As the price of dwelling disaster continues, monetary well being issues are taking heart stage. For employers, the added stress could take extra toll on their companies than pure prices.

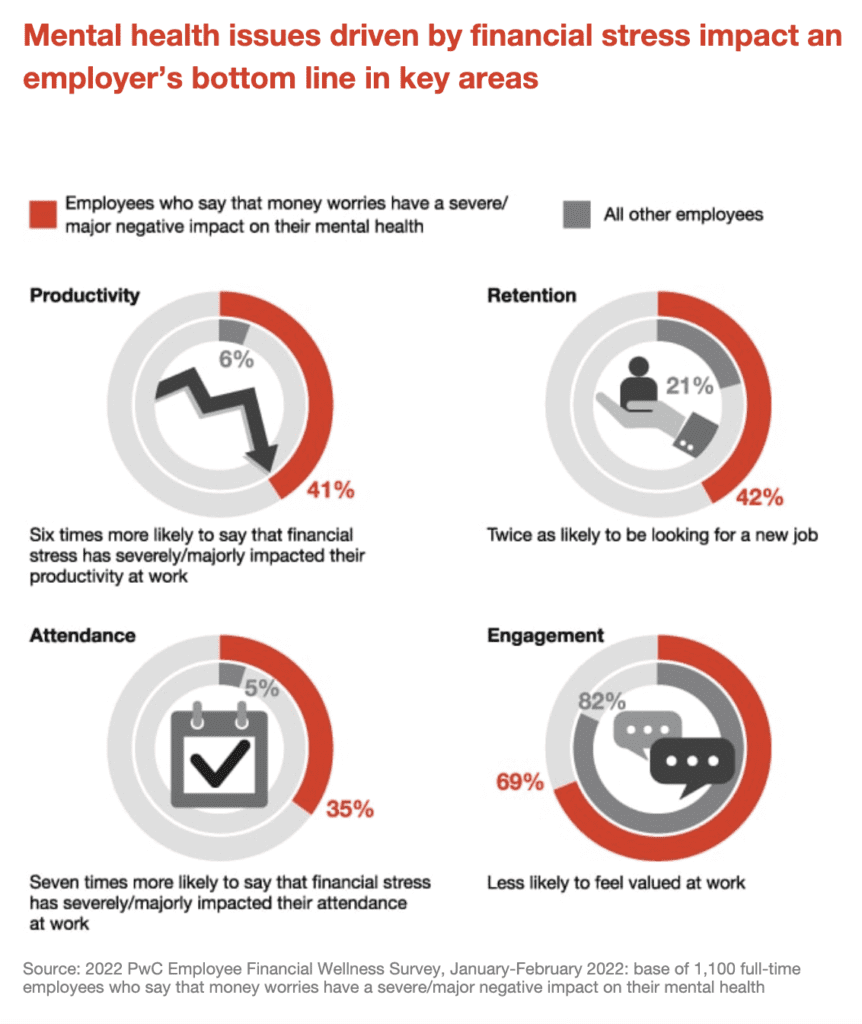

In a current survey by PwC, financially pressured staff have reported points with funds affecting a number of areas of their private lives in addition to attendance and productiveness at work. This 12 months, worker rationale for altering jobs has shifted, with 65% citing financial points as a major purpose for altering jobs, up from 38% in 2021.

Historically, employers haven’t engaged with their worker’s funds apart from the common paycheck. Workers, for his or her half, are reluctant to ask their employers for assist, with 27% saying their funds are a personal matter. One-quarter of staff are embarrassed to point out different folks they’re in debt.

“I really feel like up to now there was a stigma that you may’t help staff, with their funds at work, but it surely’s actually a should,” stated Toni Smith, Reward and insights Supervisor at Ricoh UK. “Employers do want to begin taking a look at that. It is a longer-term view. Offering help and initiatives for psychological well being and monetary well-being helps open conversations and take away the stigma round it.”

The FCA attributes 4 million days off work resulting from monetary worries and the stress related, costing companies over £1.6 billion. With elevated difficult situations, these numbers are more likely to rise.

Financially pressured staff are twice as more likely to look elsewhere, with 75% saying they might be interested in an organization that cares about their monetary well-being.

“With day-to-day monetary well-being points and the price of dwelling disaster, we’re in a little bit of an ideal storm,” stated Phil Elwell, Advertising Operations Supervisor for MyEva. “If staff can take management of day-to-day funds, that reduces stress and improves psychological and bodily well-being.”

Lengthy-term budgeting points trigger a retirement hole for a lot of

Over 20 million adults within the UK don’t really feel assured managing their cash, and 11.5 million have lower than £100 in financial savings. Low ranges of monetary literacy can have knock-on results, inflicting budgeting points and rising debt. Lengthy-term provisioning will be essential, particularly at retirement age.

The MyEva app was initially designed to help within the pension provisioning course of, taking a look at longer-term monetary well being. The platform is built-in with the worker’s pensions information, giving choices on whether or not they need to alter contributions.

“Workers can visualize the standard of life their contributions will ultimately give them along with the state pension,” stated Elwell. “I believe it may be a little bit of a shock for many individuals after they do this train. What they’re presently paying in could appear to be sufficient, however after they have a look at what it can truly give them in retirement, it’s a little bit of a wake-up name.”

He defined that pensions had up to now been an space staff had struggled to interact with, leading to a retirement hole.

At present, the state pension makes up simply over half of the earnings of middle-income pensioners, whereas for lower-income residents, it makes up round 80%. The state pension alone has its points, with many voters of retirement age being compelled to work longer earlier than receiving their weekly cost. Payouts of £185 per week make the contributions from employment important for workers to take care of an analogous high quality of life on retirement.

Ricoh UK fast on the uptake

Ricoh has identified the significance of engagement with staff’ monetary well being for a while. They first partnered with Wealth Wizards to introduce the MyEva platform to staff in 2019.

“We wished to know our staff, views, and necessities round monetary help,” stated Smith. “We wished to supply monetary help to our staff. However we wanted to know the demographics and who wished that. So we had been launched to MyEva in 2019 because the know-how that would assist us with that.

“We began with a goal of 10% of the worker inhabitants to be registered. Now a 3rd of our inhabitants are registered utilizing the MyEva app.”

Ricoh, though a global firm, employs hundreds of individuals within the UK, which means that the one-third uptake of the app is critical.

“MyEva helps our staff coordinate their spending and work out weekly or month-to-month budgets to assist handle their payments,” stated Smith. “Whereas saving throughout the present value of dwelling disaster will be difficult, a number of of our staff are actively looking for regulated recommendation on areas resembling mortgages, financial savings, and pension contributions and consolidation.”

In addition to provisioning for pensions, the app assists staff in setting financial savings targets and preserving monitor of their day by day spending. Workers even have free entry to a monetary advisor.

Associated: