For weeks already, the rotation of the Industrial sector has been persevering with its manner deeper into the main quadrant at a robust RRG-Heading.

For my look on the panel of The Pitch this month, I seemed on the Relative Rotation Graph of US Sectors to determine three sturdy sectors the place I wished to seek for my 5 inventory picks. The economic sector surfaced in that train, along with Supplies and Client Staples.

Whereas going by that course of, I got here throughout many extra fascinating charts moreover the 2 I pitched within the present. The industrials sector makes up 8.5% of the S&P 500 index however holds 71 shares. This is among the bigger sectors relating to the variety of constituents. So, for this text, I’m going to herald one further layer to get a greater deal with on the distribution throughout the sector.

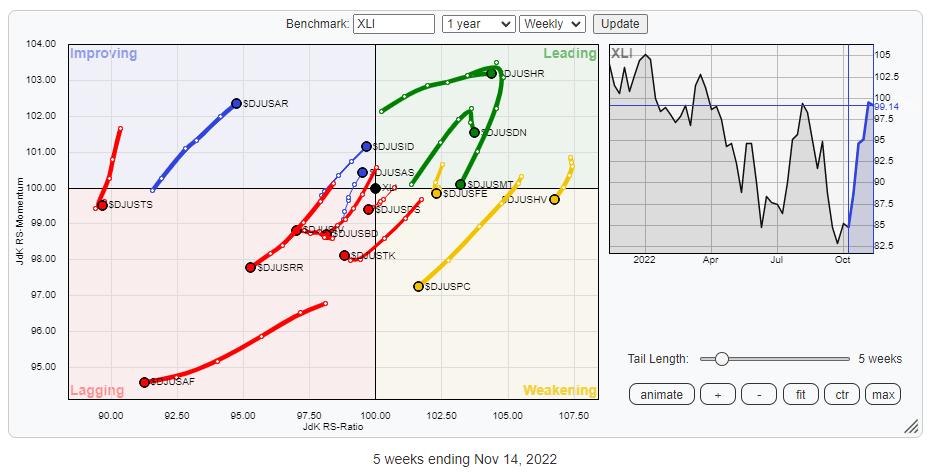

The RRG above holds the trade teams contained in the Industrials sector towards XLI because the benchmark. This picture very properly reveals the range of industries throughout the sector. Some are displaying very good and robust rotations, however there are additionally just a few which are the exact opposite.

The Dangerous

The teams on this RRG are all on a unfavourable rotation towards the sector index, which is doing properly towards the S&P 500. Because of this it is rather properly attainable to seek out cheap or good charts in these teams; nevertheless, it is rather seemingly you could find higher alternatives within the teams which are at a optimistic rotation towards XLI, as they’re routinely outperforming the S&P 500 as properly.

The Good

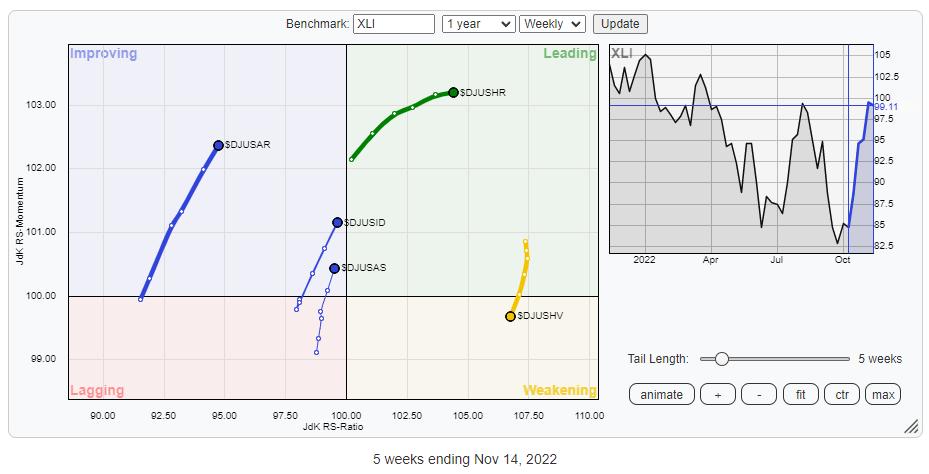

To get a clearer image, I eliminated all of the tails that aren’t transferring in a good route. I made a decision to depart $DJUSHV (Heavy Building) on the RRG, because it at the moment has the very best RS-Ratio studying and sufficient leeway to finish its rotation by weakening earlier than rotating again to main.

The rotations that I’m most taken with are $DJUSID and $DJUSAS. The reason being that they’re at a robust RRG-Heading and near crossing over into the main quadrant, which suggests they’re then certified as being in a relative uptrend (towards XLI).

$DJUSHV in all probability wants a bit extra of a rotation by the weakening quadrant earlier than this group can rotate again up. In different phrases, there may be nonetheless time to select this one up when it truly rotates again up. $DJUSHR is on the highest RS-Momentum stage, making it weak to setbacks when that momentum begins to dip. In the meantime, $DJUSAR continues to be low on the RS-Momentum axis in comparison with the opposite teams. If there have been no options, I might think about this one, however in the intervening time, that’s not crucial.

Diversified Industrials

This RRG reveals the rotation for the shares in that group towards XLI. Despite the fact that the group is doing properly towards XLI, you possibly can see that there are fairly some opposing rotations. Two of the larger names on this group which are displaying sturdy rotations, and due to this fact the drivers of power, are GE and HON.

Each shares simply ended a downtrend in value with the completion of a double-bottom formation. Shortly after the break, these formations often present traders with an excellent risk-reward ratio, because the safety, within the type of a stop-loss or help stage, is close by whereas there may be vital upside potential.

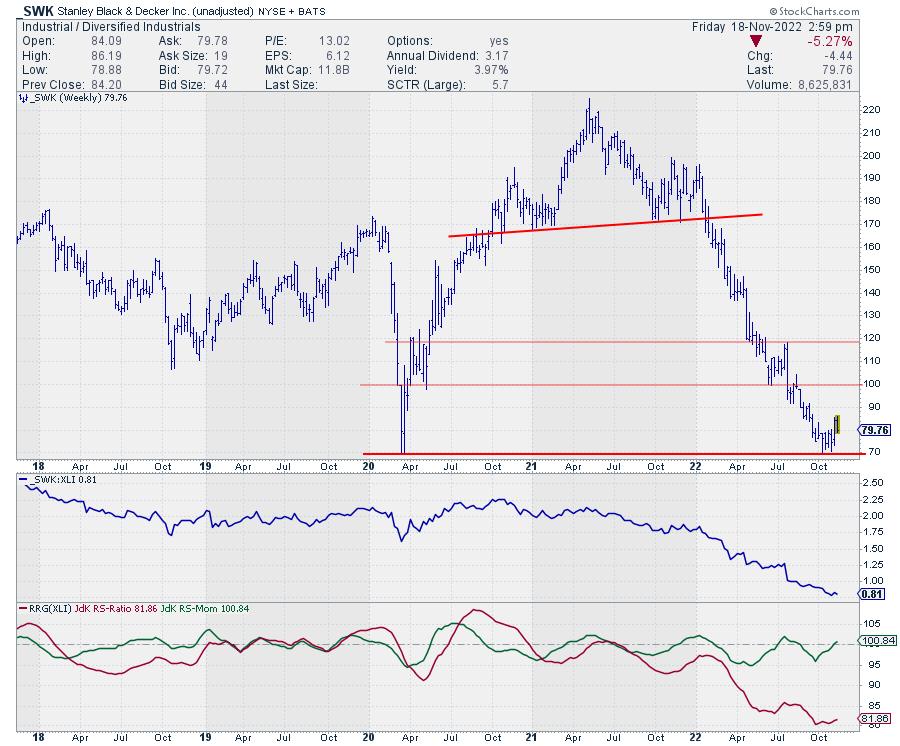

In case you’re in search of an actual cut price and never shy of some further danger, you might need to take a look at the chart for SWK.

This inventory got here all the best way down from a excessive above 220 in Might 2021 to a low at 70.24 within the week of October 10. That is a decline of round 70%! The RRG-Strains are slowly choosing up some relative enchancment.

And in case you had been ever questioning whether or not markets have a “reminiscence?” Lately, SWK bottomed at $ 70.24. The low again in March 2020 was at $70.00… That’s ok for me.

One factor is for certain. You will not be shopping for on the prime 😉

Aerospace

The Aerospace group is a bit smaller when it comes to constituents. Two of the tails are at the moment at optimistic RRG-Headings, these being RTX and BA.

Of those two, BA has the perfect potential, imho. The development in relative power is the strongest of the 2, whereas there may be nonetheless loads of room for BA to maneuver deeper into the main quadrant.

The inventory is about to finish a big double-bottom formation on the worth chart. We aren’t there but, so it’s an early name. However as it’s, if and when that peak round 172 can convincingly be damaged upwardly, a rally in the direction of the following space of resistance round 220 seems attainable.

#StaySafe and have an amazing weekend, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels underneath the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to answer every message, however I’ll actually learn them and, the place fairly attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative power inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Power in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra