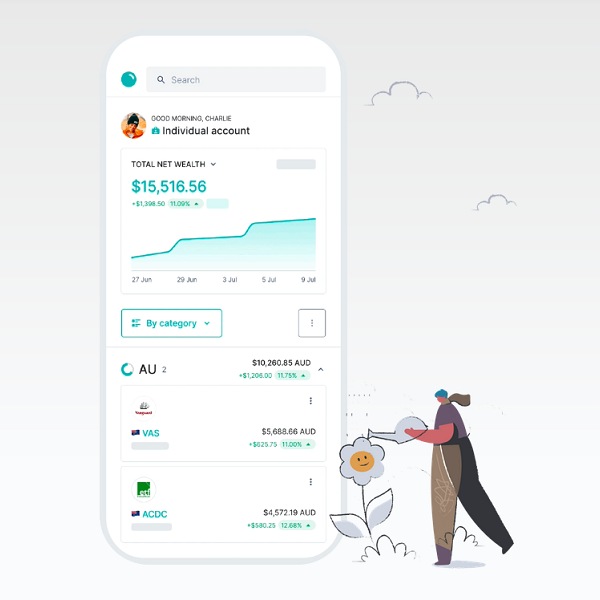

Pearler, Australia’s main long-term investing and wealth administration platform, has surpassed greater than $500 million invested in CHESS-sponsored holdings in simply its second 12 months of operation.

Regardless of this 12 months’s market volatility, Pearler’s CHESS-sponsored holdings have greater than doubled in 2022.

Furthermore, 90% of Pearler investor transactions have been buys, while adoption of its Automate product, which permits traders to set and neglect their direct share investing has grown to 47% of all trades.

Nick Nicolaides, Co-Founder and CEO of Pearler, mentioned funding developments throughout the Pearler platform present an essential perception into the monetary outlook of youthful traders. Gen Y and Gen Z make up the majority of Pearler’s buyer base, 60% and 23% respectively whereas Gen X contains 15%.

“The funding behaviour now we have noticed is counter to what’s sometimes assumed about youthful traders – that they embrace riskier choices like crypto, meme shares, and buying and selling gamification.

“What we observe is that youthful generations are extra financially literate and danger averse than they’re typically given credit score for, given youthful traders are proportionally obese in ETFs, relative to the market.”

Throughout Pearler, round 70% of investor holdings are in ETFs, in contrast with round 2.5% of whole ASX holdings.

Inside that, the asset allocation is 42% Aussie, and 55% world publicity.

Near a 3rd, 29%, of portfolios embody an ESG-themed ETF.

While, crypto ETFs characterize just one% of asset allocations.

Nicolaides mentioned, “We’re not stunned by these numbers. Our traders have proven that they’re taking a disciplined strategy to getting wealthy gradual, which is an strategy we strongly assist. Once we survey our neighborhood, they inform us their meant holding interval is 9 or extra years.”

51% of account holders at Pearler are girls.

“What stands out, additionally, is that girls are investing in ESG ETFs at a fee larger than double that of their male counterparts,” famous Nicolaides.

Nicolaides says Pearler traders have additionally proven they wish to be educated via their embrace of Pearler Trade. Launched in August, Pearler Trade is a social wealth area the place traders can ask questions, check their concepts, and share experiences in a professionally moderated surroundings.

“Pearler Trade is a discussion board the place monetary consultants like planners and fund managers can share deeper ideas about saving and investing. We’re massive on neighborhood, long run funding, and monetary literacy, and for the reason that inception of Pearler, we’ve seen the distinction a supportive neighborhood could make in everybody’s funding journey.

“What attracts traders is our emphasis on serving to younger folks navigate their wealth journey over the following 20, 30 or 40 years whereas giving them the instruments to barter any market surroundings,” Nicolaides mentioned.