Based on current PPI and CPI prints, inflation has plateaued. Some analysts will argue that inflation has hit its zenith. Nonetheless, what if one of many subsequent catalysts to even increased inflation is spurred by the potential and up to date peak within the U.S. greenback?

Trying on the worth chart of the inverse ETF to the Greenback or the Invesco DB US Greenback Index Bearish Fund, the U.S. Greenback is dropping steam. As momentum usually proceeds worth, our Actual Movement indicator actually factors within the course of a greenback worth peak.

The U.S. Greenback has been on a tear in current months, bringing it to its highest valuation versus different main developed currencies for many years. The greenback power has begun to eat into revenue and income margins for U.S. large-cap shares, to not point out the havoc greenback power has brought on in commodity markets, developed, and creating economies, and nation inventory market indexes worldwide.

With Financial institution of England, Japan and China all making an attempt so as to add liquidity to assist cease the bleed of their currencies, might that convey the U.S. greenback down additional?

What are some implications to your investing if this state of affairs performs out?

The U.S. greenback altering course could have profound results on commodity costs and cascading outcomes all through world fairness and bond markets.

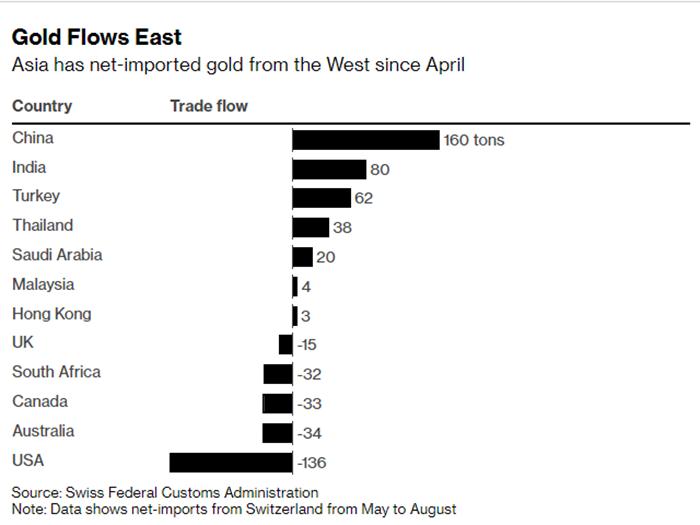

One such implication will likely be on valuable metals. Gold and silver are steadily confirming indicators of a brand new mini-rally concurrently the US greenback retreats from current historic highs. The above chart reveals that the US has been promoting gold reserves whereas another international locations have purchased in file quantities. Silver discovered a backside in early September. Gold might be forming a double backside.

Meals costs have barely budged from their highs, notably once you have a look at the place they had been pre-pandemic.

US greenback bearishness factors to a monumental world shift and can play into commodity worth power, most probably seen first in valuable metallic costs. And though, initially, a greenback drop might be good for equities, warning remains to be warranted.

Within the face of the greenback declining in worth and momentum, our yields are nonetheless rising. There have been rising requires the Fed to pause hikes to permit the economic system time to soak up earlier ones, however most Fed members appear unfazed by this rhetoric.

We aren’t anticipating a pause from the Fed anytime quickly, however we do count on the US greenback to peak earlier than the Fed raises charges subsequent month. This places the credibility of the Fed’s financial coverage in additional query.

If yields are rising, equities fall or stagnate, but the greenback drops, and commodities rise, sure, that equals extra inflation and an actual conundrum for the Fed and the U.S. authorities whatever the end result of the mid-term elections.

Are you on the lookout for some buying and selling help available in the market? As we head in the direction of the top of 2002 and into a brand new yr, are you able to reap the benefits of the upcoming alternatives? You’ll be able to join a free session with Rob Quinn, our Chief Technique Marketing consultant, by clicking right here to study extra about Mish’s top-rated threat administration buying and selling service.

Mish’s Upcoming Seminars

Dealer’s Summit: Mish speaks with Helene Meisler on October twenty third at 12pm ET. Be taught extra right here.

The Cash Present: Be part of me and plenty of fantastic audio system on the Cash Present in Orlando, starting October thirtieth working through November 1st; spend Halloween with us!

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

Mish discusses why the U.S. greenback may be some of the necessary lead indicators on this look on Benzinga.

Given blended knowledge, worry and powerful earnings, the charts are the most effective indicators for the way forward for the economic system, as Mish Schneider explains in this Yahoo! Finance look.

See Mish clarify why Bond merchants purchase dangerous firm shares on Enterprise First AM.

Learn Mish’s newest article for CMC Markets, titled “Are Lengthy-Time period Treasuries Oversold?“.

Has the market bottomed? The place ought to passive buyers go to be protected? Mish digs into these questions and extra on Coast to Coast with Neil Cavuto.

Mish and Scott talk about a attainable smooth touchdown however with a great deal of headwinds to look at for on RFD-TV’s Cow Man Shut.

With BNN Bloomberg, Mish discusses the markets as U.S. banks reported earnings and why it is necessary to look at long-term bonds and the steadiness investing within the sugar commerce.

The 6-7 yr enterprise cycle within the “inside” sectors of the U.S. economic system is going through an enormous check, as Mish discusses on NASDAQ Talks.

Watch some choose clips from Mish at ChartCon 2022!

Mish and Nicole discuss threat, inflation, lengthy bonds, greenback and the place you possibly can park some cash on TD Ameritrade.

- S&P 500 (SPY): Nonetheless 360 pivotal help and resistance at 380. 362 warning; 360, 351, 340; potential upside ranges: 380, 385, 390.

- Russell 2000 (IWM): 170 help, 177 resistance.

- Dow Jones (DIA): 306 was resistance and is now help; 314 resistance.

- Nasdaq (QQQ): 275 was earlier resistance; 270 help, 278 resistance.

- Regional banks (KRE): 58.60 help, 62 resistance.

- Semiconductors (SMH): Help at 181, resistance at 190.

- Transportation (IYT): Help at 198, 205 resistance.

- Biotechnology (IBB): Nonetheless holding 115 help, 122 resistance.

- Retail (XRT): Nonetheless holding long-term help at 55 and resistance at 62.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Wade Dawson

MarketGauge.com

Portfolio Supervisor

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For almost 20 years, MarketGauge.com has supplied monetary data and training to 1000’s of people, in addition to to giant monetary establishments and publications resembling Barron’s, Constancy, ILX Techniques, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary individuals to comply with on Twitter. In 2018, Mish was the winner of the Prime Inventory Choose of the yr for RealVision.