The seasonal patterns for October and yearend are fairly optimistic, however seasonality is only one facet of broad market evaluation and the load of the proof stays bearish.

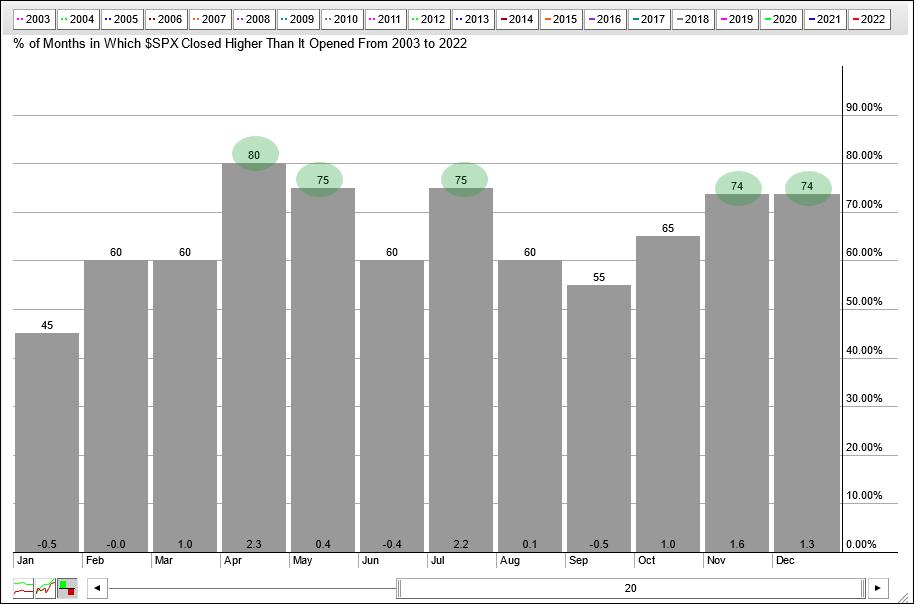

The histogram beneath reveals the seasonal patterns for the S&P 500 over the past twenty years. 5 of the twelve months stand out as a result of they closed larger greater than 70% of the time (April, Might, July, November and December). October is the sixth strongest month of the yr as a result of it closed larger 65% of the time. Not dangerous, however this additionally means October closed decrease 35% of the time.

Although October has optimistic expectations and November-December are even stronger, I’m placing seasonal patterns on the again burner as a result of the tape is bearish and the Fed is tightening. I wager lots of you possibly can guess what I’m going to say subsequent! Do not struggle the tape or the Fed. This phrase, which was coined by the late Marty Zweig, is as prevalent as we speak because it was within the 80s. Sure, the 80s are again! The tape is bearish as a result of the S&P 500 is in a downtrend. This key benchmark is beneath the falling 200-day SMA and the Pattern Composite has been damaging since April nineteenth.

The underside window reveals the Efficient Fed Funds Charge ($$FEDRATE) turning up in March and stair-stepping larger since. Charges are rising sharply so being bullish now can be combating the Fed. I might additionally observe that the stability sheet has been contracting since April. Although I’m displaying Fed Funds right here, I shall be watching the 10-yr Treasury Yield for the primary indicators of a change in Fed coverage as a result of the bond market tends to steer the Fed.

Bullish seasonal patterns could produce a counter-trend bounce or consolidation as a result of the S&P 500 grew to become fairly oversold just lately, however the index stays in a long-term downtrend and the Fed remains to be in tightening mode. No person is aware of when the bear market will finish or how far it should lengthen. The most effective we will do is settle for the proof and commerce accordingly till it modifications. Personally, I shall be watching the breadth thrust indicators which can be a part of the TrendInvestorPro Composite Breadth Mannequin, which has been bearish since April eleventh. Click on right here for instant entry to our timing mannequin, ETF reviews, complete movies and ETF Pattern/Rank desk.

The Pattern Composite, Momentum Composite, ATR Trailing Cease and eight different indicators are a part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click on right here to study extra and take your evaluation course of to the subsequent degree.

—————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic strategy of figuring out development, discovering indicators inside the development, and setting key value ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.