Most foreign exchange merchants generate profits every time the market begins to development. It is because trending markets implies sturdy volatility transferring usually in a single path. Merchants generate profits every time there may be adequate market motion or volatility. Nevertheless, worth must transfer within the path predicted by the dealer as an alternative of transferring backwards and forwards inside a brief vary. Buying and selling within the path of the development permits for big earnings as a result of it supplies each points of volatility and commerce path.

Pattern reversal methods are in all probability a few of the highest yielding buying and selling methods. Pattern reversals methods implies that merchants are capable of anticipate that the development path is about to reverse. Merchants who’re had been capable of enter a commerce because the development is reversing or close to the start of the brand new development might make big earnings as a result of they might maintain on to their trades in revenue as worth is transferring within the path of their trades. Merchants who might handle their trades effectively might maintain on to their trades till the top of the development.

Pattern reversal methods could possibly be very worthwhile. Nevertheless, anticipating development reversals might show to be very tough. Merchants could make use of excessive chance development following technical indicators with a purpose to anticipate such development reversals. With the fitting mixture of development following technical indicators, merchants can systematically determine development reversals primarily based on clear indicators.

Heiken Ashi Smoothed

Heiken Ashi Smoothed is a excessive chance development following technical indicator which is predicated on the idea of Heiken Ashi Candlesticks and transferring averages.

“Heiken Ashi” actually means common bars in Japanese. This indicator is rightfully referred to as as such. It is because the Heiken Ashi Smoothed indicator plots bars that point out development path primarily based on the typical worth of historic worth actions.

Pattern path is indicated primarily based on the colour of the bars. Lime bars point out a bullish development, whereas pink bars point out a bearish development.

Not like its counterpart, the Heiken Ashi Smoothed indicator computes for the typical worth actions, whereas the Heiken Ashi Candlesticks plots worth candles with modified open and shut primarily based on the typical historic worth. This makes the Heiken Ashi Smoothed indicator transfer characteristically extra carefully to transferring averages, with clean reversals but nonetheless keep being very responsive to cost motion actions. This makes its development indications much less inclined to false development reversal indicators, however on the similar time much less lagging in comparison with most transferring common traces.

Different Ichimoku

Different Ichimoku is a long-term development following technical indicator which is predicated on the Ichimoku Kinko Hyo indicator. Nevertheless, as an alternative of together with all of the traces which might be included within the Ichimoku Kinko Hyo system, the Different Ichimoku indicator focuses solely on the long-term development.

The Different Ichimoku indicator plots two traces with the house between the 2 traces shaded with vertical traces. This creates an space which resemble the “Kumo” or cloud within the Ichimoku Kinko Hyo system. The interplay between the 2 traces point out the path of the long-term development.

If the quicker transferring line is above the slower line, the market is taken into account to be in an uptrend. Nevertheless, if the quicker line is under the slower line, the market is in a downtrend.

A blue line can also be plotted contained in the shaded space. The blue can be near the quicker transferring line if the development is gaining momentum and would transfer nearer to the slower line if the development is slowing down.

Merchants can use the crossing over of the 2 traces as a sign of a development reversal. That is must be along with different momentum indicators.

Merchants may use the long-term development indication of the Different Ichimoku to filter out trades which might be transferring in opposition to the path of the development.

Stochastic Oscillator

The Stochastic Oscillator is a well-liked and extensively used momentum indicator which is a household of the oscillator sort of indicators. It’s used to determine momentum path in addition to overbought and oversold circumstances that are worth from imply reversals.

It plots two traces that oscillate inside the vary of 0 to 100. Pattern path is recognized primarily based on how the 2 traces work together. A bullish momentum is indicated if the quicker line is above the slower line, whereas a bearish momentum is recognized if the quicker line is under the slower line.

The Stochastic Oscillator additionally has markers at stage 20 and 80. Stochastic traces dropping under 20 point out an oversold situation, whereas traces breaching above 80 point out an overbought situation. Each circumstances are prime for imply reversals. Crossovers occurring on these areas are inclined to have a excessive chance of leading to an precise momentum reversal on worth motion.

Buying and selling Technique

Heiken Ashi Ichimoku Pattern Reversal Foreign exchange Buying and selling Technique is a development reversal technique primarily based on the confluence of development reversal indicators coming from the Heiken Ashi Smoothed indicator and the Different Ichimoku indicator, in addition to the momentum indication of the Stochastic Oscillator.

Pattern path on the Heiken Ashi Smoothed indicator is just primarily based on the altering of the colour of the bars. Nevertheless, worth motion must also begin to separate from the bars indicating that momentum is strengthening.

The Different Ichimoku sign is just primarily based on the crossover of the 2 traces. The blue line must also stick near the quicker line of the pair indicating a robust momentum on the reversal.

Lastly, the Stochastic Oscillator traces might be used to determine momentum path. That is merely primarily based on how the 2 traces overlap or crossover.

Indicators:

- Heiken_Ashi_Smoothed

- Alternative_Ichimoku

- Stochastic Oscillator

- %Okay Interval: 19

- %D Interval: 6

- Slowing: 9

Most well-liked Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

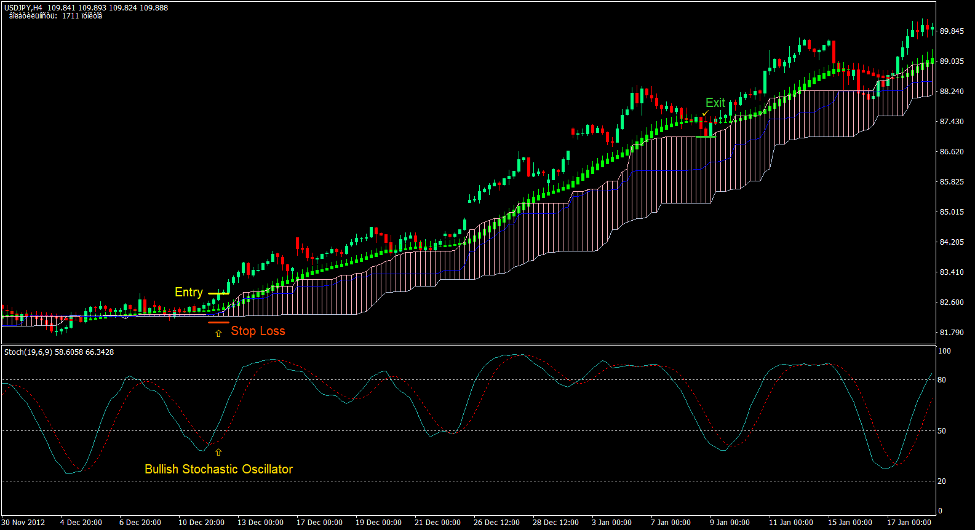

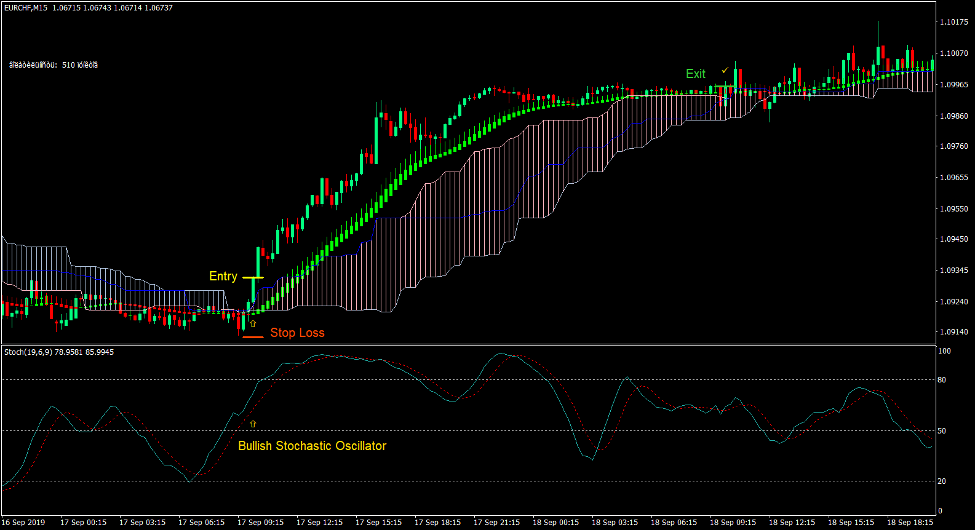

Purchase Commerce Setup

Entry

- The Heiken Ashi Smoothed bars ought to change to lime with the value candles transferring above the bars.

- The quicker line of the Different Ichimoku indicator ought to cross above the slower line with the blue line staying near the quicker line.

- The quicker stable line of the Stochastic Oscillator must be above the slower dotted line.

- Enter a purchase order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on a assist under the entry candle.

Exit

- Shut the commerce as quickly because the Heiken Ashi Smoothed bars change to pink.

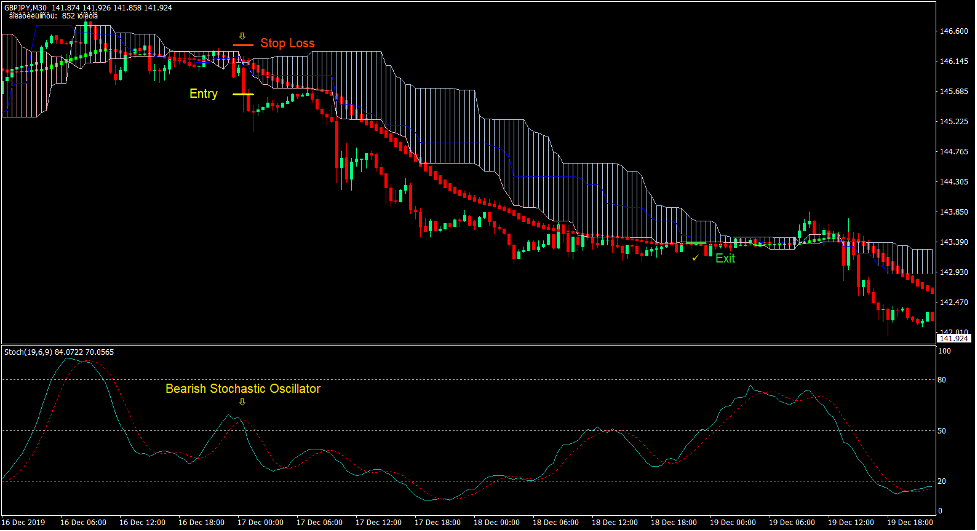

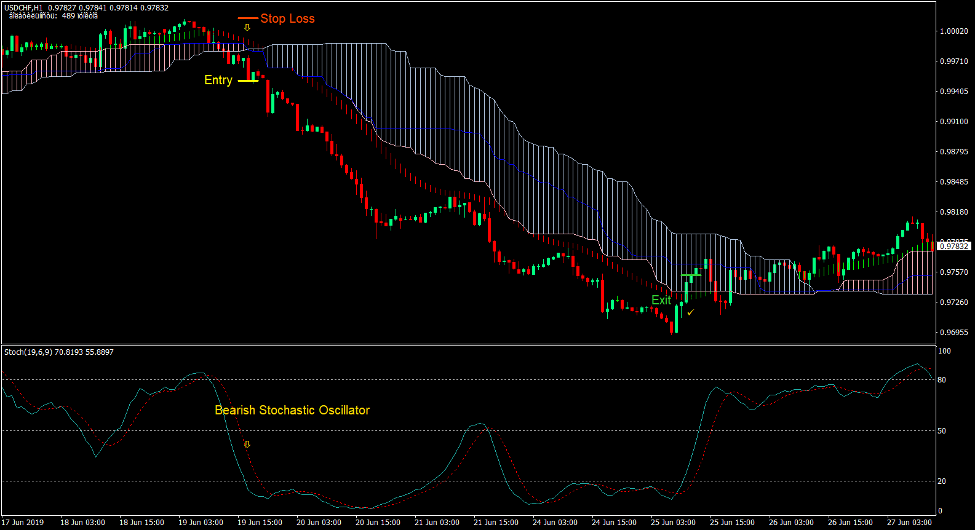

Promote Commerce Setup

Entry

- The Heiken Ashi Smoothed bars ought to change to pink with the value candles transferring under the bars.

- The quicker line of the Different Ichimoku indicator ought to cross under the slower line with the blue line staying near the quicker line.

- The quicker stable line of the Stochastic Oscillator must be under the slower dotted line.

- Enter a promote order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on a resistance above the entry candle.

Exit

- Shut the commerce as quickly because the Heiken Ashi Smoothed bars change to lime.

Conclusion

This development reversal technique primarily based on the confluence of three technical indicators might work very properly in markets which has a robust tendency to development.

The mix of the three indicators is synergistic.

The Different Ichimoku represents the long-term development.

The Heiken Ashi Smoothed indicator represents the principle development path.

The Stochastic Oscillator represents the short-term momentum.

Having all three aligned produces a excessive chance development reversal sign which has potential to end in a excessive yielding commerce.

Foreign exchange Buying and selling Methods Set up Directions

Heiken Ashi Ichimoku Pattern Reversal Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past information and buying and selling indicators.

Heiken Ashi Ichimoku Pattern Reversal Foreign exchange Buying and selling Technique supplies a chance to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional worth motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Advisable Choices Buying and selling Platform

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 General Ranking!

- Routinely Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

How one can set up Heiken Ashi Ichimoku Pattern Reversal Foreign exchange Buying and selling Technique?

- Obtain Heiken Ashi Ichimoku Pattern Reversal Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Heiken Ashi Ichimoku Pattern Reversal Foreign exchange Buying and selling Technique

- You will notice Heiken Ashi Ichimoku Pattern Reversal Foreign exchange Buying and selling Technique is out there in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: