The typical US inventory index closed decrease on Thursday (20/10). The US30 index fell –0.30%; the US100 contracted -0.51% as Tesla plunged –6.65% by the top of the buying and selling session, whereas the US500 closed –0.80% decrease. The weak point in common inventory costs has elevated liquidity towards the USD which was supported by an increase within the 10yr T-Word yield which rose to a contemporary 14-year excessive of 4.178%.

The USDIndex on Thursday narrowed its losses with a slight decline of -0.10%. The index initially fell fairly sharply, because it was weighed down by short-lived Pound beneficial properties after PM Liz Truss introduced her resignation.

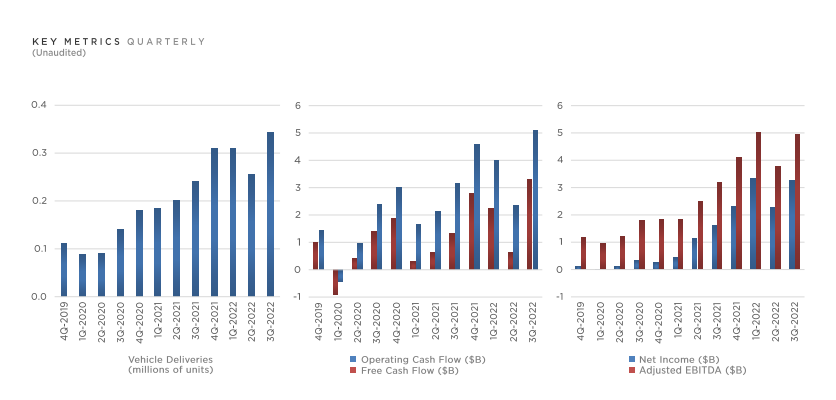

Tesla Inc. reported Q3 income of $21.45 billion, beneath market expectations of $21.96 billion. In consequence, the share worth slumped. The electrical car large described the quarter as robust with report income, working revenue and money move.

Working revenue rose to $3.7 billion within the quarter and working margin reached 17.2%. Nevertheless, the corporate mentioned profitability was impacted by greater uncooked materials, commodity, logistics and guarantee prices together with a unfavourable foreign exchange hit of $250 million. This was additionally compounded by the much less environment friendly efficiency of its new factories in Berlin and Texas.

Automotive income reached $18.69 billion, a 55% enhance from a 12 months in the past, whereas price of income for Tesla’s core automotive enterprise rose to $13.48 billion throughout the quarter, up from $10.15 billion throughout the second quarter, in keeping with the rise in automotive gross sales. Tesla reiterated its earlier steerage, saying, over a multi-year horizon, it expects to realize 50% annual progress in car deliveries.

Deliveries of its semi-electric heavy vehicles will start in December, however no actual time was given for the beginning of manufacturing of its Cybertruck pickup, with the group saying solely that it is going to be produced in Texas following the ramp-up of Mannequin Y manufacturing there.

The firm mentioned that as cargo volumes attain vital ranges within the remaining weeks of every quarter, transport capability turns into costly and tough to safe resulting in extra automobiles in transit on the finish of every quarter. It mentioned it expects to clean out logistics by the quarter will enhance the price per car.

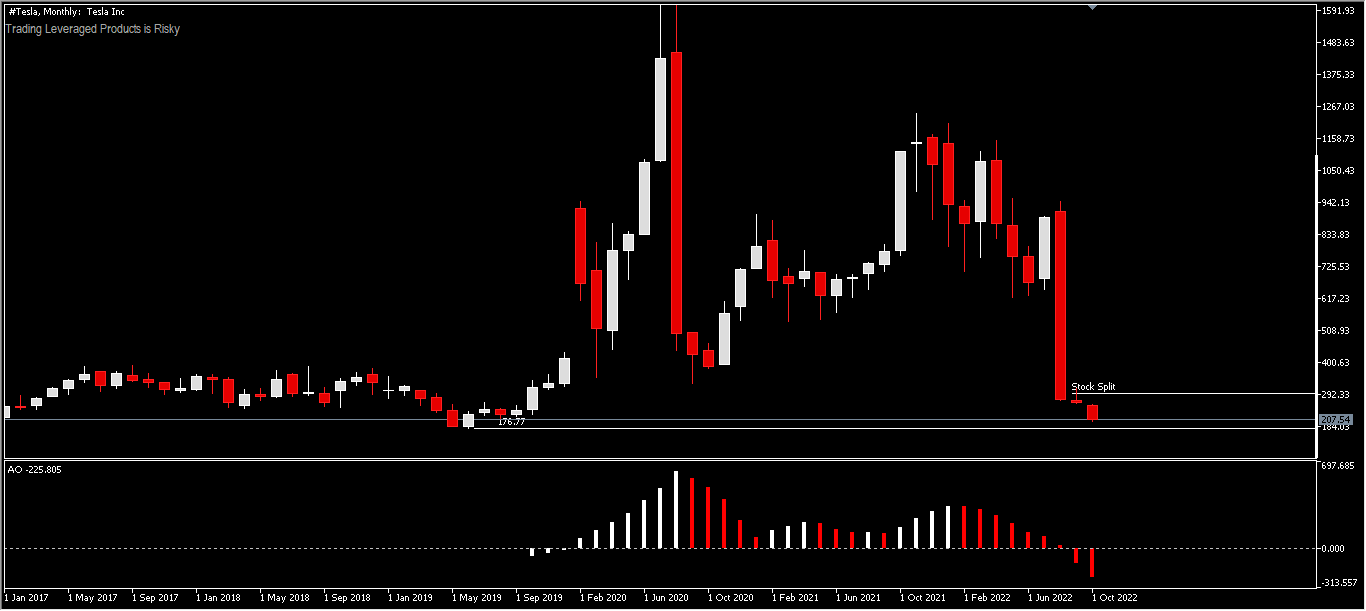

Technical Evaluation

#Tesla’s share worth because the August break up (302.24) remains to be underperforming. Following this Q3 report, #Tesla’s worth was buying and selling at round 207.54 on Thursday, which interprets to a decline of -31.2%. Sentiment over Elon Musk’s plan to purchase Twitter, considerations over financial slowdown, surging inflation and rising rates of interest contributed to #Tesla’s efficiency.

From a technical viewpoint, an additional decline to the draw back amidst the Fed’s fee hike expectations shouldn’t be out of the query. June 2019 help because the bulls’ predominant defence is at 176.77 or about 14% of the present worth. However a transfer above 228.64 minor resistance within the subsequent few days may change the bias again to the upside to check 265.71 help which is now resistance. Alternatively, it’s even attainable that the corporate’s improved efficiency may carry the value as much as the 302.24 restrict.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is supplied as a basic advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.ana