Hey pals!

With the appearance of the brand new MT5 platform, the method of testing and optimization has change into simpler and higher. On account of the truth that the platform makes use of the actual tick quotes of the dealer and the actual values of the unfold, the standard of testing has elevated and tends to one hundred pc.

It relies upon, in fact, on the dealer whether or not it saves historic information accurately.

There are such brokers that shouldn’t have a while intervals. This is applicable to totally different foreign money pairs.

In any case, the simulation high quality is increased than that of the earlier MT4 platform. Personally, I belief the brand new platform extra.

What I aslo likeon the brand new platform is that it could possibly use a number of cores, computer systems and cloud applied sciences when optimizing.

Thus, the Knowledgeable Advisor optimization course of will increase many instances over, even by tens and tons of.

In my case, about 25-30 simultaneous processes are concerned within the optimization.

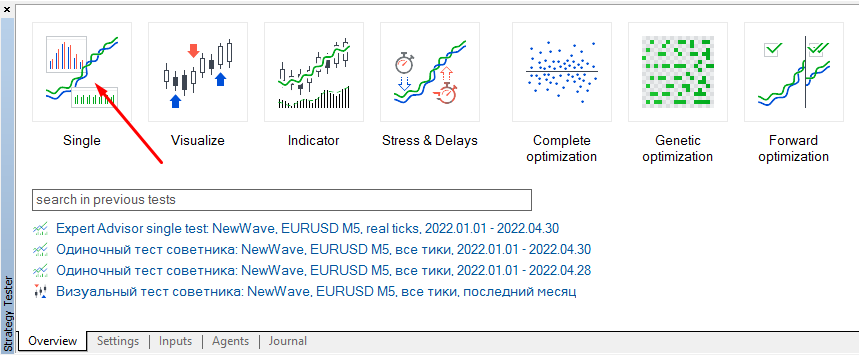

So. First, go to the MT5 technique tester (Ctrl+R) and choose single testing.

Let’s take for instance my Knowledgeable Advisor New Wave.

The hyperlink to the advisor is on the market on the hyperlink: www.mql5.com/en/market/product/81132

And my actual sign at: https://www.mql5.com/en/alerts/1519193

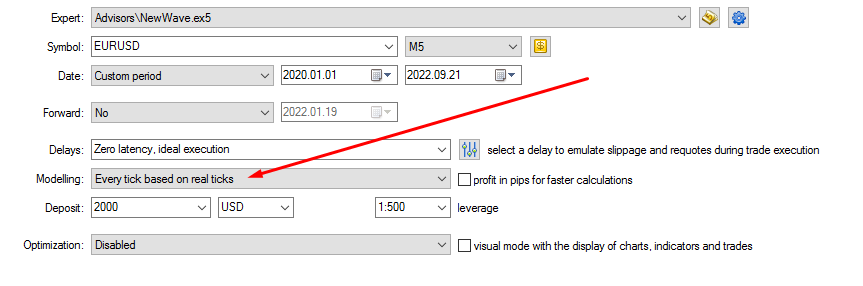

As a rule, I first do testing with subsequent tester parameters:

I select the interval of testing and optimization inside 1-2 years. As a result of historical past by no means repeats itself and good outcomes previously don’t assure them sooner or later. So testing extra reveals the efficiency of the adviser algorithm itself and its preliminary settings.

Modelling I set to “Each tick primarily based on actual ticks” to get simulation outcomes near 100%.

I select an affordable worth of the deposit primarily based on the kind of professional adviser.

For grid algorithms and totally different variations of Mertingale, the deposit should be at the least 2000 models with a typical account sort.

In my case, the EA makes use of a grid of orders, and due to this fact I take advantage of values from 2000 for testing.

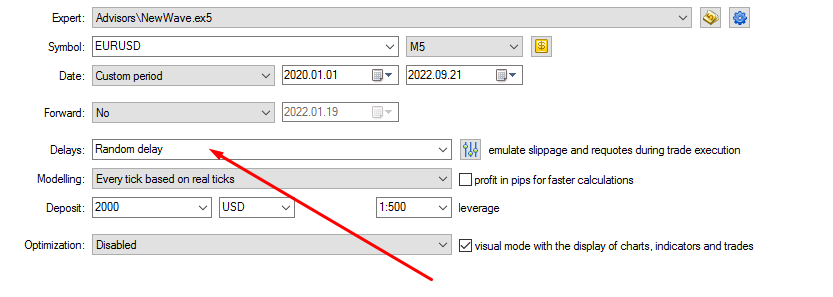

My subsequent step is to examine the EA settings with a unique worth of the Delay parameter.

I take advantage of Delays as “Random delay”.

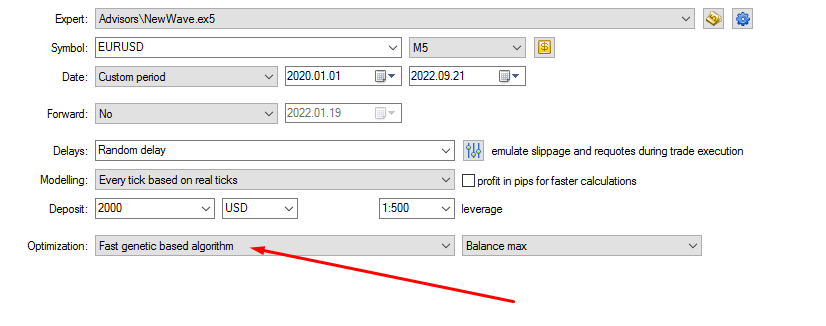

Now let’s transfer on to the Knowledgeable Advisor optimization mode.

For a sooner and extra optimum optimization course of, I select this mode “Quick genetic primarily based algorithm”.

As I mentioned, I select the interval of testing and optimization inside 1-2 years.

I see no purpose to make use of an extended interval. Historical past doesn’t repeat itself, simply as world occasions don’t repeat themselves, which make severe changes to the foreign money market (in our case).

An extended optimization interval will extra common all values. However typically it’s also helpful, I can’t cover.

Infrequently I make settings for durations of 5 years for various Knowledgeable Advisors and foreign money pairs.

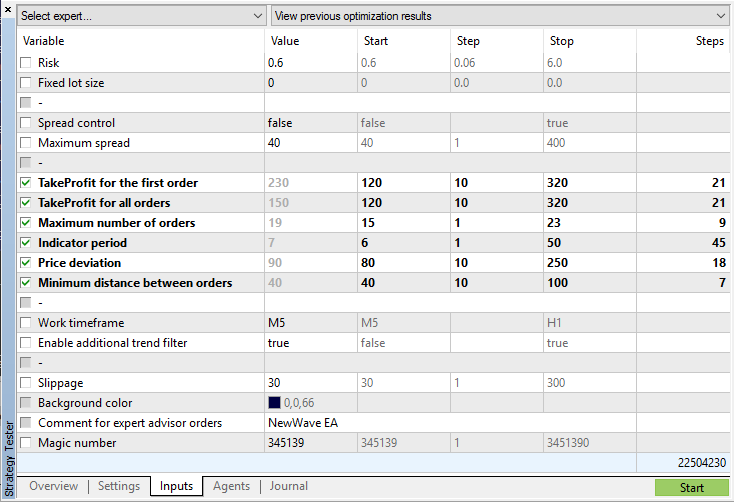

And now what parameters I optimize and in what ranges.

I normally do not embrace the “Timeframe” parameter within the optimization course of.

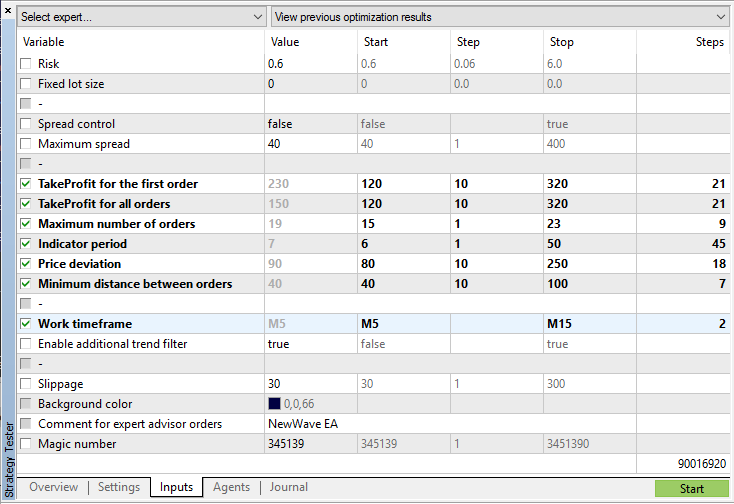

On this case, I already know that the EA reveals one of the best outcomes when working with two timeframe values.

These are M5 and M15.

And so I break up the optimization course of into two. To hurry up. Thus, I get units of parameters for 2 totally different timeframes.

However those that want also can embrace this parameter within the optimization course of.

That is how I made a decision which timeframes to take a look at, by shortly optimizing for a brief time period.

After the completion of the EA optimization course of, I select which units I like finest and run them on the backtest. Pre-writing them into information.

When selecting ready-made units, I take note of revenue, revenue issue and drawdown. Due to this fact, the set of settings used shouldn’t be at all times probably the most worthwhile.

And in the long run, when I’ve already determined which set of parameters I’ll use, I do backtesting of those parameters with totally different values of the chance parameter to search out the optimum worth based on my deposit and my desired danger.

This concludes my quick temporary instruction on testing and optimizing my professional adviser.

Thank to all!

Finest regards, Sergey.