Hiya buddies,

Labor Day is approaching, and the market is closed in commentary, so it is time for some improbable enjoyable, leisure for everybody, and rest.

I’ve been doing two movies per week together with the written commentary to introduce you to the one index and 6 sectors of the Fashionable Household. This consists of the Granddaddy of the U.S. Financial system, the Russell 2000. The household, by design, is U.S.-centric and has been a useful useful resource to inform the story of the economic system and the inventory market. A hyperlink to who the members are and why every is on our web site.

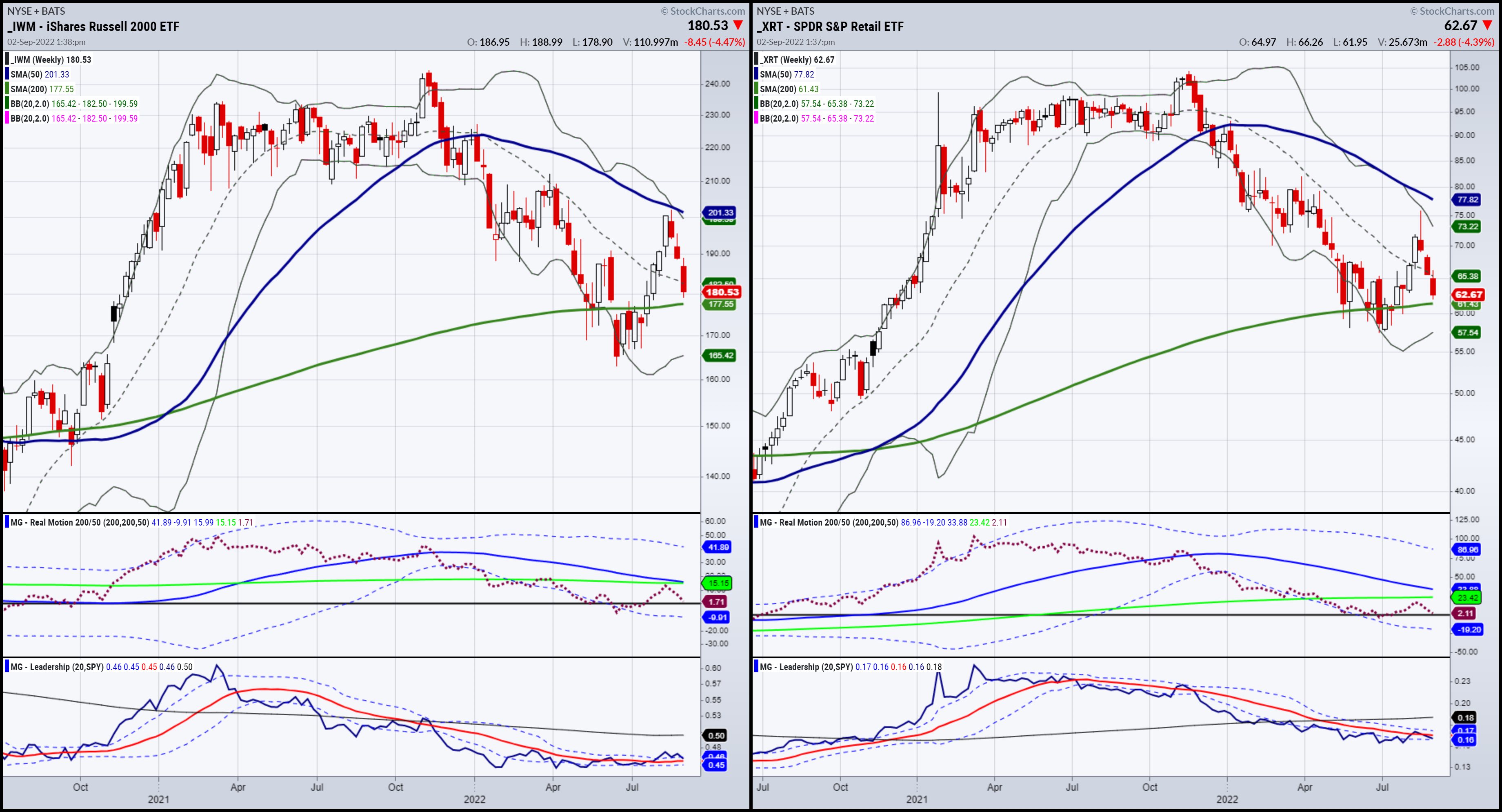

This weekend, we’re wanting on the weekly charts to achieve perspective. We start with the Russell 2000 and his spouse, Grandma Retail XRT. Each symbolize demand and provide, specializing in total consumption and small enterprise exercise. Be aware how every railed from their June lows, cleared again over their 200-week shifting averages, then ran up very near their 50-week shifting averages. We name this a buying and selling vary, and as such has been the technique now we have employed. Presently, shopping for weak point and promoting energy at turning factors yields earnings.

IWM and XRT have offered off arduous since Jackson Gap. They each now method their 200-WMAs. That makes the story clear. Ought to they maintain, up we go. Ought to they fail these vital inexperienced strains, count on one other leg decrease.

Solely 5% of People have adjusted their portfolios in 2022 of their 401(okay)s and 403 (b)s. Our largest concern is, at what level does the ache get too arduous to cope with and we see large liquidation?

Nicely, we might reasonably be ready and have a plan. Nonetheless, there are pockets of the market and throughout the household which might be doing higher than the others. Let’s study these charts as effectively.

The next two charts are Transportation (Transports IYT) and Regional Banks (our Prodigal Son KRE). We grouped them as a result of they’ve offered off, however are holding effectively above their 200-WMAs, given every relative energy. This tells us that, though weaker, demand from supply, journey and banking offers us a glimmer of hope that issues aren’t as dangerous as of us suppose. Plus, it helps our stagflation concept, the place the economic system is stagnating however not essentially collapsing. At the least, not but.

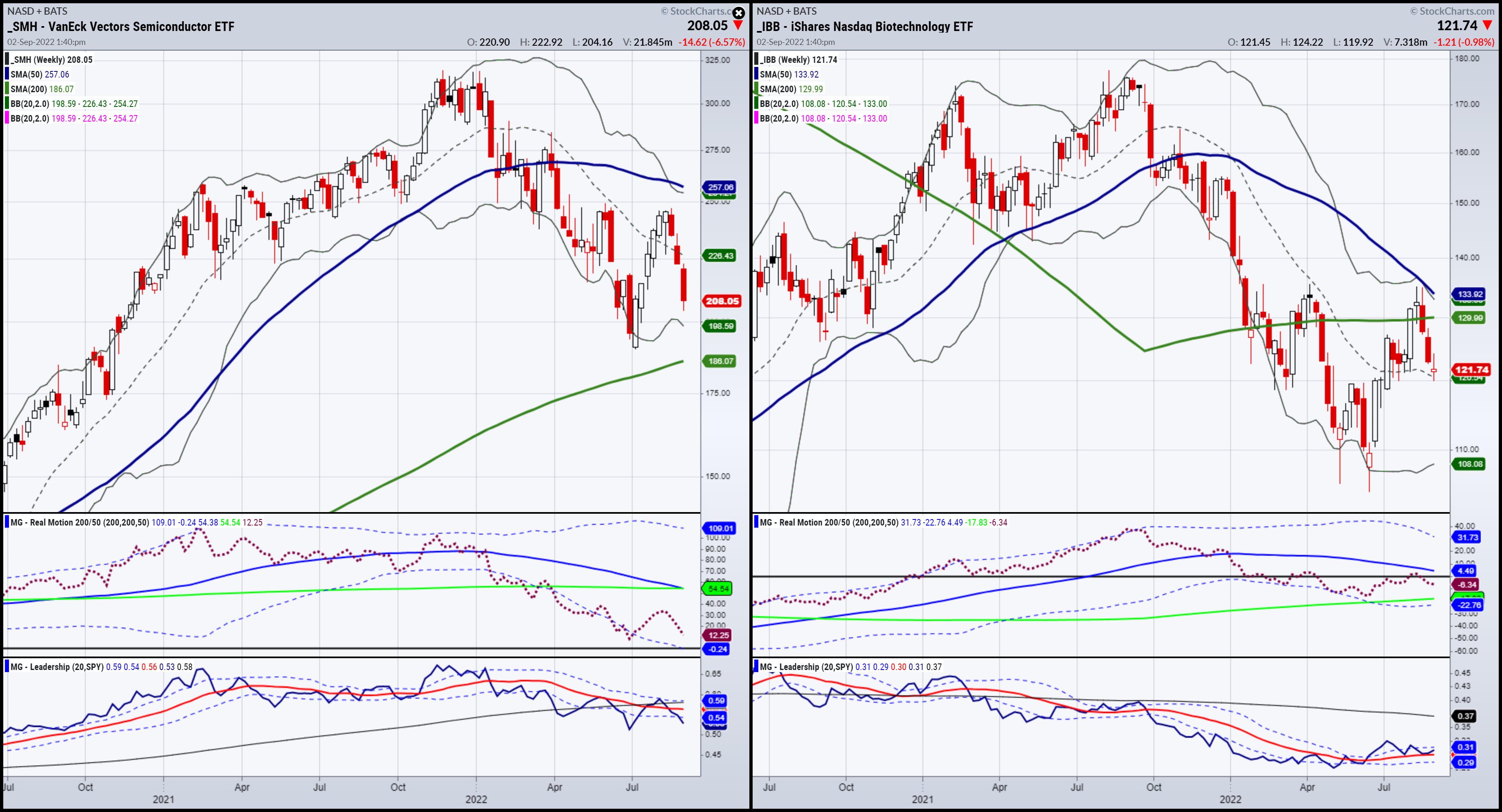

The final two members are extra speculative in nature. Sister Semiconductors (SMH), though in higher form than Granny and Gramps, on a each day chart foundation, wants to carry 200. If that stage breaks, then we’re that 200-WMA at 186-187. Large brother Biotechnology (IBB) is technically the weakest certainly one of all of the relations. Already priced below each the 50 and 200-WMAs, we see 118, or the early 2022 lows, as the primary stage to carry. If that breaks, 110 may very well be the following cease of assist.

If you happen to put this all collectively, little question this market may very well be in for extra bother. Nonetheless, by no means low cost these weekly assist ranges. Be open minded, preserve the noise down in your head, and comply with value.

The Household and the inventory market is forward-thinking. We by no means actually know what lies forward. Due to this fact, preserve the Financial Household in your toolbox, and allow them to and the charts assist you navigate your subsequent trades.

To study extra about methods to spend money on worthwhile sectors of the Fashionable Household, attain out through chat, telephone, e mail, or ebook a name with our Chief Technique Marketing consultant, Rob Quinn, by clicking right here.

Mish’s Upcoming Seminars

ChartCon 2022: October 7-Eighth, Seattle (FULLY VIRTUAL EVENT). Be part of me and 16 different elite market specialists for reside buying and selling rooms, hearth chats, and panel discussions. Be taught extra right here.

The Cash Present: Be part of me and lots of fantastic audio system on the Cash Present in Orlando starting October thirtieth operating via November 1st; spend Halloween with us! And this weekend, now we have a particular low cost code to save lots of $$$!

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

In this look on BNN Bloomberg, Mish covers what to observe for and a few picks utilizing tight dangers.

Mish appeared as a visitor on the Wednesday, August 31 version of StockCharts TV’s The Remaining Bar with David Keller, the place she encourages viewers to deal with the 50-day shifting common for transports $IYT, retail $XRT and small caps $IWM.

Take a look at Mish’s newest article for CMC Markets, titled “Persistence is a Advantage Amid Market Angst“.

On this look on Coindesk with Christine Lee, Mish sits down to debate the immediate- and longer-term image for a way the technical and fundamentals will impression crypto.

In a visitor look on Coast to Coast with Neil Cavuto, Mish and Neil discuss concerning the economic system, buying and selling ranges and which sectors to observe.

On this look with Caroline Hyde on Bloomberg TV, Mish covers charges, the greenback, commodities and key market sectors.

- S&P 500 (SPY): 390 assist held, 400 stage failed.

- Russell 2000 (IWM): Must clear 184.25 maintain 177.

- Dow (DIA): Closed weak below assist. 312 key.

- Nasdaq (QQQ): Both climbs again over 296 or extra ache to 280.

- KRE (Regional Banks): Unconfirmed bearish section w/ shut below the 50-DMA.

- SMH (Semiconductors): 215 resistance and 205 assist.

- IYT (Transportation): Unconfirmed bearish section w/ shut below the 50-DMA; if fails extra Tuesday, ache.

- IBB (Biotechnology): 125 resistance, 117 assist.

- XRT (Retail): 64.50 resistance and 62.00 6-month calendar vary excessive assist, which held — a minimum of one hopeful signal.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For practically 20 years, MarketGauge.com has offered monetary data and training to 1000’s of people, in addition to to giant monetary establishments and publications resembling Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary individuals to comply with on Twitter. In 2018, Mish was the winner of the Prime Inventory Decide of the yr for RealVision.

Get your copy of Plant Your Cash Tree: A Information to Rising Your Wealth and a particular bonus right here

Get your copy of Plant Your Cash Tree: A Information to Rising Your Wealth and a particular bonus right here