Identical to every other job, foreign currency trading can also be a every day grind. Merchants have to decide to doing the identical routine day in and time out with a purpose to seize the variety of trades needed that ought to enable the regulation of huge numbers to play out. Though it could sound straightforward, committing to the identical routine may be very tedious for a lot of merchants. Many would stop straight away as a result of they don’t see quick outcomes. What they don’t perceive is that buying and selling is all about statistics. Merchants earn money both due to excessive risk-reward ratios or excessive win charges.

Buying and selling methods that depend on excessive risk-reward ratios might expertise some drawdown intervals. Nevertheless, profitable trades with excessive yields usually carry their accounts towards the worthwhile zone.

Pattern reversals enable merchants to seize enormous returns on a couple of trades. Nevertheless, additionally it is not that straightforward to anticipate pattern reversals. Merchants who’ve a knack for buying and selling pattern reversals with a comparatively excessive diploma of accuracy are likely to revenue massive from the foreign exchange market.

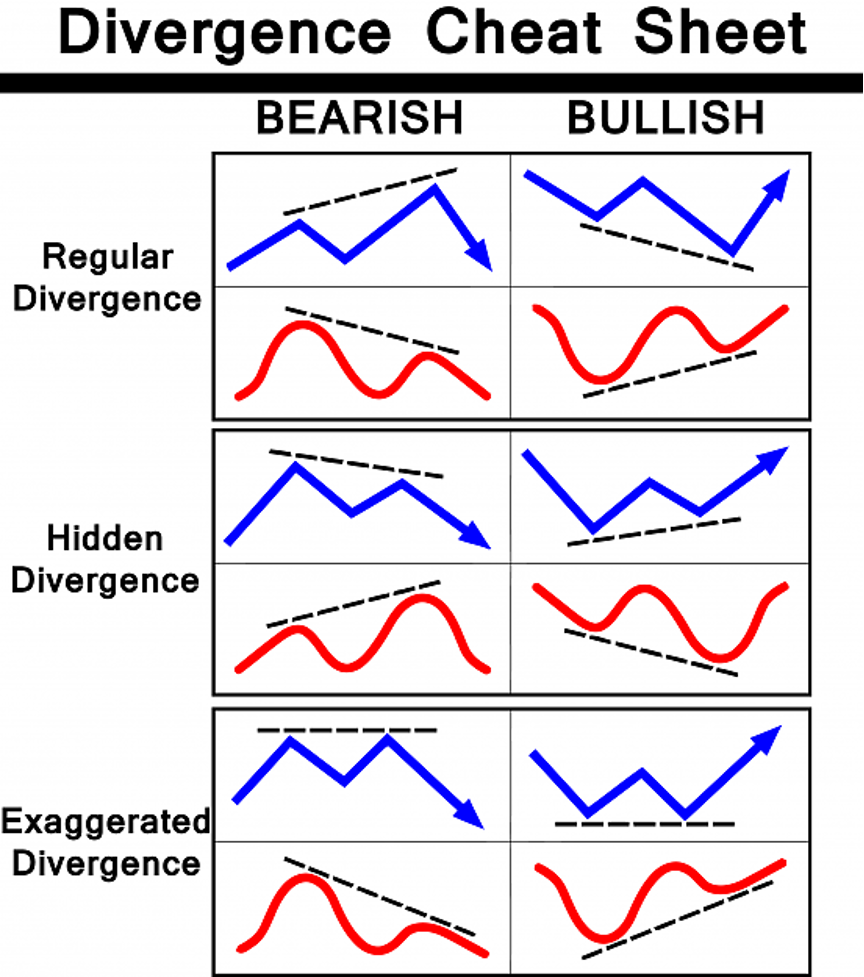

Divergences are eventualities which present variations between the depth of a swing on the worth chart and its corresponding peak or trough on an oscillator. These circumstances usually point out that worth is about to reverse.

Many merchants have reported to been reported to be very correct buying and selling pattern reversals utilizing divergences. Merchants who can grasp divergences utilizing the fitting indicators can revenue a lot from the foreign exchange market.

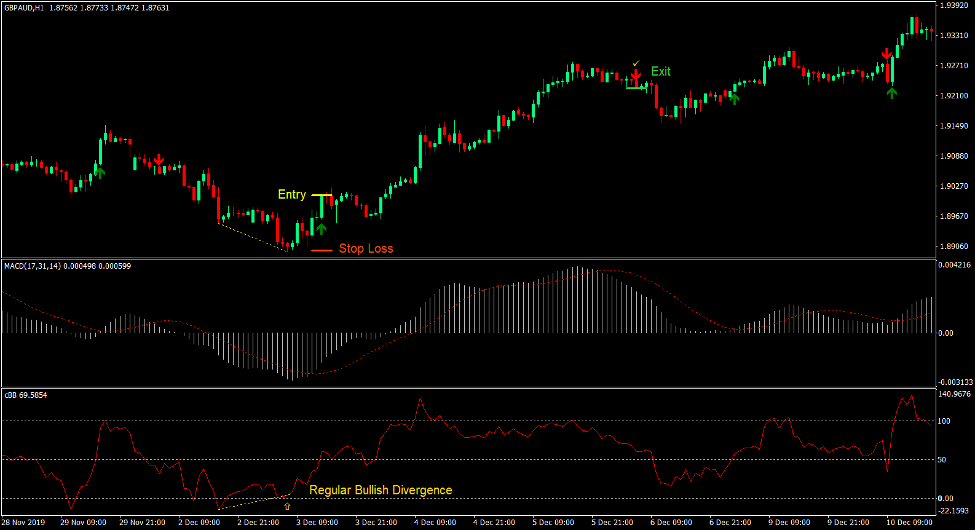

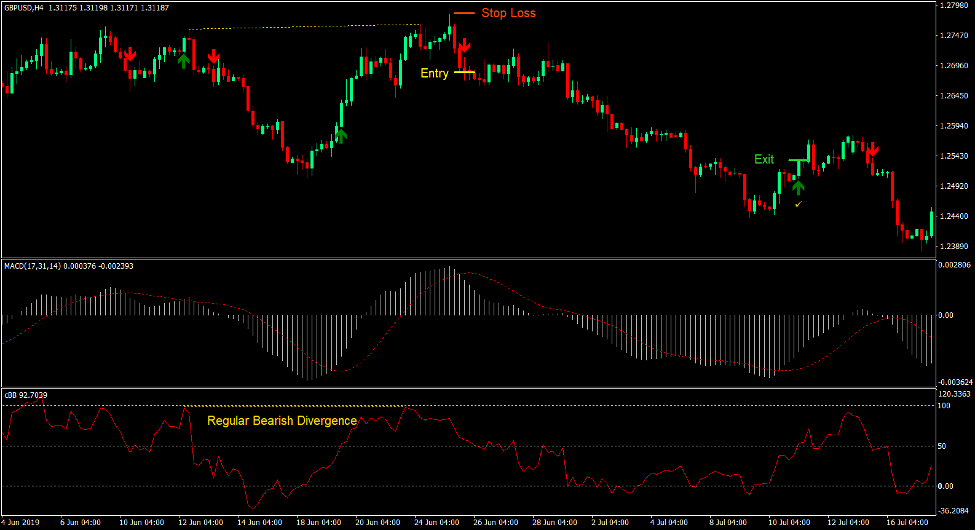

Under is a chart displaying the several types of divergences.

Transferring Common Convergence and Divergence

The Transferring Common Convergence and Divergence (MACD) is a traditional technical indicator which is extensively utilized by {many professional} merchants. It’s an oscillator kind of technical indicator which is predicated on the crossover of shifting averages.

The MACD is calculated by subtracting one Exponential Transferring Common (EMA) to a slower shifting Exponential Transferring Common. The distinction of the 2 EMA traces are then potted as an oscillator that would both be constructive or unfavorable. That is usually known as the MACD line. A sign line is then derived from the MACD line. The sign line is a Easy Transferring Common (SMA) based mostly on the MACD line.

Pattern route or bias is predicated on how the 2 traces overlap. A bullish sign is recognized every time the MACD line crosses above the sign line. Inversely, a bearish sign is recognized every time the MACD line crosses beneath the sign line.

This model of the MACD plots the MACD line as histogram bars and the sign line as an oscillating line that shadows the motion of the MACD bars.

Pattern Sign Indicator

Because the title suggests, the Pattern Sign indicator is a customized technical indicator which helps merchants determine pattern reversals and pattern route.

The Pattern Sign identifies the route of the pattern and plots an arrow on the worth chart indicating the route of the brand new pattern. It plots an arrow pointing up every time it detects a bullish pattern reversal and an arrow pointing down every time it detects a bearish pattern reversal.

This indicator is principally used as pattern reversal entry sign. Merchants use it as a set off to enter a pattern reversal setup. Nevertheless, it is also used to determine pattern route bias when buying and selling shorter time period momentum trades.

cBB Indicator

The cBB indicator is a customized oscillator kind technical indicator. This oscillator is uniquely based mostly on the Bollinger Bands.

The cBB oscillator plots a line that oscillates round its midpoint which is 50.

The road may additionally drop beneath zero or breach above 100. Traces breaching above 100 point out an overbought market, whereas traces dropping beneath zero point out an oversold market. Each circumstances are prime for a imply reversal.

Pattern route bias may be noticed based mostly on the final location of the road in relation to its midpoint. The pattern is bullish if the road is consistently above 50 and bearish if the road is consistently beneath 50.

Buying and selling Technique

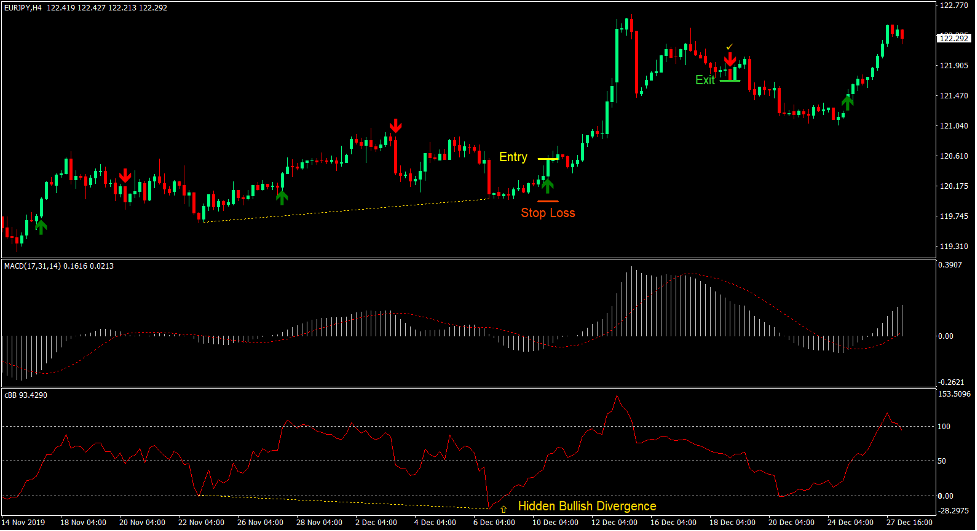

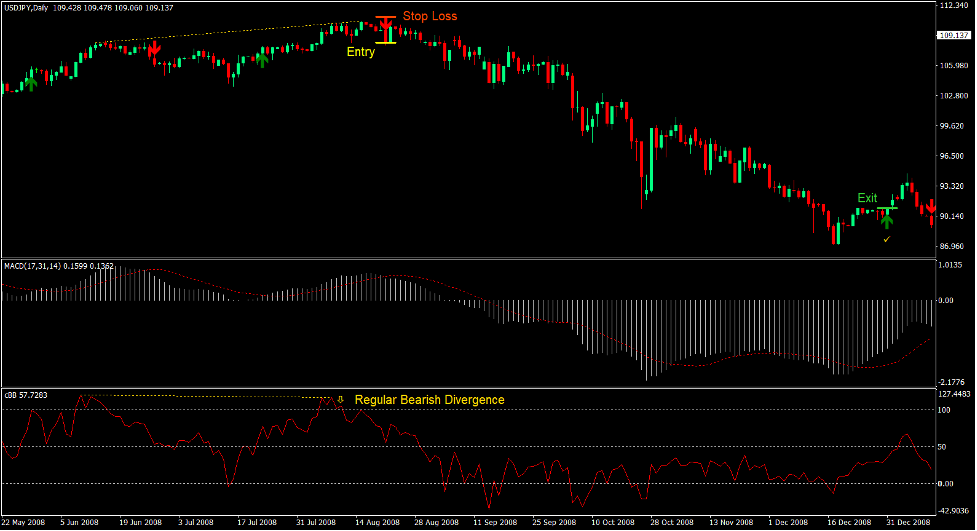

This buying and selling technique is a pattern reversal buying and selling technique which trades on divergence setups. It makes use of the cBB indicator as a foundation for divergences.

The MACD confirms the reversal based mostly on the crossing over of the MACD bars and the sign line conforming with the route of the pattern reversal.

The Pattern Sign indicator additionally acts as the ultimate affirmation of the commerce setup based mostly on the arrow it plots.

Indicators:

- Trend_Signal

- MACD

- Quick EMA: 17

- Sluggish EMA: 31

- MACD SMA: 14

- cBB

Most popular Time Frames: 1-hour, 4-hour and every day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

Purchase Commerce Setup

Entry

- A bullish divergence needs to be noticed between the cBB indicator and worth motion.

- The MACD histogram bars ought to cross above the MACD sign line.

- The Pattern Sign indicator ought to plot an arrow pointing up.

- Enter a purchase order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on the assist beneath the entry candle.

Exit

- Shut the commerce as quickly because the Pattern Sign indicator plots an arrow pointing down.

Promote Commerce Setup

Entry

- A bearish divergence needs to be noticed between the cBB indicator and worth motion.

- The MACD histogram bars ought to cross beneath the MACD sign line.

- The Pattern Sign indicator ought to plot an arrow pointing down.

- Enter a promote order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Shut the commerce as quickly because the Pattern Sign indicator plots an arrow pointing up.

Conclusion

Divergences are among the most correct kind of pattern reversal sign. In truth, {many professional} merchants have constantly profited from the foreign exchange market buying and selling divergences completely.

The important thing to buying and selling divergences efficiently is in figuring out the final route of the longer-term pattern and never buying and selling in opposition to it. Some merchants would zoom out to a better timeframe with a purpose to determine the long-term pattern and commerce solely in that route.

Then, it could all boil all the way down to figuring out the fitting divergence setups. Merchants who may determine excessive likelihood divergences are likely to constantly revenue from the market by buying and selling excessive yielding setups with a comparatively excessive diploma of win likelihood.

Foreign exchange Buying and selling Methods Set up Directions

Pattern Sign Divergence Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the accrued historical past information and buying and selling alerts.

Pattern Sign Divergence Foreign exchange Buying and selling Technique offers a possibility to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional worth motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Find out how to set up Pattern Sign Divergence Foreign exchange Buying and selling Technique?

- Obtain Pattern Sign Divergence Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Pattern Sign Divergence Foreign exchange Buying and selling Technique

- You will note Pattern Sign Divergence Foreign exchange Buying and selling Technique is accessible in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: