The markets ended the week flat-to-down as buyers digested remarks from Fed officers, who had been intent on eradicating pivot hopes that adopted comfortable CPI and PPI stories. Each inflation stories got here in beneath anticipated, which was definitely encouraging. Blended earnings stories from main retailers Walmart (WMT) and Goal (TGT) additionally stored bullishness at bay final week.

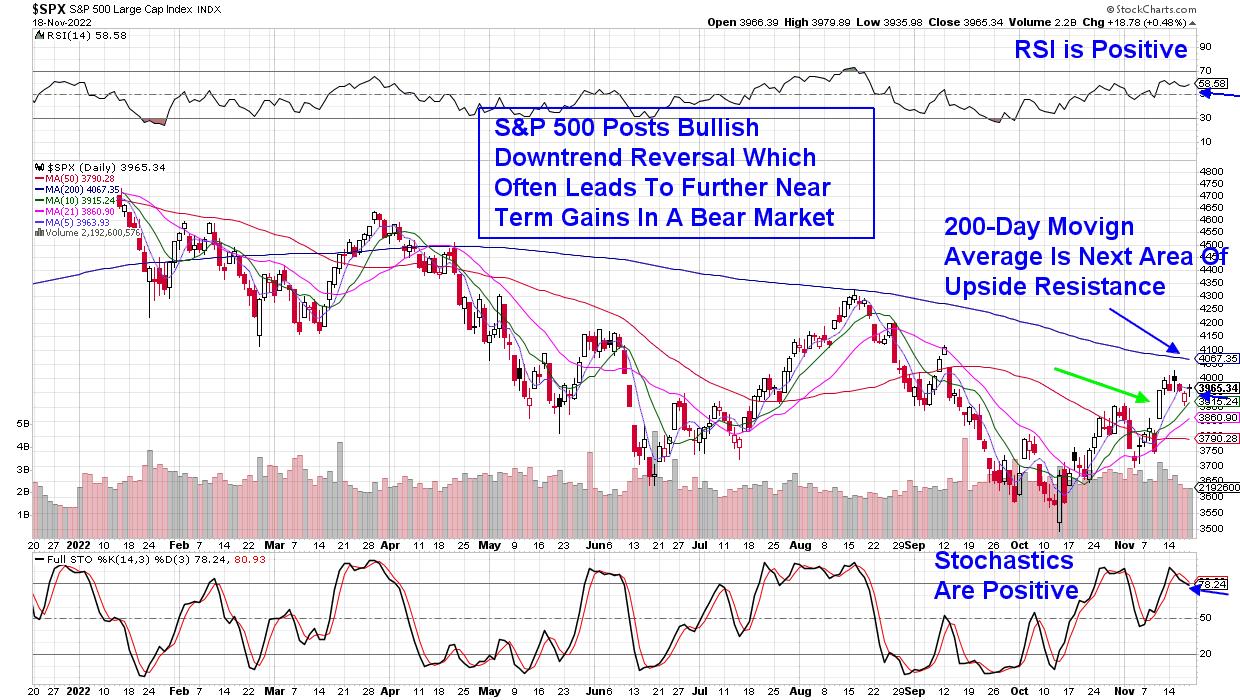

Subsequent week is the Thanksgiving vacation interval and, sometimes, the markets carry out effectively. There are obstacles, nevertheless, as highlighted within the chart of the S&P 500 beneath. Additionally of observe is that, on Wednesday, the Federal Reserve might be releasing notes from their most up-to-date assembly, and any trace of an elevated rate of interest hike cycle might ship the bulls into hiding.

DAILY CHART OF S&P 500 INDEX

Whereas the markets misplaced floor throughout a uneven interval final week, a pointy rally the prior Thursday pushed the S&P 500 right into a near-term uptrend. The transfer additionally improved breadth on this Index, so that just about 85% of shares are actually buying and selling above their key 50-day transferring common. Not all shares are able to commerce larger, nevertheless, as solely 50% are above each their 50- and 200-day transferring averages.

General, nevertheless, there are a big variety of shares in a bullish place and, amongst these, my work exhibits that shares which have already reported third quarter earnings and supply a yield larger than the S&P 500’s common of 1.7% are exhibiting probably the most potential to commerce larger. That is significantly true if the inventory is in an space of the market that may fare effectively throughout a recessionary interval. At this time’s main financial index knowledge for the U.S. has some economists forecasting that we’re already in a recession after it confirmed a 0.8% decline for October. This was the eighth straight decline within the main index.

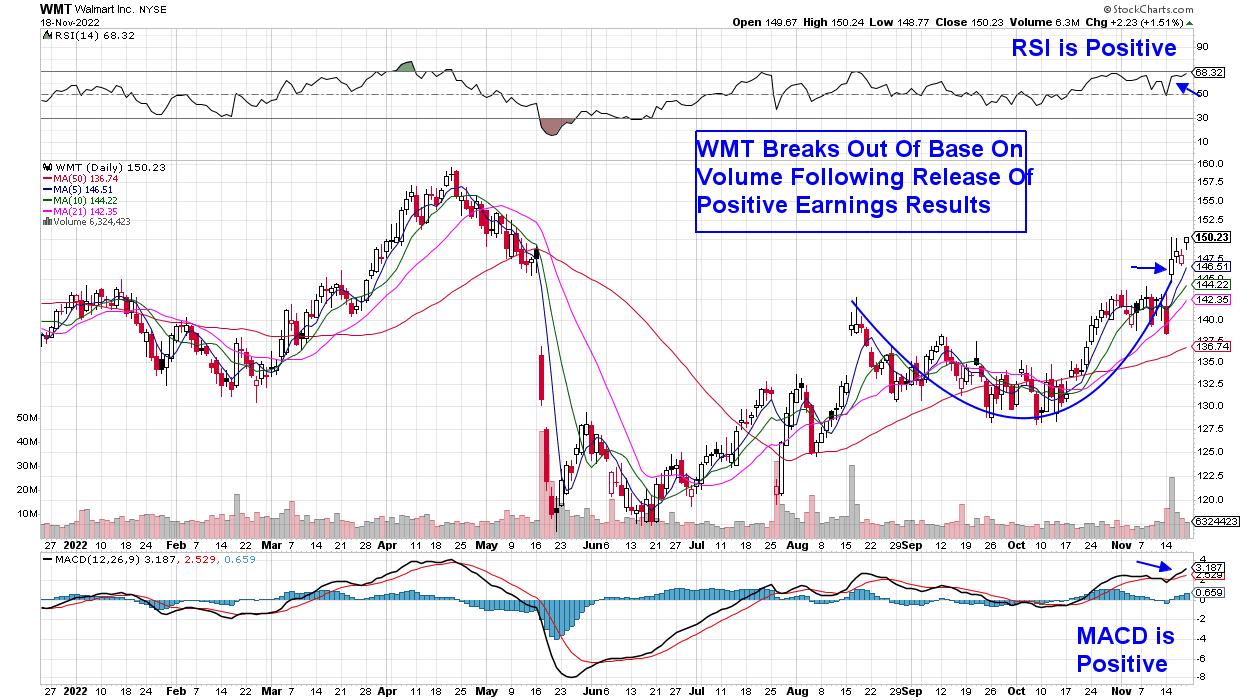

Subscribers to my MEM Edge Report are effectively conscious of my predisposition towards shares which can be recession-proof, whereas additionally exhibiting the expansion wanted to draw buyers. Amongst current winners, the report added Walmart (WMT) as a purchase concept late final month, which put subscribers able to participate on this week’s rally. Going again to the 2008 recession-led bear market, WMT was among the many high ten performers after gaining 15.6% whereas the markets had been down 37% for the yr.

DAILY CHART OF WALMART (WMT)

Different areas of the market are at present faring effectively additionally, with the Dow Jones Industrial Common down solely 7.8% year-to-date even because the S&P 500 has misplaced greater than double this quantity. The Dow has quite a lot of higher-yielding names which can be performing effectively, and several other names from this Index are additionally on my Urged Holdings Checklist.

If you would like speedy entry to those shares, in addition to insights into what to anticipate inside the markets and sectors as we head into year-end, use this hyperlink right here for a 4-week trial at a nominal charge. This twice weekly report additionally offers particular alert stories ought to we see a shift within the markets.

Might you and your loved ones benefit from the begin of this yr’s vacation season!

On this episode of StockCharts TV‘s The MEM Edge, I check out the persevering with theme of shares being pushed larger by optimistic earnings stories. I shut the present with some “thanksgiving” food-related shares, as Shopper Staples had been the top-performing space this week.

Warmly,

Mary Ellen McGonagle – MEM Funding Analysis

Mary Ellen McGonagle is an expert investing advisor and the president of MEM Funding Analysis. After eight years of engaged on Wall Avenue, Ms. McGonagle left to change into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with huge names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Study Extra