The market strikes in a number of methods. For probably the most half the market would vary, reverse or development. Though there are various several types of situations that would happen, all of it could possibly be categorized into these three market circumstances. Worth may breakout, bounce off a assist or resistance or do a minor imply reversal. Nonetheless, all of them match into one of many three circumstances. The one distinction is the timeframe. Breakouts are literally trending markets when zoomed in on the decrease timeframe. Bounces off a assist or resistance are full on reversals when zoomed in. Minor imply reversals are literally full reversals on the decrease timeframe or could possibly be small retracements on the upper timeframe.

The most effective methods to commerce the foreign exchange market logically is by searching for factors of confluence between these differing circumstances so as to make sense of a commerce setup.

Imply reversals and retracements are one of many situations that could possibly be mixed and that might make sense. Imply reversals often imply that value is both overbought or oversold and will revert to a mathematical common value. Retracements then again imply that the market is trending and is simply making a minor adjustment earlier than it makes one other thrust within the route of the development.

Turbo Pattern Breakout Foreign exchange Buying and selling Technique combines retracements, imply reversals and breakouts so as to verify a commerce setup. It makes use of some indicators that might assist merchants determine possible commerce setups.

3C Turbo JRSX

3C Turbo JRSX is a customized technical indicator which was designed to assist merchants spot development route bias, imply reversal alternatives, and momentum.

3C Turbo JRSX is an oscillator kind of indicator. It plots a line that oscillates throughout the vary of 0 to 100 with a midpoint at 50. If the oscillator line is above 50, the short-term development bias is bullish. Whether it is under 50, then the short-term development bias is bearish.

It additionally has markers at 30 and 70. If the road drops under 30, then the market is taken into account oversold, whereas if the road breaches above 70, then the market is taken into account overbought. Inversely, if the road drops under 30 and continues transferring decrease, then there’s a bearish momentum, and if the road breaches above 70 and continues rising, then there’s a bullish momentum.

The 3C Turbo JRSX oscillator line behaves moderately easily. Nevertheless, it additionally may be very responsive to cost actions. This creates an oscillator that enables merchants to look at the cyclical waves of value motion whereas not being too inclined to market noise and never too lagging for use for commerce indicators.

50 Exponential Transferring Common

Transferring averages are a mainstay in lots of buying and selling methods. Most merchants have some type of transferring common which they incorporate of their buying and selling technique. It’s because transferring averages are fairly helpful and efficient instruments.

Transferring averages are typically used to determine development route and bias. It’s often based mostly on the slope of the transferring common line and the placement of value in relation to the transferring common line.

Transferring averages are additionally used to determine potential development reversals. Merchants would often search for crossovers of transferring averages or a transferring common and value so as to spot potential development reversals.

One other use for transferring averages is as a dynamic assist or resistance. Many merchants often use these traces as a assist or resistance degree the place value may bounce off after a retracement.

Though transferring averages are nice, the query is which one to make use of. Some of the in style transferring common settings utilized by many merchants is the 50-period Exponential Transferring Common (EMA). The 50 EMA is characterised by a clean but responsive transferring common line that works properly for figuring out the mid-term development.

Buying and selling Technique

Turbo Pattern Breakout Foreign exchange Buying and selling Technique trades within the route of the development utilizing the 50 EMA, whereas being in confluence with overbought or oversold circumstances utilizing the 3C Turbo JRSX indicator.

The 50 EMA is used to determine the route of the development and as a dynamic assist or resistance. Pattern route is predicated on the overall location of value in relation to the 50 EMA in addition to the slope of the 50 EMA line.

Worth ought to then retrace to the 50 EMA line and present indicators of congestion or value rejection. This must also trigger the 3C Turbo JRSX indicator be briefly overbought or oversold. On the identical time, the retracements ought to create a minor assist or resistance line the place value may breakout from.

A commerce entry turns into legitimate when value motion confirms the bounce whereas being in confluence with the imply reversal indication kind the 3C Turbo JRSX indicator and the breakout from the assist or resistance line.

Indicators:

- 50 EMA

- 3c_Turbo_JRSX_wAppliedPrice

Most well-liked Time Frames: 15-minute, 30-minute, 1-hour, 4-hour and each day charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

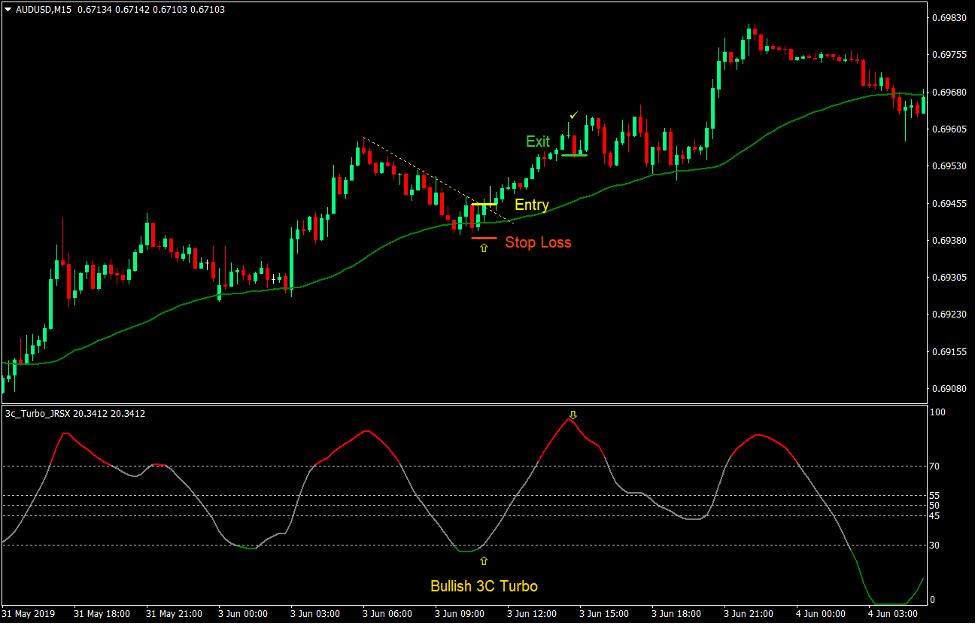

Purchase Commerce Setup

Entry

- The 50 EMA line ought to be sloping upward.

- Worth motion ought to be above the 50 EMA line.

- Worth ought to retrace in the direction of the 50 EMA line.

- A diagonal resistance line ought to be noticed.

- Worth ought to reject the realm of the 50 EMA line and break above the resistance line.

- The 3C Turbo JRSX indicator ought to reverse from an oversold situation.

- Enter a purchase order upon affirmation of those circumstances.

Cease Loss

- Set the cease loss on the fractal under the entry candle.

Exit

- Shut the commerce as quickly because the 3C Turbo JRSX indicator slopes down.

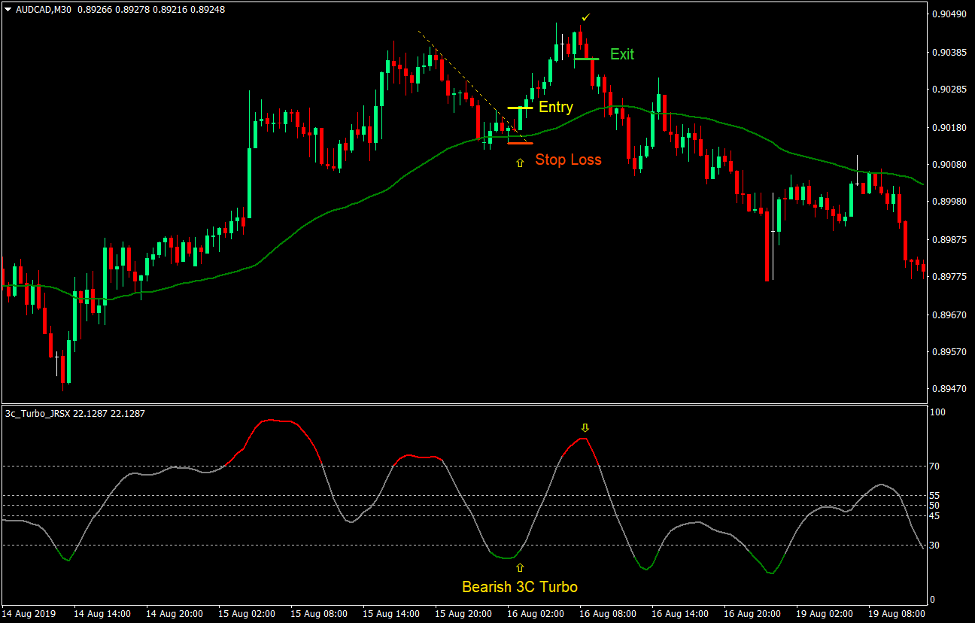

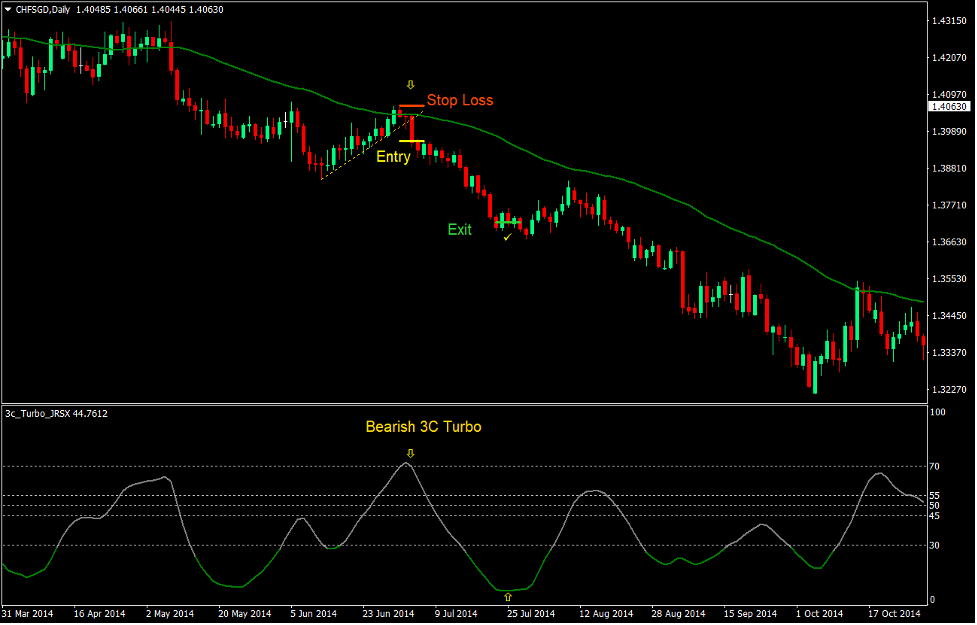

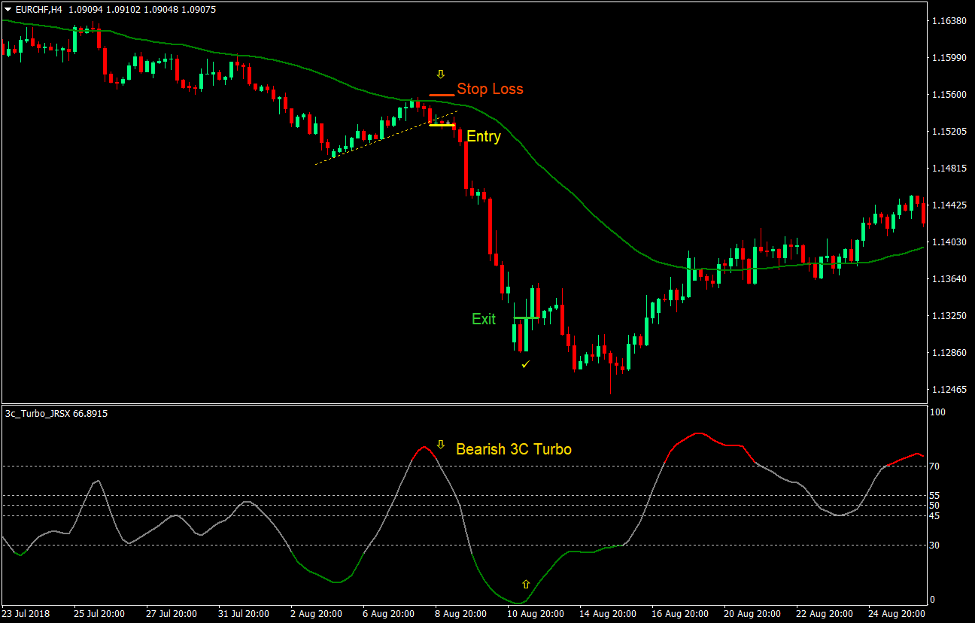

Promote Commerce Setup

Entry

- The 50 EMA line ought to be sloping downward.

- Worth motion ought to be under the 50 EMA line.

- Worth ought to retrace in the direction of the 50 EMA line.

- A diagonal assist line ought to be noticed.

- Worth ought to reject the realm of the 50 EMA line and break under the assist line.

- The 3C Turbo JRSX indicator ought to reverse from an overbought situation.

- Enter a promote order upon affirmation of those circumstances.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce as quickly because the 3C Turbo JRSX indicator slopes up.

Conclusion

This buying and selling technique has a comparatively first rate chance in comparison with most methods. It will enable merchants to persistently revenue from the market.

Nevertheless, though it has a good chance, it does have a decrease reward-risk ratio, which is widespread for many imply reversal methods. If the win price is bigger than 50%, you have to be good if the reward-risk ratio isn’t lower than 1:1.

It additionally does present alternatives for top yielding trades as a result of it’s open ended. If a commerce setup would lead to an explosive momentum transfer, then merchants may revenue huge time in a single commerce.

Foreign exchange Buying and selling Methods Set up Directions

Turbo Pattern Breakout Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the accrued historical past knowledge and buying and selling indicators.

Turbo Pattern Breakout Foreign exchange Buying and selling Technique gives a chance to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional value motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

The way to set up Turbo Pattern Breakout Foreign exchange Buying and selling Technique?

- Obtain Turbo Pattern Breakout Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Turbo Pattern Breakout Foreign exchange Buying and selling Technique

- You will notice Turbo Pattern Breakout Foreign exchange Buying and selling Technique is out there in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: