It’s going to probably take new lows in QQQ for brand new highs in VXN- and for a brand new purchase sign to emerge.

shutterstock.com – StockNews

There’s a commonality between a three-year outdated on a household automotive journey and merchants and traders. Each teams wish to know “Are We There But”. Whereas neither three -year olds or merchants are inclined to have a lot endurance, at the least the last word arrival time is thought prematurely on a household automotive journey. The final word low is just identified after the very fact within the inventory market.

In my article from a number of weeks in the past, I talked about how possibility costs will help predict future inventory costs, on this case a short-term prime. It was a tackle the Warren Buffett philosophy of being fearful when others are grasping. Possibility costs are the embodiment of this notion. When shares rise, possibility costs are inclined to fall and vice-versa.

That is evidenced within the VIX which tends to correlate inversely with the S&P 500. The VXN is a comparable measure for the NASDAQ 100 shares. Each the VIX and VXN are a 30-day measure of possibility costs.

I opined again then about how the latest lows in VXN foreshadowed a short-term prime and an impending pullback for the NASDAQ 100, or QQQ. That proved to be the case with the QQQ dropping 10% over the previous few weeks. Now the query is how low costs will go till QQQ discover some help.

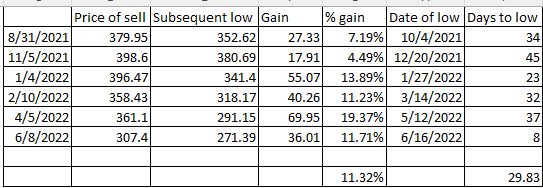

As soon as once more, I’ll flip to utilizing possibility costs to present me a clue as to when the market malaise could also be getting overdone. Simply because the lows in VXN normally level to a pullback, the spike to highs is normally a dependable indication {that a} short-term backside could also be within the offing. The chart under exhibits the earlier six occasions over the previous yr when VXN spiked to highs after which started to move decrease

Every occasion marked a major short-term prime within the VXN and a significant short-term backside in QQQ. VXN has flattened out just lately. It could take significant new lows in QQQ to get VXN prime explode larger in the direction of the 40 space and a brand new purchase sign.

The final 4 spikes within the VXN all topped out close to the 40 space. That would definitely be a degree to contemplate turning from bearish to bullish on the QQQ. A re-test of the foremost help degree at $290 within the QQQ can be simply over a ten% pullback from the latest highs close to $325. It could additionally equate to only concerning the common drop of 11.32% for the final six promote indicators. It’s extremely unlikely {that a} drop to $290 would take VXN larger as properly. Seemingly want new lows.

All mentioned, QQQ nonetheless has a little bit additional to go till it finds some footing if historical past holds. Essential to do not forget that utilizing an implied volatility-based VXN methodology is extra of a market timing device for merchants. The final word low in QQQ will rely extra on conventional metrics like valuations.

Again to the unique query of “Are We There But”. The reply is not any, not but. If the previous is any information, although, option-prices are saying it appears like we’re undoubtedly getting a lot nearer.

POWR Choices

What To Do Subsequent?

For those who’re in search of the most effective choices trades for right now’s market, you must take a look at our newest presentation Find out how to Commerce Choices with the POWR Rankings. Right here we present you find out how to constantly discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you wish to study extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

Find out how to Commerce Choices with the POWR Rankings

All of the Greatest!

Tim Biggam

Editor, POWR Choices Publication

QQQ shares closed at $289.32 on Friday, down $-1.78 (-0.61%). 12 months-to-date, QQQ has declined -27.05%, versus a -18.22% rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the complicated world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The publish QQQ Is Not There Fairly But appeared first on StockNews.com