Rising digital adoption has introduced buying to the customers’ fingertips. The retail expertise is just a few clicks away, accessed from the consolation of residence no matter the place the store relies.

Within the wake of the COVID19 pandemic, the e-commerce sector boomed. In 2021 the highest on-line marketplaces worldwide offered a complete of $3.23 trillion. This quantity is ready to rise persistently, and consultants predict the B2C e-commerce market dimension will exceed $7.5 trillion.

PayU, a web based cost service supplier working worldwide, commissioned a survey to grasp this flourishing sector higher. Assessing the markets of the U.S, Colombia, and Poland, they surveyed the tendencies available in the market to determine the areas the funds sector can deal with to serve shopper wants higher.

Room for progress in cross-border e-commerce

Regardless of a development in additional customers shopping for abroad, the survey discovered that within the U.S and Colombia, solely round one-quarter of shoppers buy merchandise outdoors their nation. In Poland, this jumped to nearly half.

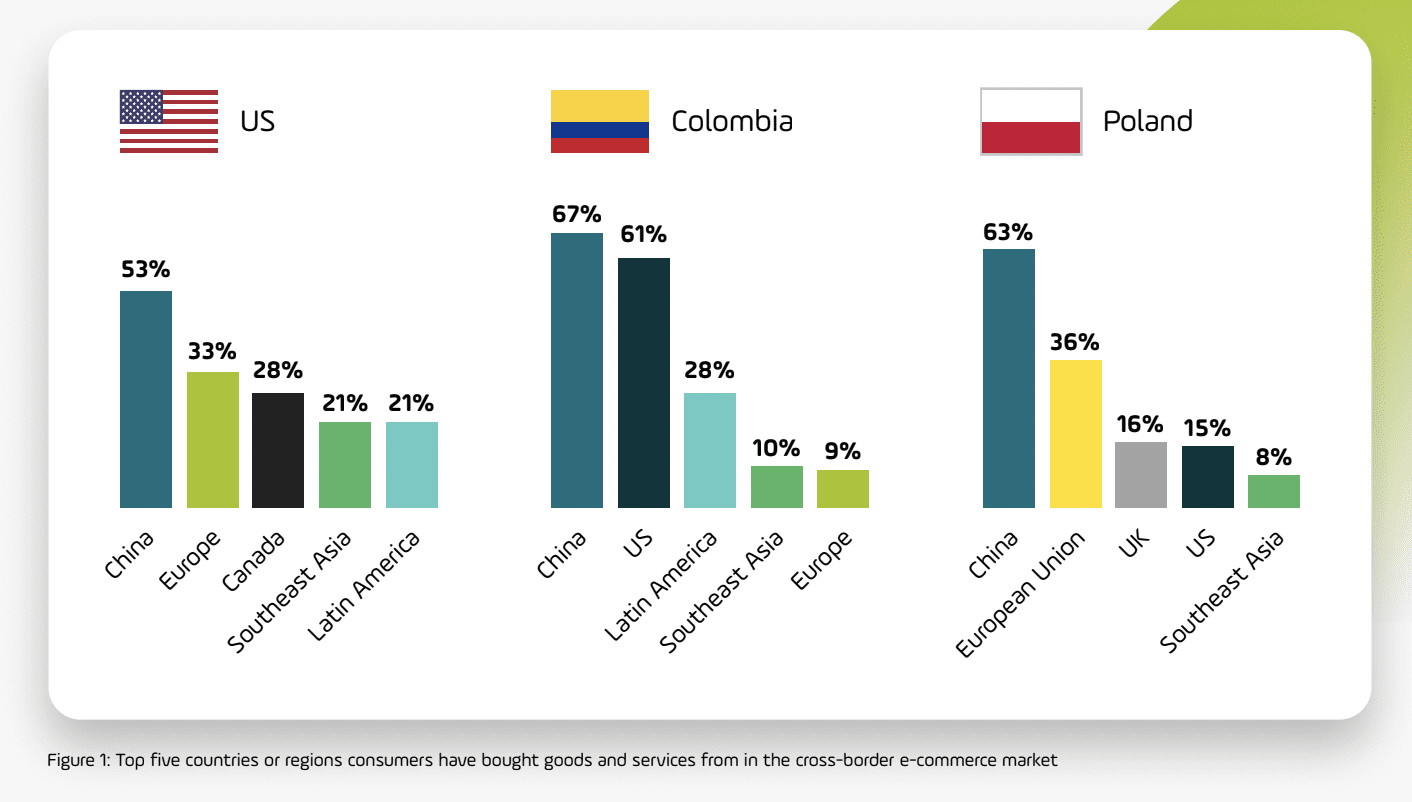

The reigning champion for these purchases was China, the origin of over half of all purchases made abroad by prospects within the three jurisdictions.

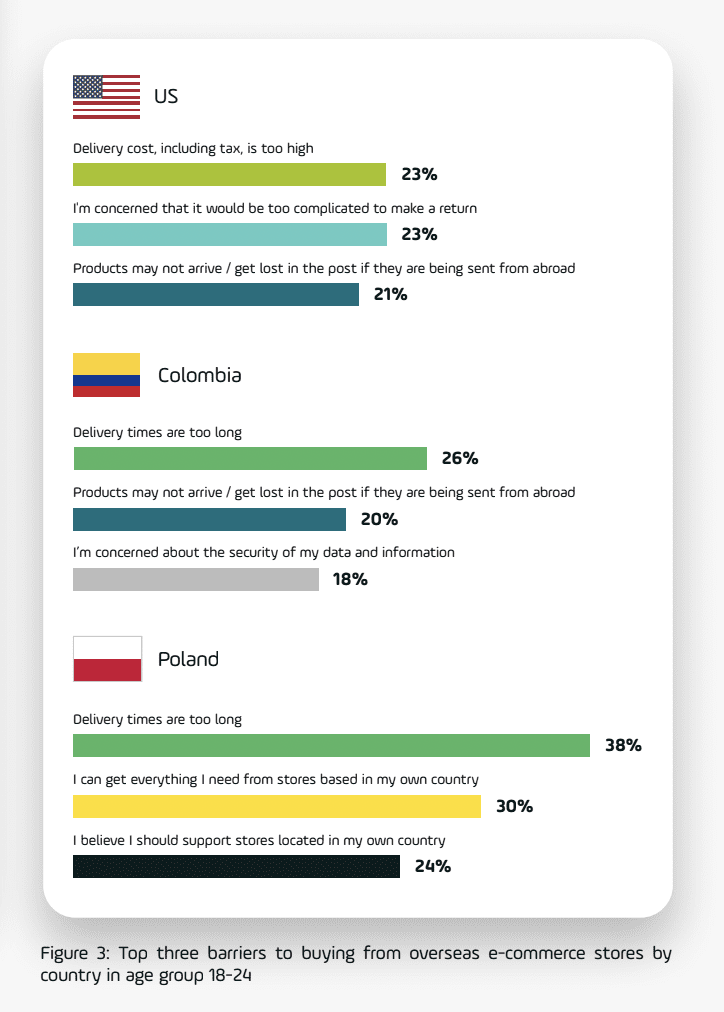

The vast majority of the folks surveyed stated that the explanation they didn’t purchase from overseas was that they may discover what they wanted inside their very own nation. Nonetheless, within the age vary 18-24, this modified dramatically, with most respondents citing lengthy supply instances and tax prices as the primary cause for his or her native purchases.

Funds resulted in a decisive issue within the resolution to buy overseas or not. In America, 55% of customers said that if their most well-liked cost selection weren’t an choice, they’d look elsewhere to purchase items.

Throughout all nations surveyed, belief within the cost supplier was important. Within the US, 73% of shoppers stated that if they didn’t acknowledge the supplier, they’d not make a cost. In Poland, this quantity rose to 88%.

Maybe unsurprisingly, bank cards have been the preferred choice for cost for a lot of. Nonetheless, Colombian customers have been break up nearly equally between choice for financial institution transfers and card funds.

Purchase Now Pay Later continued to point out low curiosity. Nonetheless, for 25-30-year-olds within the US, the recognition rose by nearly 10%.

Funds options might give retailers world aggressive edge

PayU discovered the outcomes of the survey to be enlightening, exhibiting a powerful want for e-commerce platforms and funds corporations to work collectively on a world degree. They said that the rise in cross-border cost options present a definite alternative for retailers to develop their buyer base.

“It’s clear that the development for buying internationally is accelerating, even in well-served markets just like the US,” stated Mario Shiliashki, PayU’s CEO of World Funds.

“This rising development represents an ever extra engaging alternative for retailers to spice up their progress by extending their enterprise outdoors their residence nations.”

“To capitalize on this chance, it will be important that retailers have the suitable expertise companions to navigate the complicated funds and logistics panorama to supply one of the best shopper buying expertise regionally. One vital facet is optimizing their capacity to supply essentially the most related cost strategies in each market they increase to.”

Associated: