Statistics present that December has the best chance of a constructive return over each different month of the yr, and by a good margin, with the percentages of a constructive return for U.S. Massive Caps being 77.9% utilizing knowledge from 1926 to 2020.

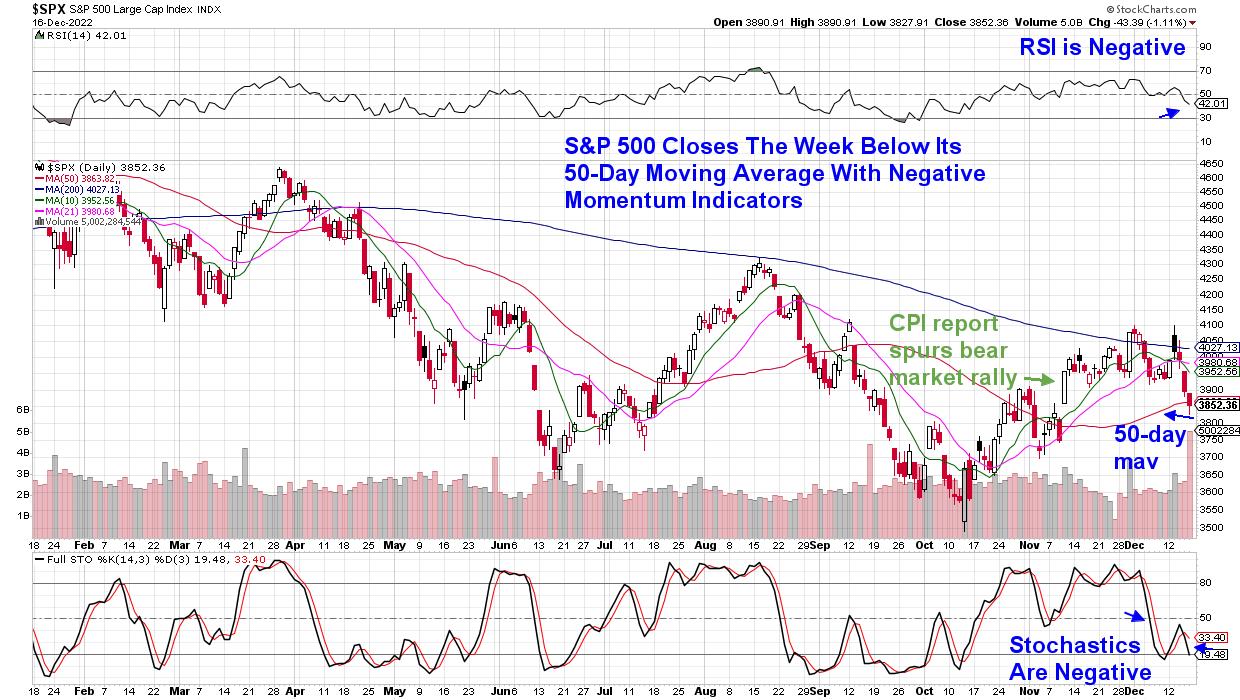

The markets may have some work to do that yr for this development to carry true, nonetheless, because the S&P 500 is down 5.6% over the primary two weeks of December. The truth is, final week’s drubbing pushed the S&P 500 beneath its key 50-day transferring common, with each the RSI and Stochastics now in damaging territory. This value motion put a halt to the bear market rally that started on November tenth, after a constructive CPI report confirmed a lot decrease inflation than anticipated.

DAILY CHART OF S&P 500 INDEX

Buyers have been promoting shares not too long ago as a consequence of fears of a recession, pushed by the Federal Reserve’s intent to maintain rates of interest excessive nicely into subsequent yr, in an effort to get inflation ranges nearer to their 2% goal. Simply final week, the Fed lowered their forecast for development within the U.S. subsequent yr to 0.5%, and so they see the jobless fee rising to 4.6% by yr finish.

This worry of a recession amongst buyers has pushed shares into an oversold place within the close to time period, and we might even see a bounce subsequent week. Bear in mind, nonetheless, that any bounce is anticipated to be short-lived, as the general bear market development stays in place.

Beneath is a shorter-term, 1-hour chart of the S&P 500 that highlights the RSI beneath 30 and the MACD beneath zero in periods of an oversold situation in November, in addition to earlier this month. As a way to anticipate any rally, the Index would wish to commerce again above its 5- and 13-hour transferring averages, with the MACD experiencing a bullish crossover of its black line transferring up by the purple line.

INTRADAY, 1-HOUR CHART OF S&P 500 INDEX

Whereas this shorter-term timeframe of investing shouldn’t be for everybody, fast earnings may be made if the proper space of the markets are in focus after which, from there, prime candidates are chosen. For my work, I have been favoring Healthcare shares longer-term, as they’ve a defensive bias with choose areas faring nicely amid prospects for elevated earnings development.

These identical shares stand to fare nicely in a shorter-term rally interval as nicely, and if you would like quick entry to my Urged Holdings Record, you may use this hyperlink right here and entry my most up-to-date MEM Edge Report at a nominal price. The MEM Edge Report will even maintain you on prime of the rotation that is happening away from areas of the market that fare poorly within the face of a potential recession. Make sure and use the hyperlink above so you may exit positions which are on the most threat whereas additionally being alerted to shifts within the broader market.

Warmly,

Mary Ellen McGonagle, MEM Funding Analysis

Mary Ellen McGonagle is an expert investing marketing consultant and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to change into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with huge names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra