OK, so we all know the market goes down. And, save for a mid-summer bear market rally, the S&P 500 and Nasdaq have been in pretty constant downtrends.

Final week, I highlighted the excessive bearish readings within the AAII Survey (it is value noting that this week NAAIM Publicity Index additionally reached its lowest stage since March 2020) and we have additionally coated the weakening breadth situations. In the present day, I wished to share the newest test on the “confirmed bearish market” guidelines. The New Dow Concept registered its first promote sign since June, confirming a broad market decline.

So what’s the new Dow Concept?

It begins with Charles H. Dow, who actually laid the foundations for contemporary technical evaluation. He pioneered the idea of market indexes and created instruments and measures which have advanced into the follow of trend-following.

ChartCon 2022 is going on in only a week! This week, I chatted with Tom Bowley, Mary Ellen McGonagle and Leslie Jouflas about our Interactive Market Outlook Panel. We’ll be discussing the outcomes of THIS SURVEY, so take a minute so as to add your voice to the dialogue!

We have now so many concepts and views to share with you, and you do not need to miss this uncommon alternative to be taught from a few of the high names in technical evaluation! Join ChartCon right now.

One in every of his core ideas was to measure the power of the market by contemplating two teams of shares: the Industrials (the producers of products) and the Railroads (the distributors of products). The thought was that if these two major elements of the economic system had been in good condition, then the market was sturdy, but when one facet was trending increased whereas the opposite index didn’t verify that development, then one thing was damaged.

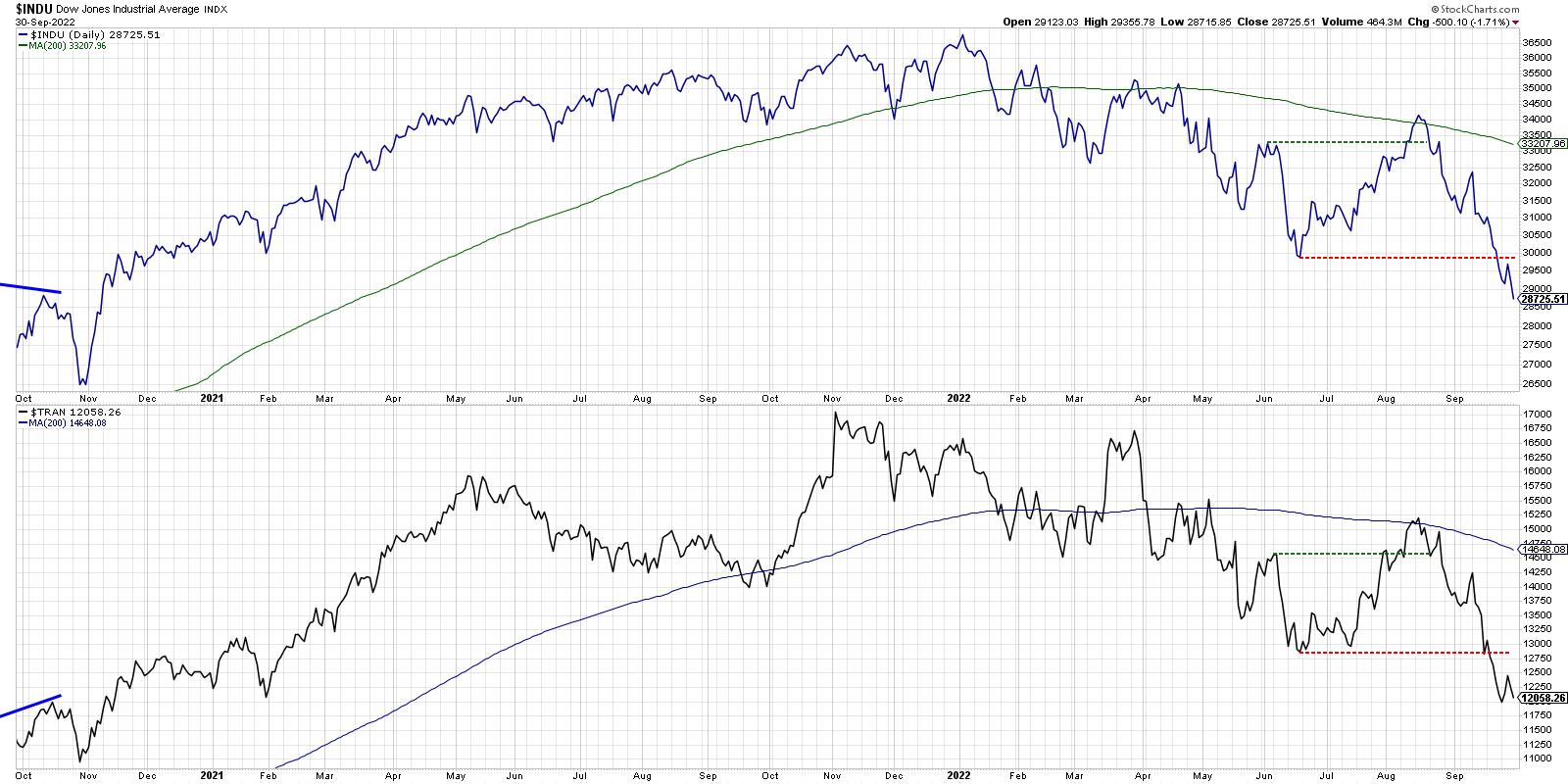

The Railroad Index finally grew to become the Transportation Index, and that leads us to the chart of what we name Conventional Dow Concept.

In final weekend’s report back to my premium subscribers, we talked in regards to the Dow Concept promote sign, which was confirmed when each the Dow Industrials and Dow Transports made a brand new swing low. However whereas these indexes each made new lows final week (together with many particular person shares, I’d add), the S&P 500 and Nasdaq Composite had not achieved so. This brings as much as the New Dow Concept, which I might counsel is a modernized model of what Charles Dow was actually making an attempt to seize.

Right here we’re reviewing the patterns for the “previous economic system” shares (S&P 500) vs. the “new economic system” shares (Nasdaq Composite). If each of those verify new highs, as they did in April 2021, then the market uptrend is confirmed. If one makes a brand new excessive however the different doesn’t (see January 2022!) then it’s thought-about a non-confirmation and a possible reversal.

What can this chart inform us of the present market setting? Properly, as of this Friday’s shut, each the S&P 500 and the Nasdaq have made a brand new swing low, as they each undercut their low from June 2022. Meaning we now have a New Dow Concept promote sign.

However did not we all know the market was already taking place? Completely. And meaning you’ll more than likely have continued promote indicators, as we did in January and Could and June. Each time these indexes each make a brand new low, it confirms the route of the general market development.

What would a market backside doubtless appear like, utilizing this chart? Ideally, there can be a bearish non-confirmation on the backside, which means one of many indexes makes a brand new low whereas the opposite makes the next low. It doesn’t all the time occur, to make certain, however when it does happen, it tends to be a terrific sign of a possible inflection level.

Essentially the most fundamental method to make use of this indicator is to search for them each to make a brand new swing excessive. Which they did again in August, simply earlier than each indexes discovered resistance on the 200-day transferring common. We highlighted this sign again in August, main us to very a lot think about the prospects of upper costs forward.

Ultimately, the market development was as soon as once more outlined this week, as a brand new promote sign indicated that, for the foreseeable future, the development is down. Which implies that, till we get a legitimate purchase sign, the trail of least resistance stays down.

RR#6,

Dave

P.S. Able to improve your funding course of? Try my YouTube channel!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer, and don’t in any method characterize the views or opinions of every other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders decrease behavioral biases by means of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor resolution making in his weblog, The Conscious Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing threat by means of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to determine funding alternatives and enrich relationships between advisors and shoppers.

Be taught Extra