The Greenback drifts since final week as traders awaited the August inflation knowledge as a consequence of be launched right this moment from the US Bureau of Labor Statistics.

Eventhough, US CPI is the near-term focus, feedback from the hawks Bullard and Waller counsel even indicators of slowing in value strains will not be prone to alter their leanings towards one other aggressive 75 bp enhance subsequent week. Then again, a number of different officers have famous issues about over-tightening amid the lengthy lags in coverage results. There, different knowledge this week together with retail gross sales, manufacturing, and manufacturing might assist their views if the information are weaker than anticipated.

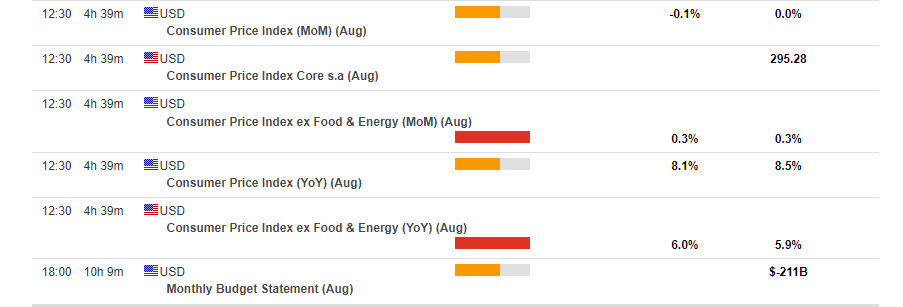

HFM financial calendar Supply: https://www.hfm.com/sv/es/trading-tools/economic-calendar

As for the information, headline August CPI ought to dip -0.1%, together with a 0.4% enhance within the core. These would lead to a slip within the headline 12-month fee to 8.0% y/y from 8.5% in July, with the core choosing as much as 6.1% y/y from 5.9% beforehand, and respective 40-year highs of 9.1% y/y and 6.5% y/y in March. For retail gross sales we’re forecasting no change in both the headline or ex-auto metrics for August. Manufacturing must also be flat, whereas the Empire State and Philly Fed indexes must be in contractionary territory.

The earlier month noticed the biggest discount in the price of transport as a result of sturdy drop in oil. Then again, there was a rise of 1.1% for meals and drinks now at 10.5% y/y (for August a rise of 1.6% is predicted to go away it at 12.1%) and 0.5% in housing, family items and medication, now at 7.4%, 10.1% and 4.8% respectively. The change in client spending habits (which fell from 1.8% to 1.5% within the second quarter (2-3% pre-pandemic)) was centered on mandatory bills.

CPI United States July 2022 Supply: datosmacro.growth.com

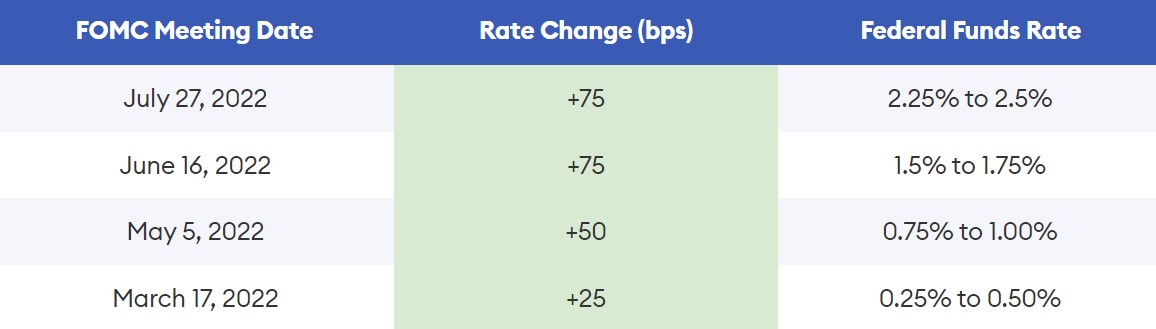

Within the meantime, the FED continues its sturdy dedication to scale back inflation, which has led to the continual tightening of financial coverage with sturdy rises in rates of interest, the final ones at 75 bp, and as Powell rightly mentions, “it would proceed with a restrictive stance for a while” till the two% goal is reached.

Typically, the anticipated knowledge would sign that the Fed’s efforts have been profitable in lowering inflation. Nonetheless, even though it is vitally attainable that it’s going to lower a bit of extra in August, it’s not identified if it would proceed for the reason that lower was not whole, since there have been additionally will increase in some sectors and it’s unlikely that the FOMC will loosen its financial coverage till reaching the goal stage (which remains to be distant), for which we may anticipate a 3rd consecutive enhance of 75 bp on the twenty first of this month.

Technical evaluation

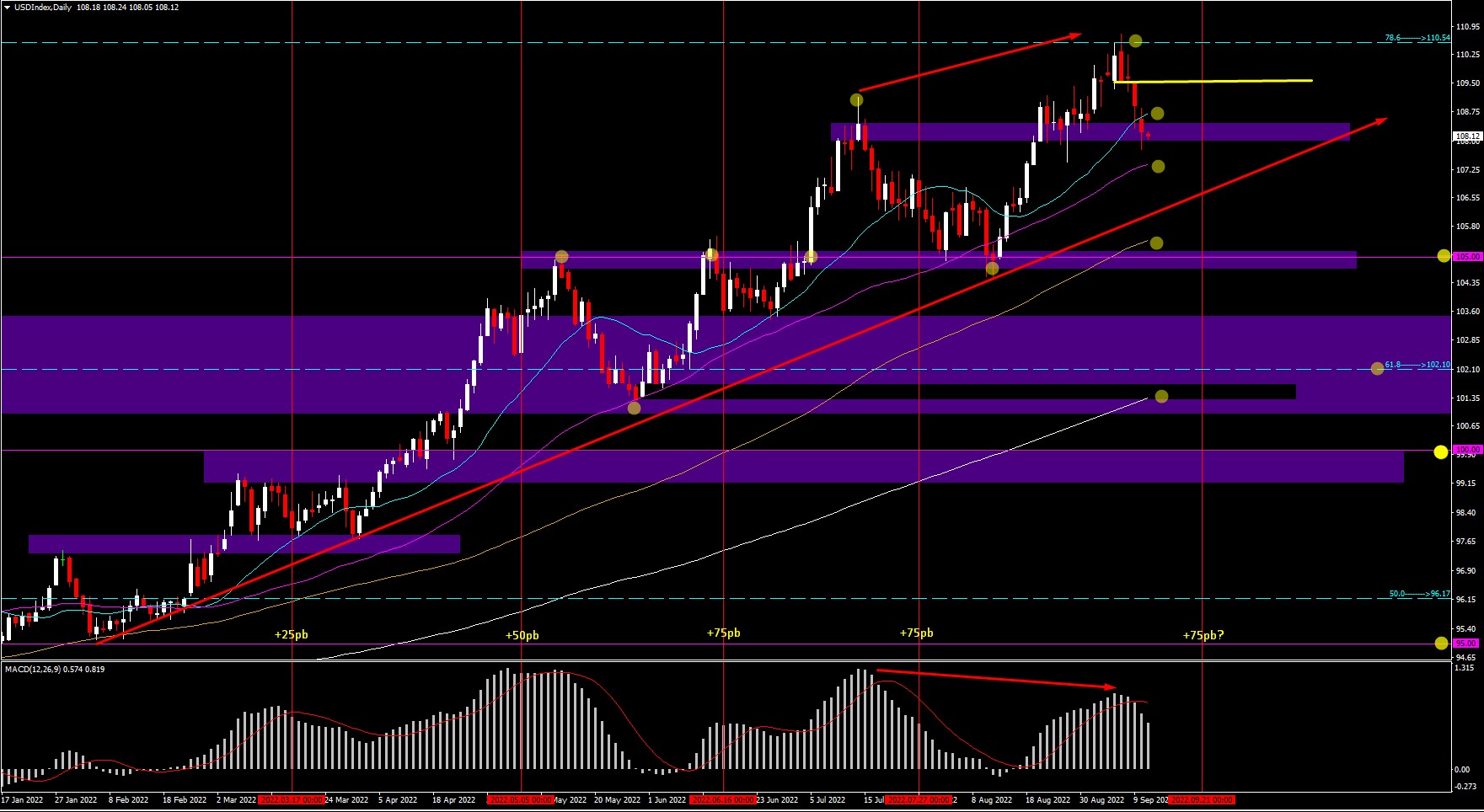

USDIndex D1 – $108.23

The USDIndex has maintained a gentle uptrend with small pullbacks and enormous bullish spurts following earlier rate of interest hikes (marked with purple verticals). The value hit highs at 110.76, ranges not seen since 2002, nevertheless it failed to carry the 110.00 stage and has dropped to 107.77 right this moment marking the bottom stage this month. Nonetheless, the Buck stays sturdy.

With bearish divergence on the MACD and with the value historical past after the final fee hikes, the value is in retracement awaiting the FED determination, now at quick assist at 108.00 whereas testing the 20-day SMA at 108.62, adopted by the 50-day SMA at 107.38. There’s stronger assist on the psychological stage of 105.00.

On the flipside, if the bullishness continues, it ought to get better and preserve 110.00, adopted by resistance on the 78.6% month-to-month Fibo at 110.54. A breakof it may open the doorways to 112-114 teritorry.

Different belongings:

- US500 +1.06% – US100 +1.27% – US30 +0.72%

- XAGUSD +5.12% – XAU/USD +0.43%

- USOil +2.15% – UKOil +2.14%

Click on right here to entry our Financial Calendar

Aldo Zapien and Andria Pichidi

Disclaimer: This materials is offered as a basic advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.