Apart from the actual buying and selling technique you employ to navigate and commerce the markets, ‘the place you place your cease loss’ is arguably a very powerful side of each commerce you’re taking.

One of many core tenets of my buying and selling strategy that I hammer-home to my members is the significance of utilizing broad cease losses. Many merchants are naturally drawn to and tempted to position as tight (small) of a cease loss on their trades as doable. There are a number of the explanation why merchants do that, however all of them are the results of not understanding key facets of buying and selling comparable to place sizing, threat reward ratios, correct cease loss placement and the usage of wider stops.

This lesson will dispel a number of the commonest myths and misconceptions round inserting cease losses and can make it easier to perceive simply how critically vital it’s that you just plan your cease loss placement accurately and don’t act emotionally when inserting your stops, e.g. avoiding inserting them too tight and in a worth space the place they’re prone to be hit.

First, a word on place sizing…

It surprises me how many individuals nonetheless e-mail me every day believing that they need to use tighter cease losses as a result of they’ve a small account and too broad of a cease will price them an excessive amount of to commerce. This notion comes from the (mis)perception {that a} tighter cease loss by some means reduces one’s threat on a commerce or (equally as mistaken) will enhance their probabilities of creating wealth since they will enhance their place dimension.

90% of latest merchants I communicate to nonetheless suppose {that a} smaller cease loss distance means a smaller threat, and that wider cease losses distance means they’re risking extra. Nonetheless, these beliefs are merely not true and for any skilled dealer who understands commerce place sizing, it’s apparent that it’s the contract dimension (variety of heaps) traded that determines the danger per commerce, not the cease loss distance by itself. The cease loss distance is nowhere close to as vital because the place dimension you’re buying and selling. It’s the place dimension (lot dimension) that determines how a lot MONEY is risked per commerce!

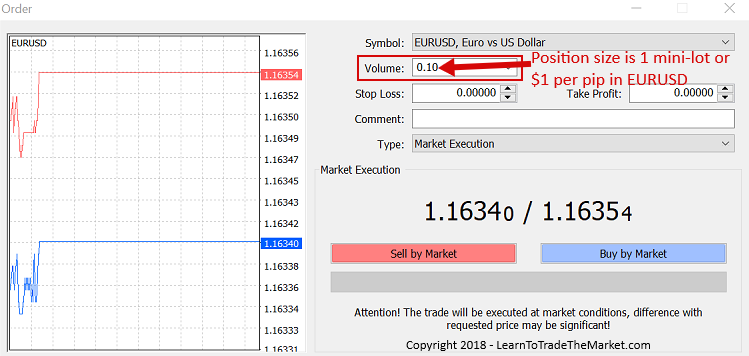

The cash you’re risking on any given commerce is elevated or decreased while you alter the variety of heaps traded. For instance, within the Metatrader platform I take advantage of, the place dimension is labelled as “quantity” and the larger the quantity the extra heaps and therefore more cash you’re risking per commerce. If you wish to dial-down your threat you cut back the variety of heaps you commerce. Cease loss distance is barely half of what determines how a lot you would possibly lose (your threat) on any given commerce. In case you are adjusting your cease loss distance however not your place dimension, you make a grave mistake!

To place this into perspective, a dealer can have a 60 pip cease loss or a 120 pip cease loss and nonetheless threat the very same amount of cash, all they do is alter the variety of contracts they’re buying and selling.

Instance:

Commerce 1 – EURUSD commerce. 120 pip cease loss and 1 mini lot traded, is $120 usd risked.

Commerce 2 – EURUSD commerce. 60 pip cease loss and a couple of mini heaps traded is $120 usd risked.

So that you see, we have now 2 completely different cease loss distances, and a couple of completely different lot sizes, however the SAME Greenback threat.

It’s additionally vital to notice that wider stops don’t lower our threat reward, as threat reward is relative. When you have a wider cease you have to a wider goal / reward. We will nonetheless yield nice trades round 2 to 1 and three to 1 or increased with each day charts and wider stops. We will additionally use pyramiding to extend that threat reward yield.

Why Wider Stops?

So, now that we all know that we will use wider cease losses on any dimension account, the query turns into why do I take advantage of wider stops and how will you implement the identical in your personal buying and selling?

Give the market room to maneuver…

What number of instances have you ever been proper a few market’s course, your commerce sign was proper, however you continue to misplaced cash by some means? Very, very irritating. So, right here’s why this retains occurring to you; your cease loss is just too tight!

Markets transfer, typically erratically, typically with excessive volatility with none discover. As a dealer, it’s a part of your obligation to issue this into your resolution making course of when deciding the place to position your cease losses. You can not simply place your cease loss at a set distance on each commerce and “hope for the very best”, that isn’t going to work and it’s not a technique.

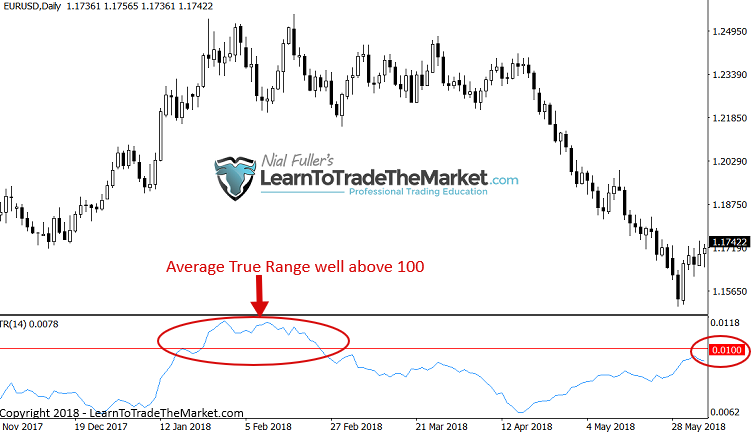

You have to enable area for the conventional “vibrations” of the market every day. There’s something known as the Common True Vary (ATR) of a market that may present you the common each day vary over any given time interval. This may help you see the market’s latest and possibly present volatility, which is one thing it’s essential to know when making an attempt to determine the place to place your cease losses.

If the EURUSD strikes 1% or extra some days (over 100 pips) why would you place a 50 pip cease loss? It is unnecessary does it? But, on a regular basis, merchants do precisely that. In fact, there are different components to contemplate, comparable to time-frame traded and the actual worth motion setup you’re buying and selling in addition to surrounding market construction, which I broaden upon in nice element in my professional buying and selling course.

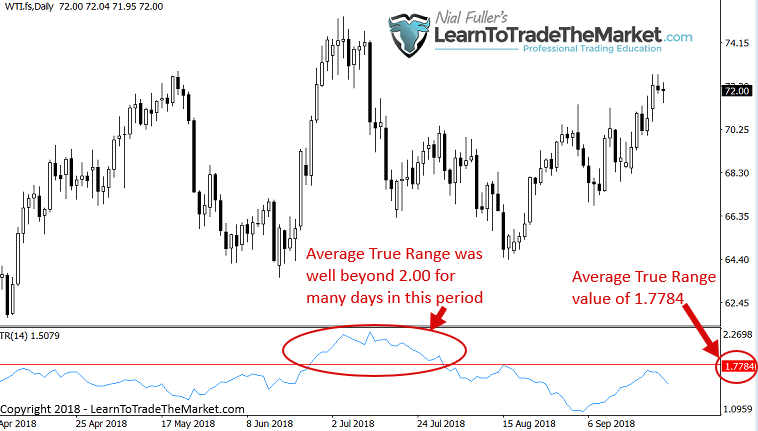

Beneath, we see two pictures, the primary is the EURUSD each day chart exhibiting an ATR of above 100 and close to 100 for a lot of days. The second is Crude Oil exhibiting a big each day ATR as nicely (above $2 for a lot of days). Merchants who aren’t even conscious of the ATR of the market they’re buying and selling are at an enormous drawback in the case of inserting their cease losses. At a naked minimal, you need your cease loss larger than the 14 day shifting ATR worth:

Crude Oil ATR: Crude Oil is measured in {dollars} and cents however an ATR above $2 a day and even $1.75 is comparatively giant. Relaxation assured, for those who aren’t inserting your stops outdoors of this ATR, you’re going to get burned.

Wider stops give trades longer to play out

As we all know, when buying and selling worth motion based mostly on the end-of-day strategy that I take advantage of, massive trades can take days or perhaps weeks to unfold. You’re simply not going to catch a 200 to 300 level transfer on EURUSD with a 30 to 50 pip cease, more often than not you should have been stopped out nicely earlier than the market goes the right means.

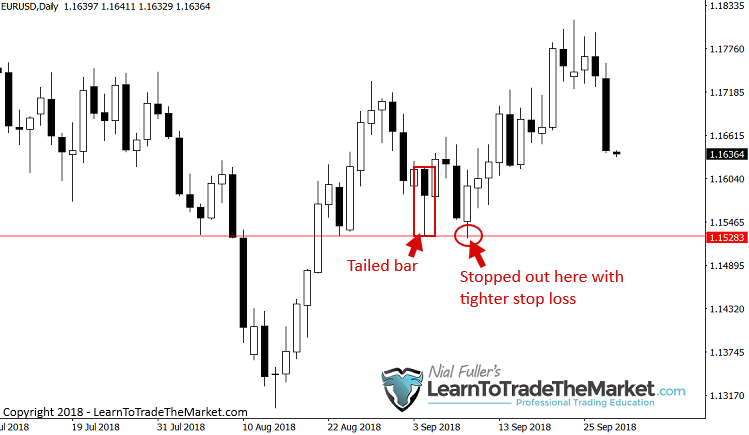

Case and level: The 2 pictures under present the identical EURUSD tailed bar sign however with completely different cease loss placements.

The primary picture under reveals a tighter cease loss and the second picture under reveals a wider cease loss, from this instance, it’s fairly clear why you want wider stops.

Be aware, the cease loss within the wider state of affairs seen under, was positioned 20-30 pips under the help stage at 1.1528 space, that is typically a very good approach to make use of:

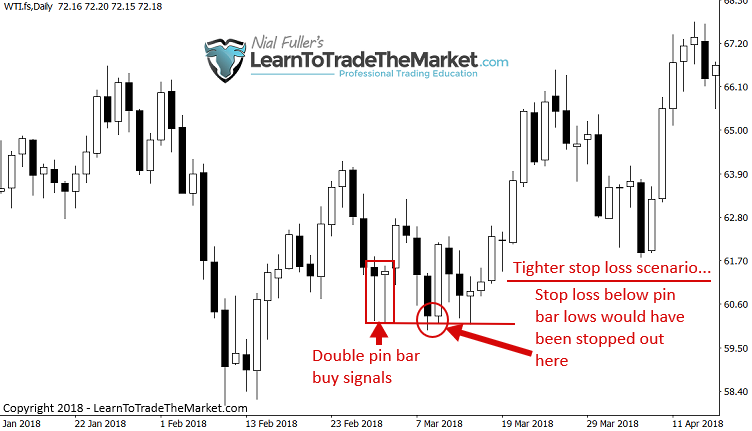

Subsequent, let’s have a look at an instance on the each day Crude Oil chart under. This time we have now a really apparent double pin bar purchase sign that shaped on the each day chart time-frame not too long ago. Discover, for those who positioned your cease just below the pin bar low, as many merchants love to do, you’ll have been stopped out for a loss simply earlier than the market pushed increased, with out you on board.

Now, for those who positioned your cease loss 50 factors or so under the lows of these pins, not solely does that hold you within the commerce however you’ll have been a idiot to not make a pleasant revenue after worth started pushing increased once more.

Be aware: Irrespective of which entry you’re utilizing, a market entry or a 50% tweak entry, a wider cease loss will nonetheless dramatically change the result of the commerce, even for the extra conservative 50% tweak entries. The aim is to remain available in the market till it clearly proves you mistaken, to not get shaken out just by the pure each day fluctuations of worth. Give the market the room it must breathe!

I don’t day commerce, so wider stops are important

In the event you’ve adopted me for any size of time, you understand I don’t day commerce. My view on day buying and selling is that it’s simply playing on the pure market ‘noise’ that happens every day, and I’m a dealer, not a gambler. Due to this fact, it’s important I take advantage of wider cease loss that received’t lead to my getting chopped up within the short-term intraday noise of the market.

It’s an attention-grabbing ‘coincidence’ (not likely a coincidence), day merchants naturally use very tight / small stops (some don’t use any!) and the stats present that day merchants usually lose cash and do worse than longer-term place merchants. Is it only a coincidence that individuals who use tight cease losses are likely to lose more cash than those that use wider stops and maintain merchants for longer? I believe not.

Longer-term trades require bigger cease losses. If we all know the EURUSD strikes just a few share factors every week (say 200-300 pips) and we’re a worth motion setup that would yield us a 200 to 300 pip revenue goal, then it stands to cause you’re going to wish wider cease loss to remain in that commerce.

Remember, the ability of upper time-frame charts is immense. Sure, you must wait longer for trades to play out on increased time frames, however the commerce off is that you just get extra correct alerts and it’s a lot simpler to name a market the upper in time-frame you go. Thus, buying and selling turns into much less like playing and extra of a ability set the upper up in time-frame you go. For a lot of causes, the each day chart time-frame is my favorite, it’s a contented medium.

Way of life and fewer stress

Maybe the best profit to YOU is that utilizing wider time frames reduces stress and improves your life-style. You may set and neglect trades with wider cease losses. Wider stops are what my finish of day buying and selling strategy encourages and it means you don’t have to sit down there agonising over every tick of the market.

This type of buying and selling additionally permits you extra time to study and give attention to discovering good trades and determine developments and worth motion patterns, studying the footprint on the chart; the stuff that issues!

If you wish to stroll away out of your trades and calm down while the market does the ‘heavy lifting’, then all you must do is: Use wider cease losses and alter your place dimension to take care of your required greenback threat per commerce. That’s it!

Conclusion

Let me ask you one thing…

Are you aware why most merchants fail over the long-run? Nicely, sure, as a result of they lose an excessive amount of cash. However, WHY do they lose an excessive amount of cash?

The 2 fundamental the explanation why so many merchants lose cash and blow out their accounts are: Buying and selling an excessive amount of (over buying and selling) and utilizing cease losses which are too tight (not letting the commerce have room).

A humorous factor occurs while you begin inserting tight stops, you get stopped out extra typically! Appears apparent, proper? But, every day, 1000’s, most likely thousands and thousands of in any other case very clever merchants do one thing actually unintelligent; they place a tiny little cease loss on a superbly good commerce setup. They do that as a result of they don’t perceive place sizing or they do that as a result of they’re being grasping, both means, they’re doomed to fail and be simply one other statistic.

Don’t be like them.

Be affected person. Be prepared to position a wider cease even when meaning letting a commerce go for just a few weeks. Ask your self, what’s higher: Inserting 20 trades with tight stops and dropping on most of them or inserting 2 trades with broad stops, successful massive on one and taking a predefined 1R loss on the opposite? I promise you, it’s the latter, not the previous.

Learn this lesson once more carefully. It could be a very powerful buying and selling lesson you ever study. Mix the ideas taught right here in the present day with buying and selling methods and worth motion methods I educate in my buying and selling programs and the each day steerage from my members commerce setups publication and you’ve got your self a fairly potent long-term buying and selling technique that, if adopted, stands an excellent likelihood at bringing you nearer to constant success within the markets.

What did you consider this lesson? Please go away your feedback & suggestions under!

If You Have Any Questions, Please Electronic mail Me Right here.