- USDIndex – Examined right down to 111.50 and stays beneath 112.00. PMI knowledge was weak throughout the globe, falling additional into contraction, this added to the sentiment that the FED could possibly cool aggressive curiosity hikes in December, lifting shares (save Chinese language tech firms) and weighing on yields. Riski Sunak, set to grow to be new UK PM lifted, GBP, Gilts & UK100. Asian markets hit 2.5 yr lows however recovered on again of optimistic Wall Avenue shut (Nikkei +1.02% Cling Seng +0.5%), European FUTS additionally increased.

- EUR – rotated from 0.9800, lows yesterday again to 0.9900 at the moment, trades at 0.9870 now forward of ECB on Thursday.

- JPY – Friday and early Monday volatility cooled by the US & Asian periods with the pair now pivoting at 148.85, once more forward of the BOJ fee announcement later this week.

- GBP – Sterling rotates round 1.1300 forward of former UK Fin. Minister, Rishi Sunak, changing into the youngest UK PM in fashionable historical past and the primary British Asian.

- Shares – Wall Avenue rallied once more yesterday (+0.86-1.34%) SNAP recovered +7.09% after Fridays drumming, (Alibaba -12.4%, Tencent -14.6%, JD.com -13.02%) HSBC & UBS each beat expectations at the moment. US500 3797 (+1.19%) US500 FUTS trades at 3810 now. Greatest week forward for Earnings.

- USOil – from $83.00 lows once more yesterday to check $85.00 at the moment, Oil markets stay inclined unstable newsflow.

- Gold – rotates by $1650. Latest lows at $1620 stays help and $1665 resistance.

- BTC – $19.5K was examined once more yesterday and stays resistance, with $19.2K help to date, this week.

Right this moment – German Ifo Survey, Australian Federal Price range, US Richmond Fed, BoE’s Capsule. EARNINGS – Alphabet, Microsoft, GM, UPS, GE, Raytheon, Coca-Cola, 3M, Visa, and extra.

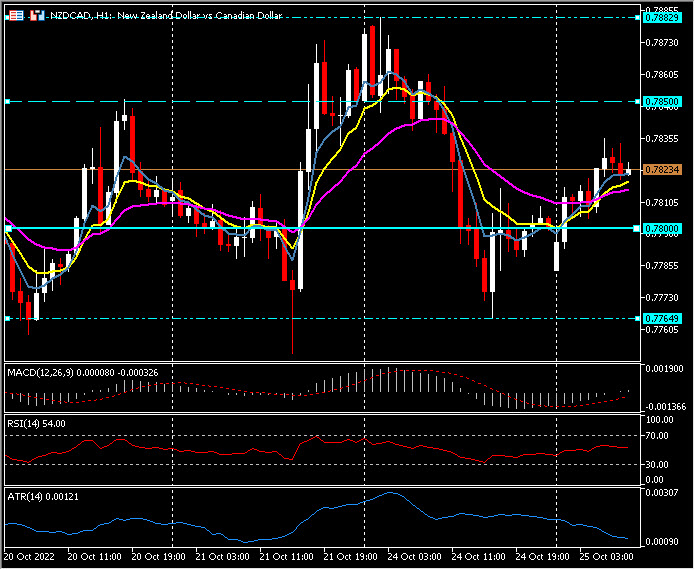

Greatest FX Mover @ (06:30 GMT) NZDCAD (+0.37%) Collapsed from 0.7880 to 0.7765 yesterday however has recovered to 0.7830 at the moment, subsequent resistance 0.7850. MAs aligned increased, MACD histogram & sign line optimistic & rising, RSI 54.90 & rising, H1 ATR 0.00121, Day by day ATR 0.00935.

Click on right here to entry our Financial Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.