Three weeks in the past, we obtained an inflow of extremely useful suggestions from founders after Paul Bassat reached out to the neighborhood through this LinkedIn submit.

One recurring theme within the suggestions that resonated with me was: telling founders you make investments early is definitely not that useful. Founders requested: what does ‘early’ imply? What does ‘seed stage’ imply? Are you meant to have any traction on the ‘early’ stage of a startup?

An enormous problem for founders is that each fund has completely different solutions to those questions.

I wished to make the solutions to these questions much less opaque by sharing our information. I went by means of the ten+ yr historical past of Sq. Peg’s investments, and reviewed all of the funding papers the staff had written to know what we knew concerning the corporations on the time we invested. Right here’s what I discovered.

1. Our investing behaviours have modified over time

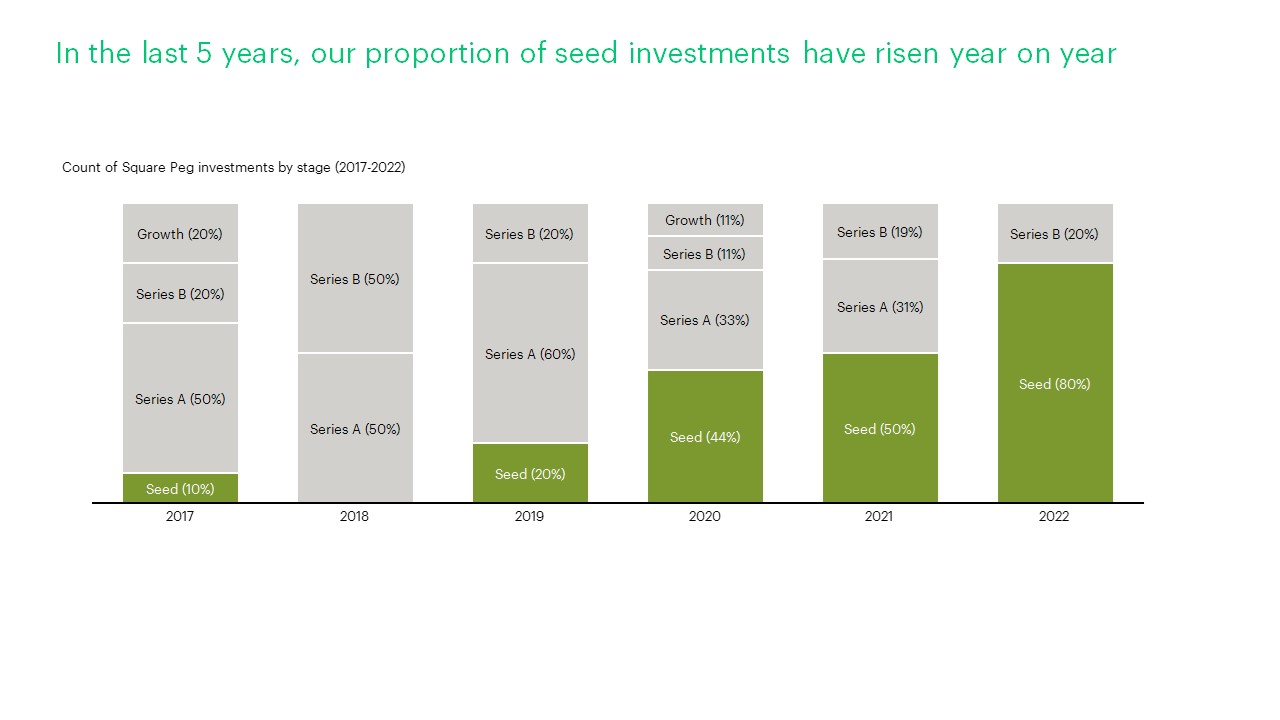

Within the final 5 years, the proportion of investments into seed rounds has risen yr on yr to now type the bulk – in 2022, seed represents 80% of our new investments.

2. After we do make investments at seed or Collection A, we have a tendency to jot down bigger cheques (US$1m+)

Our historic information from 2012 to 2022 confirmed that roughly 40% of our preliminary investments in a startup occurred on the seed stage.

However labels like ‘seed’, ‘Collection A’ or ‘Collection B’ could be unhelpful as a result of cheque sizes and valuations related to levels change over time relying on market cycles. Subsequently, I present under the breakdown by cheque dimension as nicely.

After we make investments on the seed stage, we have a tendency to jot down cheques of greater than US$1m. Dan Krasnostein, our Melbourne accomplice, lately wrote an ideal submit right here explaining why that’s the case. Briefly – we’re excessive conviction, excessive dedication buyers. We don’t do small cheques to “check the water”. We solely make investments after we are so excited that we’re banging our arms on the desk to accomplice with you.

As a founder, meaning you possibly can count on us to drop every thing to be useful to you. We’re empathetic companions who’re there with you for the lengthy journey – each the ups and downs.

The opposite issue to remember for present spherical dimension is what the subsequent spherical seems like (i.e. what milestones does the founder must hit to make the subsequent spherical successful, and the way a lot cash do they should get there). A bigger spherical can usually give founders extra buffer to experiment and make room for prime worth angels or seed-focused funds. That being stated, a small spherical is healthier than no spherical. Pragmatism wins above all: founders need to make the most effective resolution with the choices out there to them.

3. We don’t must see income traction at seed stage

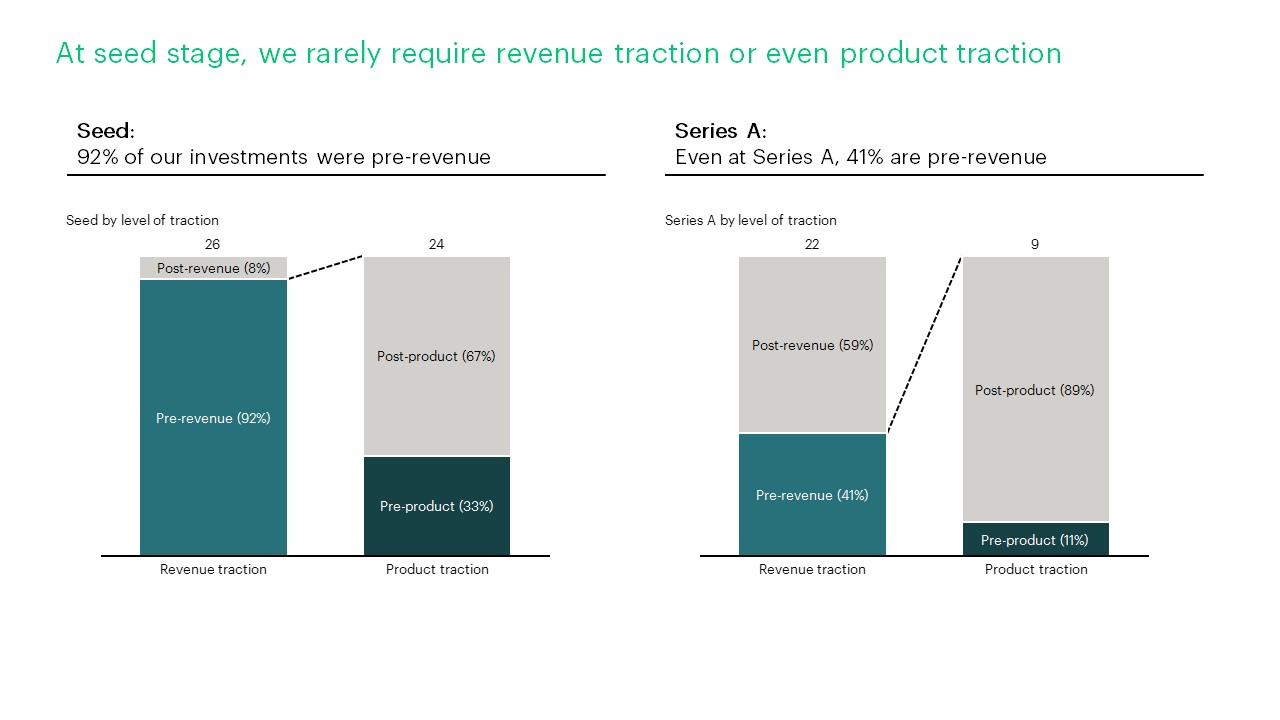

Traction could be an unclear time period to founders as a result of many funds will demand to see completely different ranges of ‘traction’ for a similar stage.

A standard demand to founders could also be to return again when there’s income. Trying again over the previous 10 years, that has not been a requirement we make to founders. In 92% of our seed investments, we now have invested pre-revenue.

We additionally have a look at different indicators, for instance:

- The depth of a founder’s perception into the issue;

- Whether or not the speculation on the answer is compelling and differentiated; and

- The extent of ambition and the plans round attaining it.

Founders don’t must have all of the solutions. Usually, we’re impressed by founders who’re conscious and upfront concerning the dangers, in addition to what they know and what they don’t know.

Listed below are some examples of funding into seed companies and the explanations behind them (the founder archetypes vary fairly a bit!):

- Saasguru (pre-revenue) – first-time tech founders with a background in cloud consulting. They’d deep perception into the cloud abilities hole, in addition to an method that went past the “digital textbook” mannequin of first-gen ed-techs.

- Vow (pre-revenue and pre-product) – the founders got here from outdoors the business they have been tackling, which gave them a contemporary perspective and a novel technique to unravel the way forward for meals with cell-based meats.

- Zeller (pre-revenue and pre-product) – a seasoned staff that had come out of Sq., seeking to construct a funds answer that that they had robust area experience in.

What’s frequent in these investments just isn’t that “we’re on the lookout for a founder who has executed X, Y, Z or comes from A, B, C background” however that all of them demonstrated a singular perception into the issue and a compelling, differentiated speculation on how they might remedy it.

What ought to founders take away from all this?

I hope that by sharing this information, we now have a minimum of made Sq. Peg’s definition of ‘early’ extra clear to founders.

The broader message I need founders to remove although is that after we say we’re ‘excessive conviction’ buyers, that doesn’t imply we have to see a post-product-market-fit enterprise the place the income is flying. It merely implies that we do need to say ‘no’ loads after we can’t get to that stage of excessive conviction. Nevertheless, after we say sure, we’re totally behind you for the primary and subsequent rounds.