I used to be taught early on that “a rising tide lifts all boats” and that the true recreation as an fairness investor was to get the market name proper. Overlook in regards to the particular person shares and as an alternative focus your consideration on the macro name.

As a result of most shares simply observe the market, proper?

Nicely, typically sure… and typically no.

After our three panelists every shared 5 concepts throughout our newest episode of The Pitch, I commented to the group that it is fascinating to me that, whereas there are many potential headwinds to the most important market averages, none of appear to be having bother discovering compelling charts. In truth, a few of the teams like eating places, renewable vitality tools and vehicles mainly look downright bullish.

So how can we reconcile a weaker tape this week with rising energy in these teams? Nicely, we’ve to keep in mind that it isn’t a inventory market… it is a market of shares.

I exploit my Market Pattern Mannequin as a scientific solution to decide whether or not I must be leaning risk-on or risk-off. However I spotted a very long time in the past that, whatever the general market pattern, it’s all the time a great time to personal good charts.

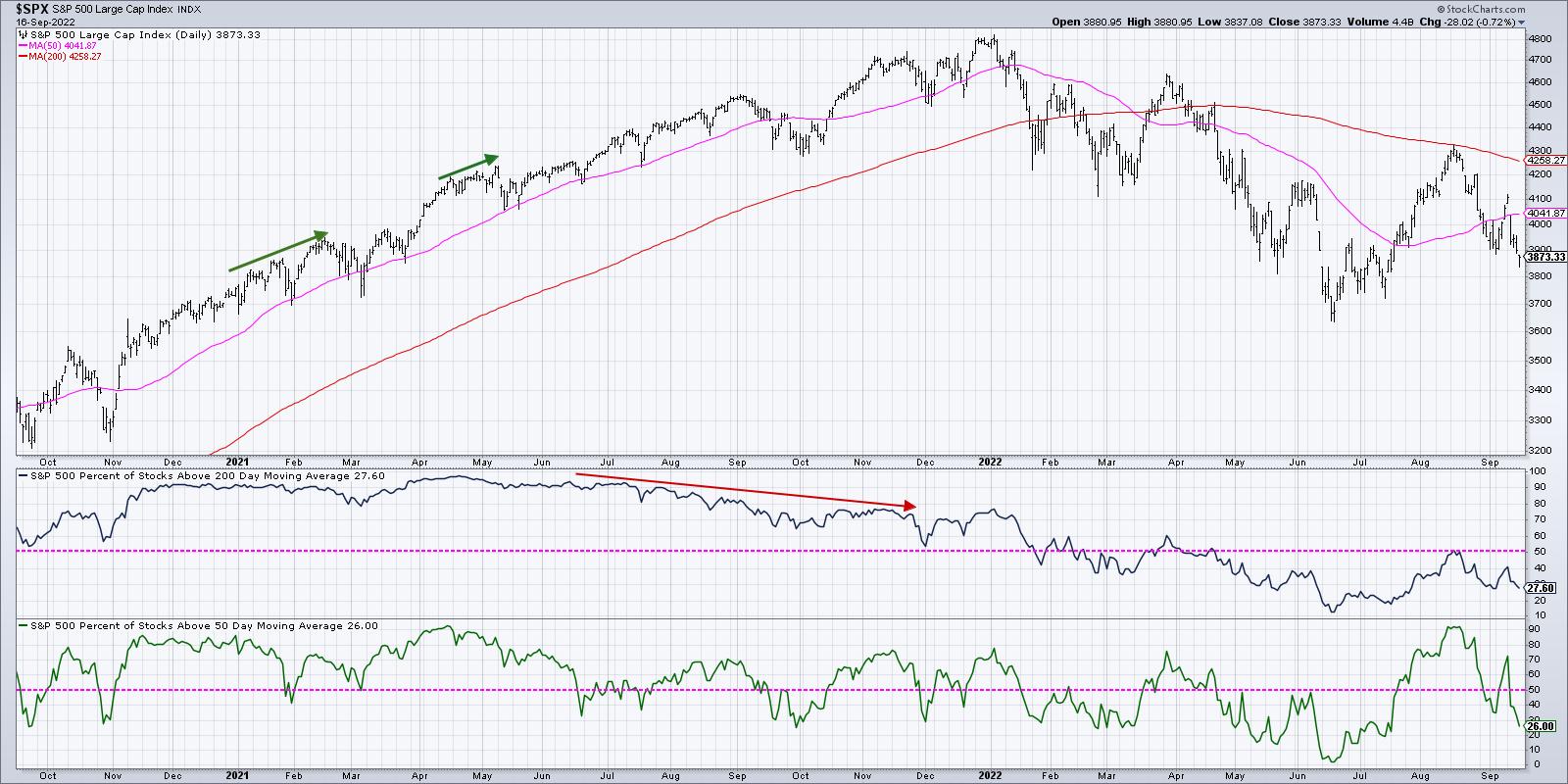

The S&P 500 failed to carry a key assist degree this week, lastly closing beneath 3900 for the primary time since mid-July. And mega-cap management names, like MSFT and AMZN, are testing key assist ranges whereas different FAANG shares, like META, have already damaged all the way down to new lows for the yr.

Maybe most concerningly, solely 26% of S&P 500 members stay above their 50-day transferring common as of Friday’s shut. That is down from over 70% only one week in the past! I’ve realized that when that indicator is beneath 50%, then the breadth is simply not supportive of additional upside for the benchmarks.

However regardless of all of these macro headwinds main into subsequent week’s Fed assembly, loads of particular person shares are demonstrating clear patterns of accumulation. Once I scanned for brand new swing highs and lows for my Market Misbehavior Premium Members earlier this week, I got here up with 83 new highs and 125 new lows. And that is after Tuesday’s huge down day.

Regardless of the questionable market circumstances, three teams stand out with sturdy patterns and upside potential. I ought to observe that every one three of those teams had been highlighted in our newest episode of The Pitch. As a matter of truth, this primary group was chosen by not one, not two, however, for the primary time ever, all three of our panelists.

Tesla (TSLA) managed to pound out a brand new four-month relative excessive this week, handily outperforming the broader market because it stays above each the 50-day and 200-day transferring averages. Whereas a break above earlier resistance round $315 would full the bullish rotation right here, it is necessary to concentrate on the relative image, which signifies that this identify has supplied a improbable alternative to outperform in current months.

And it isn’t simply Tesla. Different auto makers, like RIVN and GM, have rotated from a distribution part (decrease highs and decrease lows) to an accumulation part (larger highs and better lows).

The eating places group has additionally had a robust run regardless of the challenges going through the broad market averages. CMG and others have rotated properly to an accumulation part.

I chatted with Julius de Kempenaer on The Closing Bar this week in regards to the energy in Shopper Discretionary shares, which is somewhat stunning based mostly on its conventional position as offense. In truth, one of many nice indicators in 2022 has been the equal-weighted Shopper Discretionary to Shopper Staples ratio, which has confirmed to be a significantly better indicator than the cap-weighted ratio utilizing the XLY and XLP.

The cap-weighted ratio made a brand new swing excessive in late March, whereas the equal-weighted ratio didn’t. This was a stable indication that the March upswing was to be questioned. Just lately, the cap-weighted ratio broke above its June excessive whereas the equal-weighted ratio has but to take action. This implies that the rally in August was not supported by a broader advance in offense over protection. (Sure, Tom Bowley, I consider in equal-weighted ETFs. Actually.)

So whereas Shopper Discretionary as a complete has supplied combined outcomes, charts like Starbucks (SBUX) are breaking above key resistance ranges and signaling additional upside potential.

Lastly, we’ve the renewable vitality tools, which consists of names like PLUG, FSLR and ENPH.

Enphase Power is presently the top-ranked large-cap identify, utilizing the StockCharts SCTR rankings, and ended the week close to a 52-week excessive. So whereas FAANG shares are testing new 52-week lows, charts like ENPH nearly look a FAANG chart flipped the wrong way up.

I am involved about draw back potential for the most important market averages going into subsequent week’s Fed assembly. I’ve even up to date draw back targets for the S&P 500 and Nasdaq, given the rise chance of a retest of the June lows. However regardless of the potential weak spot for equities as a complete, there are many alternatives on the market if you already know the place to look!

For extra data on why the S&P 3900 degree is so necessary, head over to my YouTube channel.

RR#6,

Dave

P.S. Able to improve your funding course of? Try my YouTube channel!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator, and don’t in any approach signify the views or opinions of another particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders decrease behavioral biases by way of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness strategies to investor determination making in his weblog, The Conscious Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing danger by way of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to establish funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra