Annually, because the festive season arrives, we should additionally maintain a watch out for potential scammers attempting to break the enjoyable. It is because scammers turn into extra energetic in the course of the holidays, focusing on us whereas we’ve our guard down.

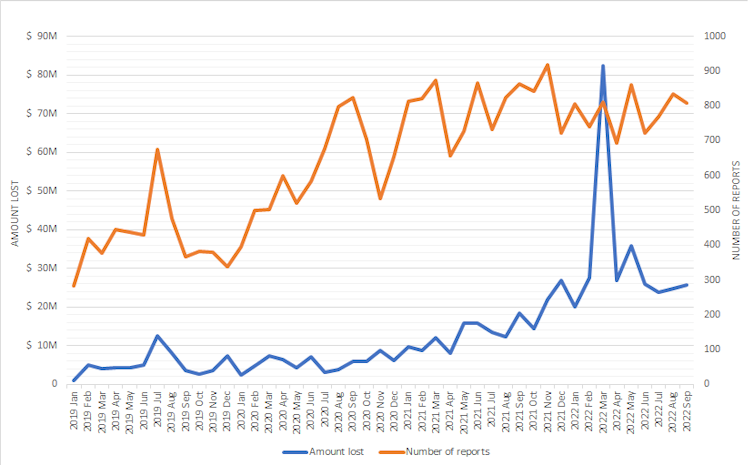

To date in 2022, Australians have misplaced round half a billion {dollars} to scams, which is already considerably greater than had been misplaced by this time final yr. Nearly all of these losses – round $300 million – have concerned funding or cryptocurrency scams.

scamwatch.gov.au

Researchers from Deakin College’s Centre for Cyber Safety Analysis and Innovation had a chance to interview latest victims of those scams. Here’s what we discovered.

Anybody can fall for a rip-off

I used to be shocked and couldn’t settle for that this occurred to me though I used to be very cautious […] I used to be numb for a few minutes because it was a big sum of money. – (26-year-old feminine workplace supervisor from South Australia)

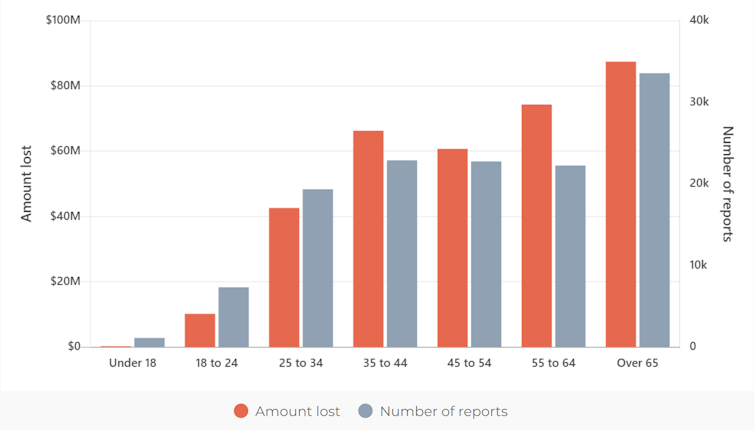

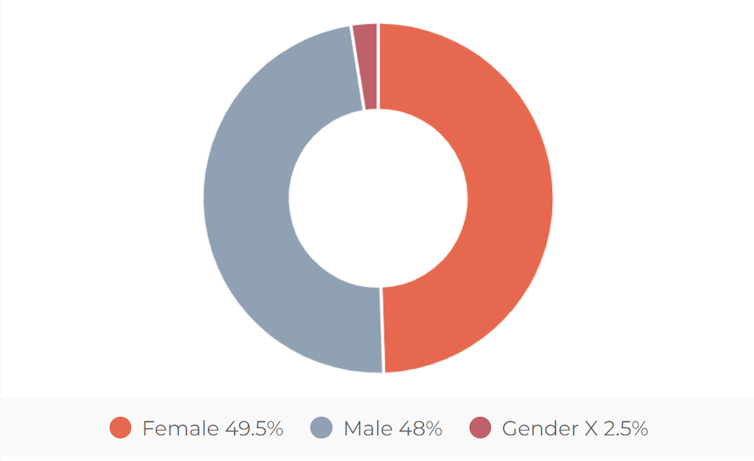

These scams have turn into extremely refined and criminals have turn into much less discriminating about whom they aim. That is mirrored in latest sufferer demographics, displaying all kinds of backgrounds, a extra even distribution throughout a number of age teams, and an nearly even break up on gender.

scamwatch.gov.au

scamwatch.gov.au

So, how are you going to spot these scams and the place are you able to get assist you probably have fallen sufferer?

If it sounds too good to be true, it would simply be a rip-off

I used to be dumbfounded, to say that floor shattered underneath my toes can be an understatement, it is going to take me a really very long time to recuperate from it, financially and mentally. – (36-year-old feminine, authorized practitioner from Victoria)

Most crypto scams contain getting the sufferer to purchase and ship cryptocurrency to the perpetrator’s account for what seems to be a official funding alternative.

Cryptocurrency is the foreign money of selection for any such crime, as a result of it’s unregulated, untraceable and transactions can’t be reversed.

Victims of such scams are focused utilizing quite a lot of completely different strategies, which embrace:

Funding scams: scammers faux to be funding managers claiming excessive returns on crypto investments. They get the sufferer to switch over funds and escape with them.

“Pump and dump”: scammers often hype up a brand new cryptocurrency or an NFT venture and artificially enhance its worth. As soon as sufficient victims make investments, the scammers promote their stake, leaving the victims with nugatory cryptocurrency or NFT.

Romance scams: includes scammers utilizing relationship platforms, social media or direct messaging to interact with you, acquire your belief and pitch a tremendous funding alternative promising excessive returns, or ask for cryptocurrency to cowl medical or journey bills.

Phishing scams: an outdated however nonetheless efficient rip-off involving malicious emails or messages with hyperlinks to pretend web sites promising large returns on funding or simply outright stealing credentials to entry customers’ digital foreign money wallets.

Ponzi schemes: a kind of funding rip-off the place the scammers use cryptocurrency gathered from a number of victims to repay excessive curiosity to a few of them; when victims make investments extra funds, the scammers escape with all of the investments.

Mining scams: scammers try to persuade victims to purchase cryptocurrency to make use of in mining extra of it, whereas in actuality there isn’t any mining occurring – the scammers simply make transfers that seem like returns on the funding. Over time, the sufferer invests extra, and the scammers maintain taking all of it.

Though strategies evolve and alter, the telltale indicators of a possible rip-off stay comparatively related:

- very excessive returns with guarantees of little or no danger

- proprietary or secretive methods to achieve a bonus

- lack of liquidity, requiring a minimal accumulation quantity earlier than funds are launched.

The place to hunt assist when you’ve been scammed

I felt helpless, I didn’t know what to do, who to succeed in out to, I used to be too embarrassed and simply stored blaming myself. – (72-year-old male, accountant from Victoria)

For those who assume you will have fallen sufferer to one in all these scams, here’s what you could do subsequent:

- inform the Australian Competitors and Client Fee (ACCC) right here or attain out to related authorities as per recommendation on the ScamWatch web site

- attain out to your family and friends members and inform them of the rip-off; they will also be a supply of assist and help throughout such occasions

- as these occasions can have a psychological affect, it’s advisable you speak to your GP, a well being skilled, or somebody you belief

- you can even attain out to counselling providers similar to LifeLine, past blue, Sucide Name Again Service, Mens Line, and extra for assist and help.

For those who ever end up in a troublesome scenario, please keep in mind assist and help is offered.

Lastly, to stop your self turning into the following statistic over the vacation interval, remember the next recommendation:![]()

- don’t share your private particulars with folks on-line or over a name

- don’t put money into one thing you don’t perceive

- if doubtful, speak to an skilled or search on-line for sources your self (don’t imagine any hyperlinks the scammers ship you).

Ashish Nanda, CyberCRC Analysis Fellow, Centre for Cyber Safety Analysis and Innovation (CSRI), Deakin College; Jeb Webb, Senior Analysis Fellow, Centre for Cyber Safety Analysis and Innovation (CSRI), Deakin College; Jongkil Jay Jeong, CyberCRC Senior Analysis Fellow, Centre for Cyber Safety Analysis and Innovation (CSRI), Deakin College; Mohammad Reza Nosouhi, CyberCRC Analysis Fellow, Centre for Cyber Safety Analysis and Innovation (CSRI), Deakin College, Deakin College, and Syed Wajid Ali Shah, CSCRC Analysis Fellow, Centre for Cyber Safety Analysis and Innovation, Deakin College

This text is republished from The Dialog underneath a Artistic Commons license. Learn the unique article.