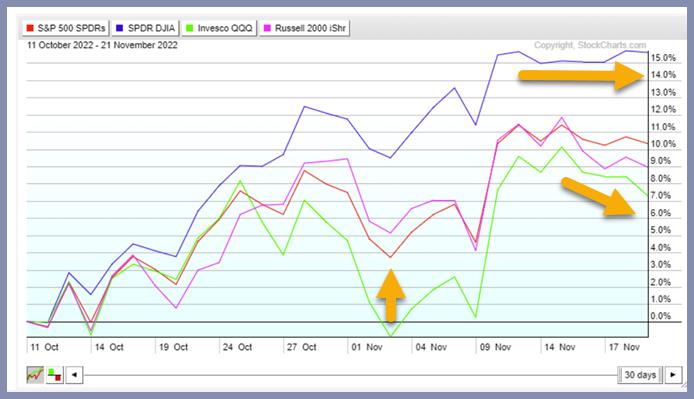

The market had a comparatively quiet day as buyers look to the Thanksgiving vacation. Shares did finish decrease on Monday, with the QQQs declining 1.1%. DIA misplaced 0.06% right this moment. As seen within the chart above, ranging from October 11, 2022, the Dow Jones (represented by DIA) outperformed the opposite key US Indices.

Compared to the tech heavy QQQs, that are down -29.71% 12 months so far, DIA is simply down -7.8%. Though buying and selling volumes are sometimes decrease throughout a holiday-shortened week, merchants ought to stay vigilant. Our threat gauges proceed to flash warning. Shopper Staples led on Monday with a acquire of 1.1%, whereas Utilities have gained virtually 3% during the last 5 buying and selling days regardless of a decline in risk-on sectors.

Merchants ought to monitor volatility carefully, in addition to the efficiency of every US index, as a result of they provide a glimpse of the place issues could possibly be heading by 12 months’s finish.

DIA is down modestly from latest highs whereas decisively outperforming small caps and expertise. It’s near taking out the earlier highs of mid-August. DIA exhibits management within the Triple Play Indicator and powerful momentum within the Actual Movement Indicator, as proven by the inexperienced arrows above.

The Pattern Energy Indicator (TSI) rating for DIA is constructive at 3.38, which is exceptionally excessive, suggesting that the present pattern is strong and has extra longevity. The TSI is constructive and the strongest of the 4 fairness US benchmarks. DIA additionally crossed the 200-week transferring common in early November and is now buying and selling sideways, consolidating latest strikes.

In an inflationary local weather, investing in companies with robust money circulation, pricing energy, and dividends turns into extra interesting and plenty of of those firms are within the Dow Jones. Utilizing our proprietary buying and selling indicators, corresponding to Actual Movement and Management, it is possible for you to to commerce successfully, acknowledge pattern power and pinpoint pattern management for efficient buying and selling in any market situation.

Rob Quinn, our Chief Technique Marketing consultant, can present extra details about our proprietary buying and selling packages, our Pattern Energy Indicator (TSI), and give you a complimentary one-on-one buying and selling seek the advice of. To seek out out extra about Mish’s Premium buying and selling service, click on right here.

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

Learn Mish’s newest article for CMC Markets, titled “What’s Subsequent For Key Sectors After the Midterms“.

Mish explains why MarketGauge loves metals and continues to be patiently loading up equities on Enterprise First AM.

Mish talks metals, charges, greenback, and which sector to purchase/keep away from in this look on UBS Trending.

See Mish discuss with Charles Payne on Making Cash in regards to the Oil markets testing the boundaries of Fed coverage, China, and what to purchase within the metals.

- S&P 500 (SPY): 392 assist and 397 resistance.

- Russell 2000 (IWM): 179 assist and 185 resistance.

- Dow (DIA): 334 assist and 340 resistance.

- Nasdaq (QQQ): 278 assist and 286 resistance.

- KRE (Regional Banks): 60 assist and 66 resistance.

- SMH (Semiconductors): 210 assist and 219 resistance.

- IYT (Transportation): 222 assist and 228 resistance.

- IBB (Biotechnology): 130 assist and 136 resistance.

- XRT (Retail): 62 assist and 67 resistance.

Keith Schneider

MarketGauge.com

Chief Government Officer

Wade Dawson

MarketGauge.com

Portfolio Supervisor

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For almost 20 years, MarketGauge.com has offered monetary data and schooling to 1000’s of people, in addition to to giant monetary establishments and publications corresponding to Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary individuals to comply with on Twitter. In 2018, Mish was the winner of the Prime Inventory Choose of the 12 months for RealVision.