Meta Platforms (previously often known as Fb, Inc.) shall report its earnings end result for Q3 2022 on 26th October (Wednesday), after market shut. The expertise conglomerate with market cap over $340B which relies in California, US, engages in connecting folks and communities in addition to serving to companies to develop by way of its Household of Apps (FOA) together with Fb, WhatsApp, Instagram, Messenger and many others. Final yr, the corporate introduced that it’s engaged on the event of augmented and digital actuality associated shopper {hardware}, software program and content material (these are grouped below Actuality Labs (RL)), hoping to increase past 2D screens into the way forward for digital connection, particularly the Metaverse.

Netflix was the primary FAANG member that introduced out satisfying outcomes to the general public. This week, the remainder of the members (Amazon, Apple, Google (Alphabet)) together with Meta shall additionally launch their quarterly monetary outcomes.

Final Friday, Wall Avenue Journal reporter Nick Timiraos acknowledged in his newest article that the Fed might ease its tempo of rate of interest hikes (presumably 50 bp) in December, after elevating rates of interest by 75 bp in November – an indication for the US shares market to reverse its current sell-off? As of market shut, the US indices soared larger: USA500 at 3764, USA100 at 11335, USA30 at 31151.

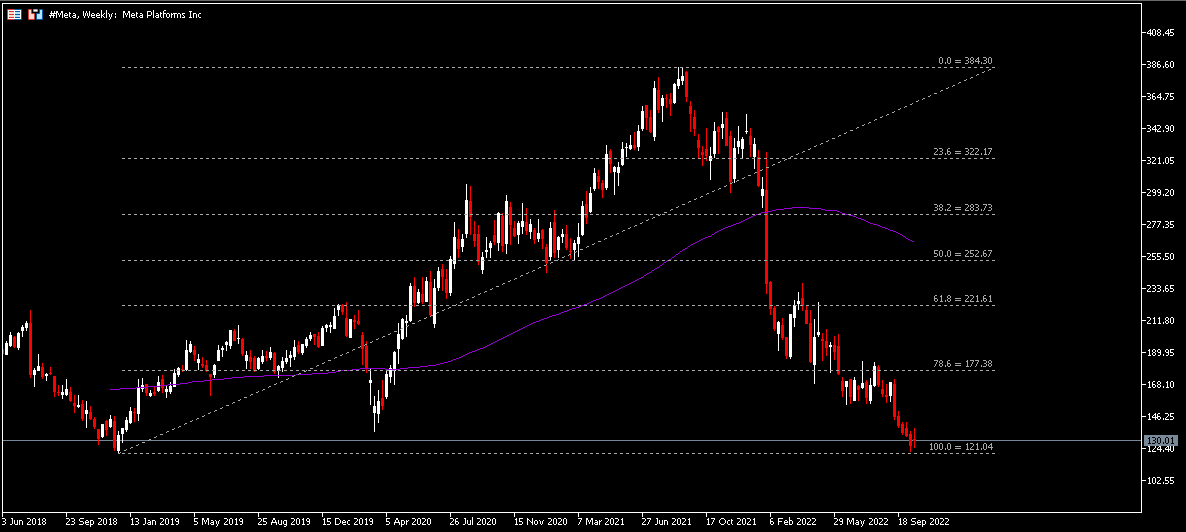

Fig 1:Meta Annual Income (in million USD), 2009-2021. Supply:Statista

Fig 1:Meta Annual Income (in million USD), 2009-2021. Supply:Statista

Final yr, Meta continued to rack in most of its income by way of commercial from the FOA section, which accounted to about $115.66B, whereas the RL generated roughly $2.27B. That is the primary ever report that the corporate’s annual income has surpassed the $100B threshold. The positive aspects had been over $31B (or +37%) in comparison with these in 2020.

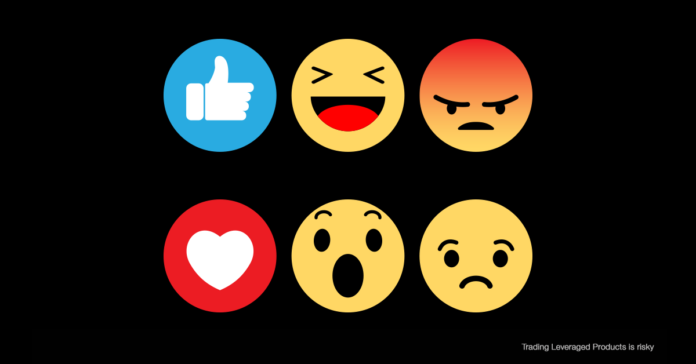

Fig. 2:Fb DAU vs MAU Supply:Statista

Based on a statistic launched in January this yr, Fb topped the chart as the preferred social community worldwide. Nonetheless, additionally it is price noting that the platform noticed its first historic drop in each day energetic customers (DAU) in This autumn 2021, from 1.930B (q/q) to 1.929B (q/q). Additionally, month-to-month energetic customers (MAU) within the newest quarter report dropped to 2.934B (beforehand 2.936B). These stats unveiled the truth that the expansion of energetic customers has been regularly slowing, because of causes equivalent to intense competitors (for eg. TikTok, YouTube), recessionary fears, surging price which led to advertisers lower on spending, Apple privateness adjustments and many others.

Regardless of experiencing a $2.81B loss on its digital actuality division within the earlier quarter, Meta is set to proceed spending closely on the applied sciences for its final imaginative and prescient, the Metaverse. The corporate raised the worth of its Meta Quest 2 VR headset starting August this yr because of rising inflationary price, nevertheless, the administration cited that it’s nonetheless the most cost effective VR in comparison with its friends. As well as, there are rumors that Meta has offered over ten million VR units, a preliminary purpose set by Mark Zuckerberg again in 2018. Nevertheless, on this case, it isn’t simply numbers alone that issues. In truth, an enthusiastic person base is probably the most vital aspect in conserving the VR ecosystem alive, in line with the administration.

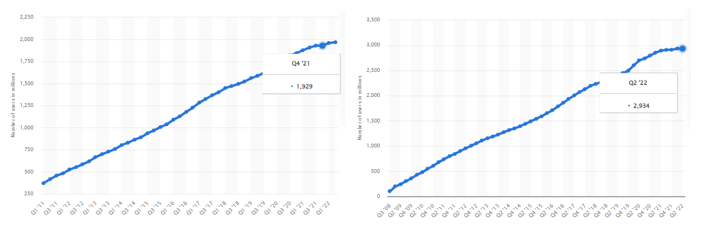

Fig 3:Meta Platforms Reported Gross sales and Earnings per Share versus Analyst Forecast. Supply: CNN Enterprise

Consensus estimates for reported gross sales of Meta Platforms, Inc. within the coming quarter stood at $27.5B, down -4.51% from the earlier quarter and down -5.17% in comparison with identical interval final yr. EPS is predicted to hit $1.89, additionally down -23.17% from earlier quarter and down -41.30% from the identical interval final yr.

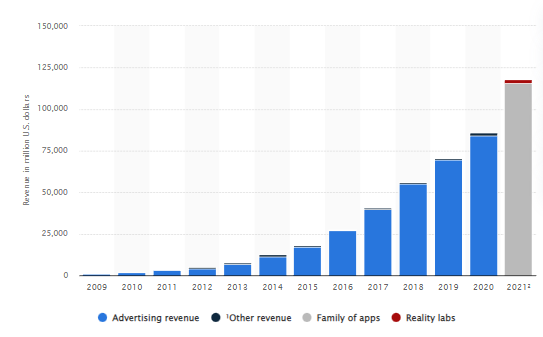

Technical Evaluation:

Fig 4:Meta Platforms Historic Value. Supply:Google Finance

Fig 4:Meta Platforms Historic Value. Supply:Google Finance

The #Meta (META.s) share worth final closed at $130, barely above the lows of the yr that was fashioned within the earlier week, at $122.50 (this was the bottom stage since December 2018 ($121.04)). In February this yr, the corporate suffered its report one-day loss ever (-26%), with over $230B market worth being wiped off (additionally a report one-day market cap loss for a US firm), following issues over the corporate’s progress trajectory.

Technically, the sharp plunge marked the day #Meta shares entered into the bear territory, and stays till in the present day. The low estimate of analysts, $150, serves as the closest resistance to focus, adopted by $177 (FR 78.6%) and $222 (FR 61.8%). Then again, the lows of December 2018, $121.04, serves as the closest help. Breaking beneath this stage might open up extra room for the bears to check the following help on the lows seen in December 2016, $115.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.