2022 has been a tricky marketplace for trend-followers, however swing merchants have been capable of catch just a few rides. Pattern-followers are struggling as a result of whipsaws are above common this yr. A whipsaw happens when an uptrend can not prolong after a bullish development sign and the commerce ends in a loss.

2022 has been a tricky marketplace for trend-followers, however swing merchants have been capable of catch just a few rides. Pattern-followers are struggling as a result of whipsaws are above common this yr. A whipsaw happens when an uptrend can not prolong after a bullish development sign and the commerce ends in a loss.

Earlier than taking a look at some trend-following stats, observe that I’m utilizing a database of 105 ETFs with buying and selling historical past again to not less than 2007. These ETFs embrace US stock-based ETFs (index, sector, trade group), commodity ETFs, bond ETFs and foreign money ETFs. There are not any worldwide inventory ETFs on this record. I’m utilizing the Pattern Composite for development alerts on this check. A cross above zero triggers a bullish development sign, whereas a cross beneath zero triggers a bearish development sign. The Pattern Composite and ten different indicators are a part of the TIP Indicator Edge Plugin for StockCharts ACP.

From January 2007 to December 2021, there have been 1739 bullish Pattern Composite alerts and 44.34 p.c of those resulted in additional good points earlier than the Pattern Composite triggered bearish. The typical acquire was 18.28% and the common loss was 4.48%. There have been 104 bullish Pattern Composite alerts to this point this yr and solely 19.23% of those resulted in a revenue. The typical acquire was 2.97% and the common loss was 5.41%. 2022 has been a tricky yr for trend-following.

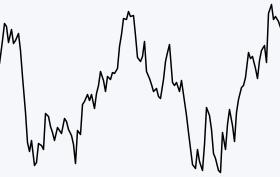

The chart above exhibits a efficiency instance for a generic trend-following technique. The technique performs nicely over time because the fairness curve strikes from the decrease left to the higher proper (2007 to 2022). There are, nevertheless, drawdowns alongside the best way and these drawdown intervals can final greater than a yr (pink arrow traces). Pattern-following methods work nicely when markets development and endure drawdowns when markets don’t development. **it occurs. Take a look at $SPX from 2007 to 2022 for reference.

We have now all heard of diversification for a portfolio, however merchants may also think about diversification for his or her methods. Imply-reversion and swing buying and selling methods differ from trend-following methods and have a greater likelihood of success when markets don’t development. The chart beneath exhibits the Utilities SPDR (XLU) with the Pattern Composite (backside window) whipsawing this yr because the ETF produced 5 double-digit swings since late February (+20%, -16.8%, +21.4%, -22.7%, +14.4%). The blue traces present short-term bullish continuation patterns that swing merchants might use to commerce the short-term strikes.

Because the chart above exhibits, the March pennant and the July wedge led to massive strikes, however the early September flag breakout was a failure. Presently, XLU broke out of a falling flag with a surge final week Thursday (10-Nov) and fashioned one other bull flag the final six days. A breakout can be short-term bullish. Be aware that swing buying and selling methods require extra monitoring and merchants usually use revenue targets to lock-in good points.

TrendInvestorPro tracks Pattern Composite alerts for the 274 ETFs in our MasterList and ranks these ETFs in line with worth efficiency. Our reviews and movies spotlight chart setups with dozens of ETFs featured every week. Click on right here for quick entry.

The Pattern Composite, Momentum Composite, ATR Trailing Cease and eight different indicators are a part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click on right here to be taught extra and take your evaluation course of to the subsequent degree.

—————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic strategy of figuring out development, discovering alerts inside the development, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise Faculty at Metropolis College in London.