Three out of each 10 funds in Africa fail, in keeping with reviews. Elements behind this vary from a fragmented funds panorama and invalid playing cards to dormant accounts and better dispute charges; they floor yearly resulting in a $14 billion loss in recurring income for digital companies throughout the continent.

These issues are sure to extend as digital funds in Africa proceed to develop, 20% year-on-year, per some reviews. And whereas gateways and aggregators have made it simpler for companies to simply accept a number of fee strategies, few options exist to mixture them for necessity’s sake and take care of fee failures that come up from every platform. That’s the place Revio, a South African API fee and collections firm, is available in. The fintech which makes it simpler for companies throughout Africa to connect with a number of fee strategies and handle fee failures is asserting that it has raised $1.1 million in seed funding.

Fintech investor SpeedInvest led the spherical, with participation from Ralicap Ventures, The Fund and Two Tradition Capital. A number of angel buyers additionally participated together with fee and income restoration specialists from Sequoia, Quona Capital and Circle Funds, in keeping with a press release shared by the startup.

Revio was based by Ruaan Botha in 2020. As an expert who has labored in South Africa’s banking and insurance coverage industries for over a decade, Botha determined to launch Revio after seeing how a lot time and guide effort companies spend in partaking clients on excellent and failed funds. It was clear that only a few corporations had invested meaningfully in income restoration. When asking over 25 purchasers the place they’d make investments $1 in the event that they needed to repair their fee programs, most of them stated they’d spend a minimum of 90% of that cash on managing fee failures and buyer churn.

“We’ve got the debit order as the biggest recurring fee technique in South Africa. However the second companies need to begin including different completely different fee strategies to take care of buyer demand, it was tremendous onerous for them to take action,” Botha advised TechCrunch in an interview. “And it was simply due to the disconnect between banks, new fintechs and fee aggregators which additionally made it tough for companies to gather recurring income on an ongoing foundation. So with Revio, we needed to make it tremendous easy for companies to attach any fee strategies that they want, not solely in South Africa however the remainder of Africa and globally as properly.”

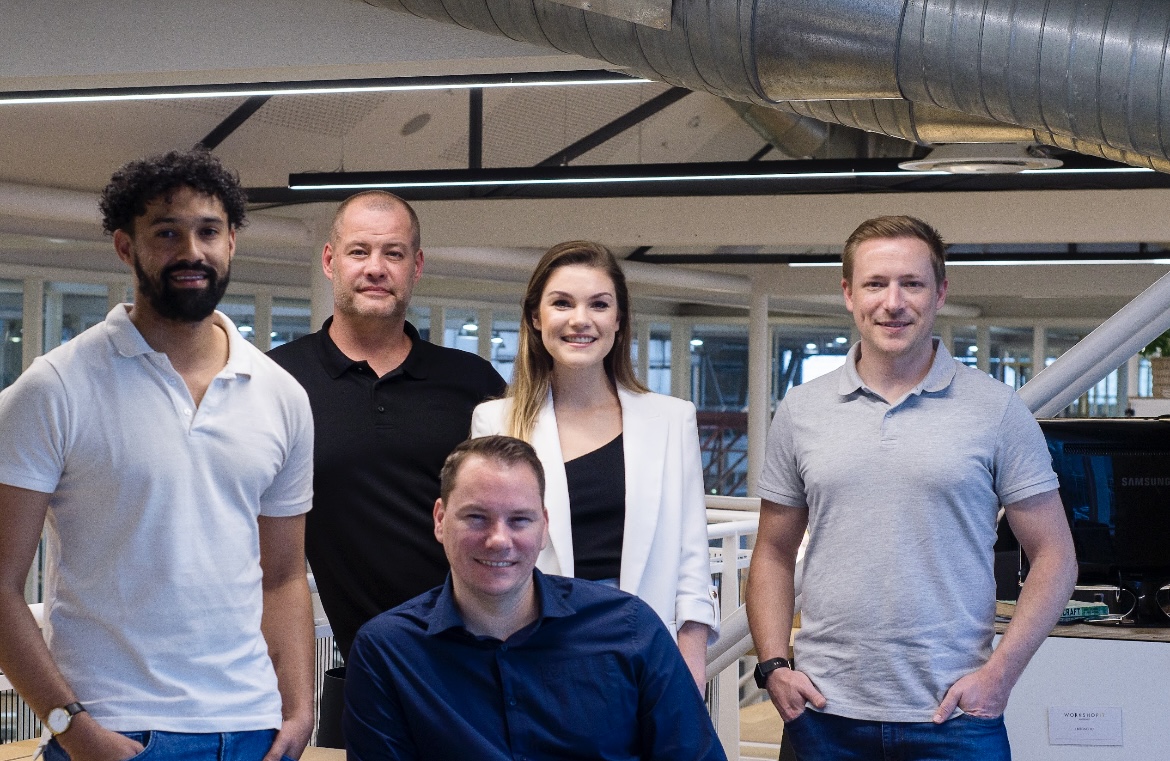

Botha is joined by three executives who run the corporate affairs: Chief business officer Pieter Grobbelaar, an ex-country lead at Flutterwave; chief know-how officer Kyle Titus, who has expertise working with fintechs and a enterprise studio and chief working officer Nicole Dunn, a enterprise builder and operator that has labored with a number of African startups.

Dunn, on a name with TechCrunch alongside Botha, stated Revio aggregates and orchestrates over a number of completely different fee strategies in Africa together with card, financial institution switch, debit order, cellular cash, vouchers, and QR code. The platform collects and settles funds in additional than 40 markets via fee suppliers like Flutterwave, Paystack, Ozow and Sew. A few of its options, along with a number of fee strategies, embrace good fee routing, automated billing processes, auto-retires, and real-time analytics and reporting.

CEO Ruaan Botha

In over a 12 months of operations, Revio has onboarded over 50 purchasers and processes 1000’s of transactions month-to-month. They vary from large-scale enterprises to mid-market corporates, and fast-growing scale-ups which might be concerned with recurring income companies and excessive transactional volumes, sometimes needing a number of fee strategies in a number of markets. These are sometimes insurers, telcos, retailers, subscription software program or media, asset leasing or financing companies, and different lenders.

“We’ve additionally then constructed out orchestration functionality the place we are able to cut back fee failures via issues like good transaction routing, good retries to ensure a buyer doesn’t go into arrears, particularly on recurring funds,” stated Dunn. “After which the place we differentiate ourselves is that we serve companies with recurring income as an alternative of the standard e-commerce platforms.” She provides that Revio has over 100 purchasers within the pipeline ready to be onboarded.

Fee orchestration is changing into more and more vital in at this time’s world the place companies function in a number of nations and wish an array of fee strategies to get by. Whereas a handful of such platforms have existed within the U.S. and Europe to deal with this heavy lifting by way of unified funds API corresponding to Primer, Spreedly and Zooz, companies in growing markets are beginning to see equivalent platforms corresponding to Revio and Egypt-based MoneyHash take heart stage throughout varied areas.

With regards to competitors and the way it stands out, Revio claims that it’s the primary African funds platform centered on fee failures and income restoration. “We even have extra performance and protection within the sub-Saharan African context, Sub Saharan in comparison with different platforms out there,” Dunn added. Anyway, the worldwide funds orchestration market, per reviews, is rising at a quick tempo (per a examine, the market measurement is anticipated to achieve $6.52 billion by 2030, advancing at a CAGR of 24.5% from 2022 to 2030) and there’s greater than sufficient house for newer platforms to seize market share – and incumbents like Revio to deepen its attain.

It’s one motive why the two-year-old fintech raised this capital: transfer into new markets inside and out of doors Africa, increase its crew within the course of and launch new merchandise for its growing clientele.

“I’d say the use funding is twofold,” Botha stated. “One is to get entry to extra strategic abilities round machine studying and information to assist us develop and drive higher engagement with clients, perceive why they fail and the right way to get a greater response fee. With the info from that, we are able to begin our experimentation into a few of the core markets in Africa. We need to function in about 13 African nations within the subsequent 18 months, however specializing in three or 4 massive markets. After which, get sufficient traction that we are able to tackle to different rising markets like Latin America.”