UK markets in turmoil as fiscal considerations mount. The brand new PM’s plan to revive spirits by launching a serious spherical of tax cuts hasn’t actually labored. Certainly, within the present state of affairs, the place development constraints primarily lie with the availability aspect, final week’s mini-budget put the federal government on target for unsustainable funds and a standoff with the BoE and the result’s that bonds and Sterling slid to the trough of 1985, in free fall.

UK property are beneath strain as buyers proceed to react to Friday’s mini-budget. The give attention to tax cuts raised concern of ever extra aggressive central financial institution motion and a spike in inflation and fueled concern that authorities funds will more and more change into unsustainable. That the measures will be capable of carry development within the present state of affairs appears unlikely, as the principle challenges not simply within the UK lie on the availability aspect. The FTSE 100 is presently down -0.8%, underperforming versus the DAX, which is down -0.1%, after a weaker than anticipated spherical of Ifo confidence readings. The two-year fee jumped 52 bp to 4.4% this morning, the 10-year continues to be up 34 bp at 4.16%, with the inversion of the curve flagging recession dangers. Cable noticed a report low of 1.035 early within the session, however has since managed to maneuver as much as a nonetheless dismal 1.08. EURGBP is at 0.8993, after touching a session excessive of 0.93953 – a stage final seen early in 2020.

The BOE raised rates of interest by 50bp, whereas a brand new financial plan did not ease considerations over the specter of a recession. GBPUSD misplaced round 3.5% on Friday, hitting a low of 1.0838. Normally, Sterling’s weak point helps the UK market, however this time the consumers gave up with greater than 2.2% losses on the UK100. The index fell under 7000 for the primary time in three months and closed at 7021. The sell-off was exacerbated by the GfK client confidence indicator which fell from -41 to -49, breaking the historic report since 1974. The CBI retail exercise indicator fell from 37 in August to – 20 in September. Additional decline of financial exercise was sooner than anticipated; the composite PMI fell from 49.6 to 48.4 towards expectations of 49.0 after the Providers index fell from 50.9 to 49.2.

This week will inform whether or not the UK is already in recession as the ultimate studying of second quarter GDP is due. The newest studying was -0.1% so a small optimistic revision could possibly be sufficient to halt a technical recession, but it surely hasn’t modified the market’s skepticism.

Technical Overview

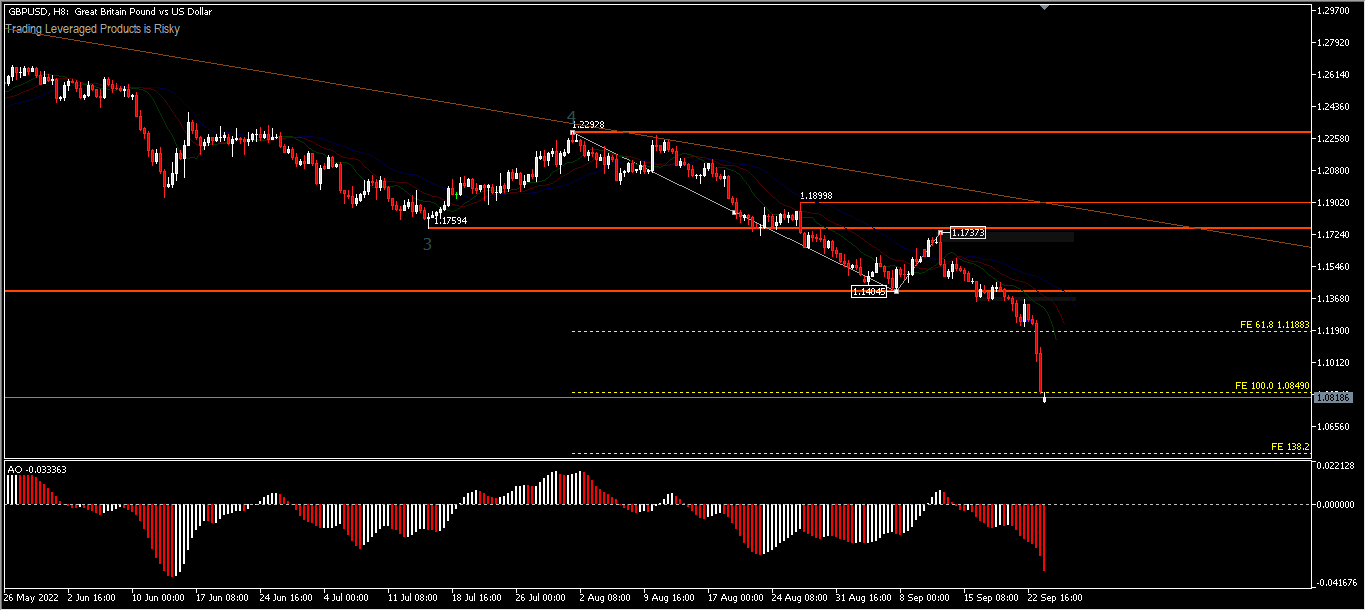

GBPUSD – Downtrend hit a low of 1.0838 final week and in at this time’s open shifted once more to the draw back. Within the close to future there isn’t a signal of a low level. Long run continued declines nonetheless go away key 37-year assist at 1.0520 (Feb 1985). Nevertheless, if projected with Fibonacci Enlargement, from the draw 1.2292-1.1404 and 1.1737 the subsequent doable goal is on the FE1 38.2% stage round 1.0500, and FE 161.8% (+/-1.0300) as Friday’s decline has arrived at FE 100% (1.0850).

The motion to the upside can be quickly restricted by the assist at 1.1404 which is now resistance earlier than making one other decline. Nevertheless the outlook will stay bearish so long as the resistance at 1.1737 stays intact.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a basic advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.