Mastercard’s Q3 Earnings Report can be launched on October 27, 2022. Given the prior quarter’s outcomes, which surpassed Wall Road projections, the enterprise is poised to determine one other report.

Excluding uncommon occasions, Q2 adjusted internet gross sales rose by 27% and adjusted working earnings elevated by 40% 12 months over 12 months. Working expenditures climbed by 12%, with acquisitions accounting for a 5% rise. Working earnings elevated by 40%, regardless of a one-point decline resulting from acquisitions [1].

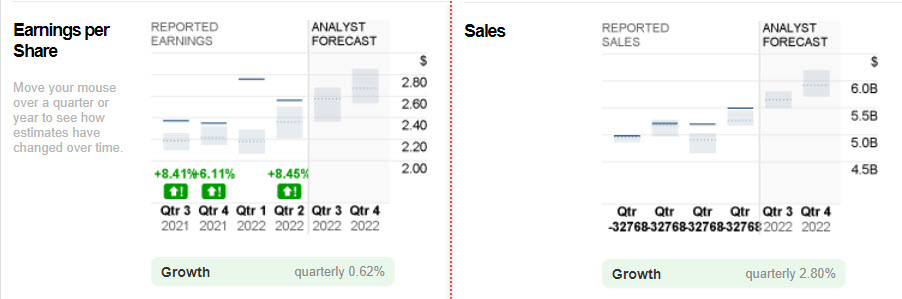

The 27% rise in internet income was largely pushed by home and cross-border transaction and quantity development, and likewise service growth, which was offset partially by development in rebates and incentives. EPS elevated 40% yearly to $2.56, together with a $0.05 contribution from inventory buybacks. The corporate repurchased $2.4 billion in inventory throughout the quarter and a further $448 million till July 25, 2022 [2].

The corporate appears for a strong Q3 because it expects internet income to climb on the excessive finish of the excessive teenagers, excluding acquisitions [3].

In the course of the Q2 report name, Sachin Mehra, Chief Monetary Officer, mentioned, “From an working expense standpoint, we count on Q3 working bills to develop on the excessive finish of a low double-digit charge versus a 12 months in the past on a currency-neutral foundation, excluding acquisitions and particular objects.” The corporate additionally talked about that given the present rates of interest, they’ve an expense run charge of round $115 million every quarter on the opposite earnings and value line. It excludes fairness funding features and losses, that are excluded from our non-GAAP measurements. The corporate anticipates a 19% to 21% tax charge in Q3. In This fall, we anticipate a tax charge of round 19% [4].

Analyst forecasts for Q3 2022 earnings per share vary from 2.37 to 2.68 with a consensus estimate of two.58, whereas forecasts for Q3 2022 gross sales vary from 5.5B to five.8B with a consensus estimate of 5.7B. Just lately, the corporate launched Crypto Supply, which is able to assist monetary establishments in providing crypto buying and selling [5].

Mastercard will function a “bridge” between Paxos, a cryptocurrency buying and selling platform that PayPal presently makes use of to supply an identical service, and banks.

In accordance with the corporate, its obligation is to maintain banks in compliance with rules by following crypto compliance necessities, authenticating transactions, and offering anti-money-laundering and id monitoring companies.

#Mastercard Inventory Evaluation

2022 has been tough. After gaining a excessive of 399.92, it reached a low of 276.87 within the second week of October. The value is at present down nearly 30% from highs. The value is beneath the 200-day MA on the each day chart, and the RSI is close to the impartial degree.

The subsequent resistance for Mastercard lies round 314.98. If it crosses this degree, the inventory might attain 339.48, the extent it achieved on September 12. On the flip aspect, the inventory’s assist lies round 264.19. If the worth breaches this degree, it might additional dip in direction of 249.67 [6].

- https://investor.mastercard.com/financials-and-sec-filings/quarterly-results/default.aspx

- https://investor.mastercard.com/financials-and-sec-filings/quarterly-results/default.aspx

- https://investor.mastercard.com/financials-and-sec-filings/quarterly-results/default.aspx

- https://investor.mastercard.com/financials-and-sec-filings/quarterly-results/default.aspx

- https://www.mastercard.com/information/press/2022/october/mastercard-to-bring-crypto-trading-capabilities-to-banks/

- https://finance.yahoo.com/quote/MA?p=MA&.tsrc=fin-srch

Click on right here to entry our Financial Calendar

Adnan Rehman

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.