Final Friday, I spoke on Girls of Wall Road Twitter Areas and Fox Enterprise’s Making Cash with Charles Payne to speak a few key month-to-month transferring common.

What makes this transferring common so vital proper now could be that three of the Financial Fashionable Members of the family are testing it. The three members, Granddad Russell 2000 (IWM), Grandma Retail (XRT) and Transportation (IYT), nicely deserve their standing as what Stanley Druckenmiller calls the “inside” of the U.S. economic system. In actual fact, the elements of the trendy household had been put collectively earlier than we heard Druckenmiller’s viewpoint. We’ve got noticed how predictive all of them are in serving to us see upfront the subsequent large market path. Therefore, these “inside” indicators — proper now — are all sitting simply above a 6–7-year enterprise cycle low.

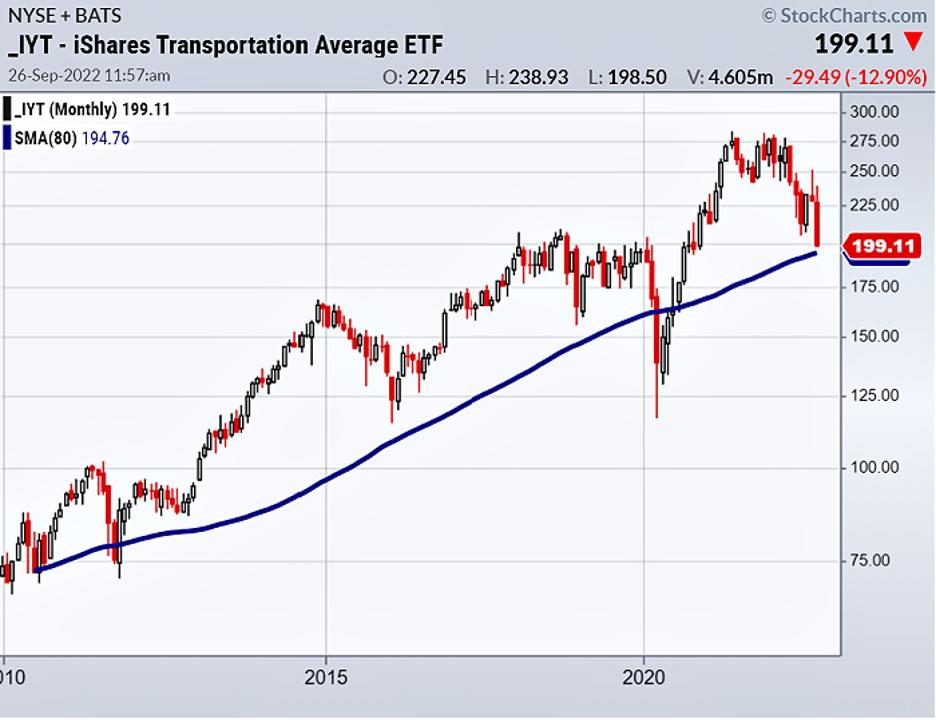

For the needs of this each day and since we now have featured this sector rather a lot these days, the chart of IYT is an ideal instance of this transferring common and what to look at for. Aside from the transient blip in 2011 when the federal government shut down, after which once more in the course of the pandemic, IYT has sat above the darkish blue line for 11 years. At the moment, that line sits on the 195 space. The identical is true with IWM and XRT, each marginally holding their month-to-month MAs.

So, watch IYT to both maintain, and start a rally presumably again nearer to 220, or for IYT to fail 195, during which case we see the entire market promoting off additional.

To notice, the opposite relations, similar to Sister Semiconductors (SMH) and Prodigal Son Regional Banks (KRE) are nonetheless sitting nicely above the month-to-month MA. Massive Brother Biotechnology (IBB), nonetheless, is now buying and selling under it. And never within the household, however nonetheless notable, is the REIT sector (IYR), additionally sitting under it. SPY has the identical MA, solely that one sits at 310 (a good distance off).

By the way, junk bonds broke down below this transferring common in November 2021. The market has been gradual to take junk bond’s trace.

For extra info on learn how to make investments profitably in sectors like biotech, please attain out to Rob Quinn, our Chief Technique Advisor, by clicking right here.

Mish’s Upcoming Seminars

ChartCon 2022: October 7-Eighth, Seattle (FULLY VIRTUAL EVENT). Be part of me and 16 different elite market specialists for reside buying and selling rooms, fireplace chats, and panel discussions. Be taught extra right here.

The Cash Present: Be part of me and plenty of great audio system on the Cash Present in Orlando, starting October thirtieth operating via November 1st; spend Halloween with us!

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

A enterprise cycle is about 6-7 years – the place are the indices now and what do you have to look ahead to? Mish discusses this query on this look on Fox’s Making Cash with Charles Payne.

- S&P 500 (SPY): Testing the earlier low; 362 help, 370 resistance.

- Russell 2000 (IWM): Broke the June low of 165.18; 162 help, 170 resistance.

- Dow (DIA): Broke June low – 289 help, 298 resistance.

- Nasdaq (QQQ): Testing the June low; 269 help, 280 resistance.

- KRE (Regional Banks): Relative outperformer; 57 help, 61 resistance.

- SMH (Semiconductors): 187 help, 194 resistance.

- IYT (Transportation): 196 help, 200 resistance.

- IBB (Biotechnology): 112 help, 118 resistance.

- XRT (Retail): 55 help, 60 resistance.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For practically 20 years, MarketGauge.com has supplied monetary info and training to 1000’s of people, in addition to to massive monetary establishments and publications similar to Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to observe on Twitter. In 2018, Mish was the winner of the High Inventory Decide of the 12 months for RealVision.

Get your copy of Plant Your Cash Tree: A Information to Rising Your Wealth and a particular bonus right here

Get your copy of Plant Your Cash Tree: A Information to Rising Your Wealth and a particular bonus right here