan.com.

Additionally Learn: Distinction Between Credit score Rating and CIBIL Rating

Incessantly Requested Questions

A Everlasting Account Quantity or PAN is a novel 10-digit alphanumeric identifier issued to any taxpayer or particular person who applies for it by the Earnings Tax Division. The PAN is issued in view of assuaging any type of tax fraud. The ten-digit alphanumeric identifier is the first storage for any tax-related info of a person. It is extremely necessary for a lot of causes.

-

I bought a brand new PAN card. Will it have an effect on my credit score rating?

In case you misplaced your previous PAN card and requested a substitute card, your credit score rating won’t be affected as the brand new PAN card has the identical quantity because the previous one. Nonetheless, getting a brand new PAN card with a brand new PAN quantity could have an effect on your credit score rating. Your credit score rating is straight affected by your credit score historical past, and your PAN quantity is straight linked to your transaction historical past. Getting a brand new PAN quantity will trigger the CIBIL database to flag your account.

-

How can I enhance my credit score rating?

There are a lot of methods by which you’ll be able to enhance your credit score rating; a few of these are:

- Repeatedly pay your dues on time. Late repayments are seen negatively by lenders.

- Keep away from utilizing an excessive amount of credit score, and at all times preserve your balances low.

- Preserve a wholesome stability of secured and unsecured loans. It could appear suspicious to lenders if in case you have too many unsecured loans.

- Apply for credit score solely when there’s an absolute want for it. Fixed software for brand new credit score will make you appear credit score hungry.

- In case you have a joint account, are a guarantor, or are co-signed on a mortgage, it’s best to monitor it month-to-month. It is because if the opposite individual defaults, you’ll equally be accountable, negatively affecting your future.

- Verify your credit score experiences repeatedly to keep away from errors. In case of an error, log a dispute to CIBIL or request your lender to report the inaccuracy to CIBIL.

-

The way to resolve errors in your CIBIL report?

It is extremely necessary to completely evaluation your CIBIL report, checking each little piece of data to determine the issue. As soon as all of the errors have been recognized, write to CIBIL and lift a dispute. After which, you possibly can await CIBIL to acknowledge your grievances and rectify the issue and they’ll ship you the error-free report for verification.

-

The way to verify CIBIL rating free on the Buddy Rating?

To entry your free CIBIL rating on the Buddy Rating, you could go to the Buddy Mortgage Web site and click on on “verify free credit score rating.” Enter all the mandatory particulars accurately and get your free credit score rating.