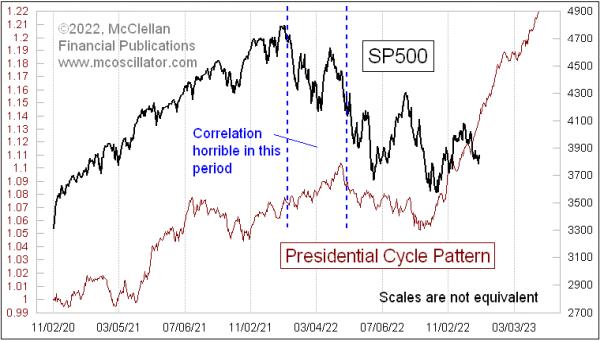

Now that the November 2022 mid-term elections are behind us, the inventory market is now in yr 3 of the 4-year presidential cycle sample. Some analysts take a look at that on a calendar day foundation, however I choose to depend the years as starting on November 1 for this function, because the inventory market usually responds to whoever will get elected president as quickly because it is aware of the result. Often that’s straight away, though again within the yr 2000, it took all the best way till mid-December to settle issues.

Throughout a typical 4-year presidential time period, the inventory market tends to be flattish through the first 2 years. Then the third yr is almost at all times an up yr. The election yr generally is a lot extra iffy, and there are examples of election years turning out actually badly, as was the case in 2000 and 2008. However third years are actually constantly up, nearly all the time. The notable exceptions had been 1931, when the world was in the course of the Nice Despair, and 1939, when the Wehrmacht was marching by means of Poland. Outdoors of situations like these, the third yr can normally be counted on to be an up yr.

This time could also be completely different, although. The third yr up section did get off to an important begin popping out of the October 2022 lows proper on schedule. However the rally has faltered in December in a method that the Presidential Cycle Sample (PCP) on this week’s chart doesn’t painting.

The PCP is formulated by chopping up all the information into 4-year chunks of time, then averaging them collectively. A number of extra changes are wanted to get constant information. One such adjustment is to equalize all the years. Up till 1952, the inventory market traded on Saturdays; then, within the mid-Nineteen Sixties there was a interval when buying and selling was shut down on Wednesday in order that the “paperwork” may get caught up (there have been no computer systems then). So to get every 4-year interval to be of a constant size, some trimming of Saturdays or duplication of prior days for uneven holidays is required.

I additionally recalculate every 4-year interval’s costs to mirror a beginning worth of 1.00 as of Nov. 1 of the election yr. That method, greater worth ranges of current years will not throw off the calculation of the “common”.

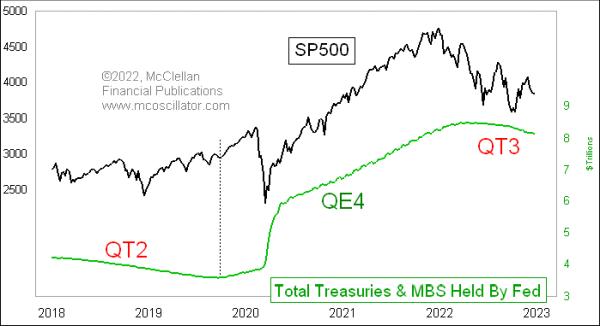

The massive decline we have now seen in December 2022 is certainly out of character for a 3rd yr. This doesn’t essentially imply that the inventory market can’t get again into gear with what the PCP reveals, nevertheless it does say that we’re not off to a typical begin. And this is sensible, once we contemplate that the Federal Reserve will not be solely elevating rates of interest on the quickest price ever, additionally it is promoting off its Treasury and mortgage holdings on the quickest price ever.

We all know that the primary spherical of quantitative tightening (QT1) in the summertime of 2008 had a horrible impact for the inventory market. QT2 in 2018-19 was not as dangerous, as a result of it was balanced out by an earnings tax price minimize enacted in 2017. However QT2 did maintain the inventory market simply transferring sideways, till the Fed began shopping for Treasuries and MBS once more in late 2019.

In physics phrases, there’s at all times a “stability of forces equation”. The movement of the thing or particle in query is determined by the sum of all of these forces. For 2023, we have now the bullish power of the third yr of a presidential time period being met by the bearish forces of Fed price hikes AND Fed QT. If ever there have been a situation below which the bullish tendency of the third yr won’t work, that is that point.