Learn or take heed to any monetary media outlet and also you’re more likely to hear the phrases “inverted yield curve.” What does that imply and, extra importantly, what does it imply to your investments?

The form of the yield curve might not have made the highest of your checklist of dialogue matters at previous vacation events. However this yr, it’d make it to the primary spot. Individuals are feeling inflation ache, they’re involved about larger rates of interest, they usually’re frightened the economic system might plunge right into a recession. So, it could be a superb time to brush up on why it is essential to grasp the dynamics of Treasury yields, and what it means when the yield curve inverts. However earlier than diving into the inverted yield curve, it could be useful to grasp the yield curve on the whole, specifically its typical form and what its form signifies.

What’s a Yield Curve?

A yield curve is a chart of bond yields. Though yield curves could be created for any bond, buyers and merchants take note of the U.S. Treasury yield curves. Why? As a result of they signify the rate of interest the U.S. authorities pays to borrow cash, which varies relying on the time and size of the mortgage. Usually, longer-term loans will carry a better rate of interest than shorter-term loans. On this situation, the yield curve would slope upward—a sign of financial growth. However economies do not at all times develop. Generally the yield curve is flat, which may very well be an indication of a slowing economic system with modest development. Now and again the yield curve inverts, which generally is a signal of a weakening economic system. When the yield curve flattens or inverts, the connection between yield curves and recessions can get a little bit difficult.

Why Pay Consideration to the Yield Curve?

The yield curve offers you a “huge image” view of the inventory market and the well being of the general economic system. When rates of interest rise, mortgage charges, automobile loans, or some other varieties of loans rise in tandem. And that may impression client confidence ranges. Lending slows, companies make investments much less, and folks purchase much less. All these components might result in slower development.

When buyers begin to fear a couple of slowdown within the economic system, they typically contemplate investing in long-term bonds. The rise in demand sends long-term bond yields decrease. Demand for short-term bonds decreases and the decrease demand sends short-term Treasury yields larger.

Bond costs and yields transfer in reverse instructions. When bond costs rise, yields go decrease.

One other issue additionally performs into the dynamics—the Fed. When the Fed raises charges, short-term bond yields transfer larger.

If long-term bond yields are unchanged and short-term yields rise, the yield curve will probably flatten. However typically, a fall in demand and the Fed’s determination to boost charges may end up in an inverted yield curve. That is the other of what usually takes place throughout an financial growth, which is why an inverted yield curve may very well be an indication of a possible recession.

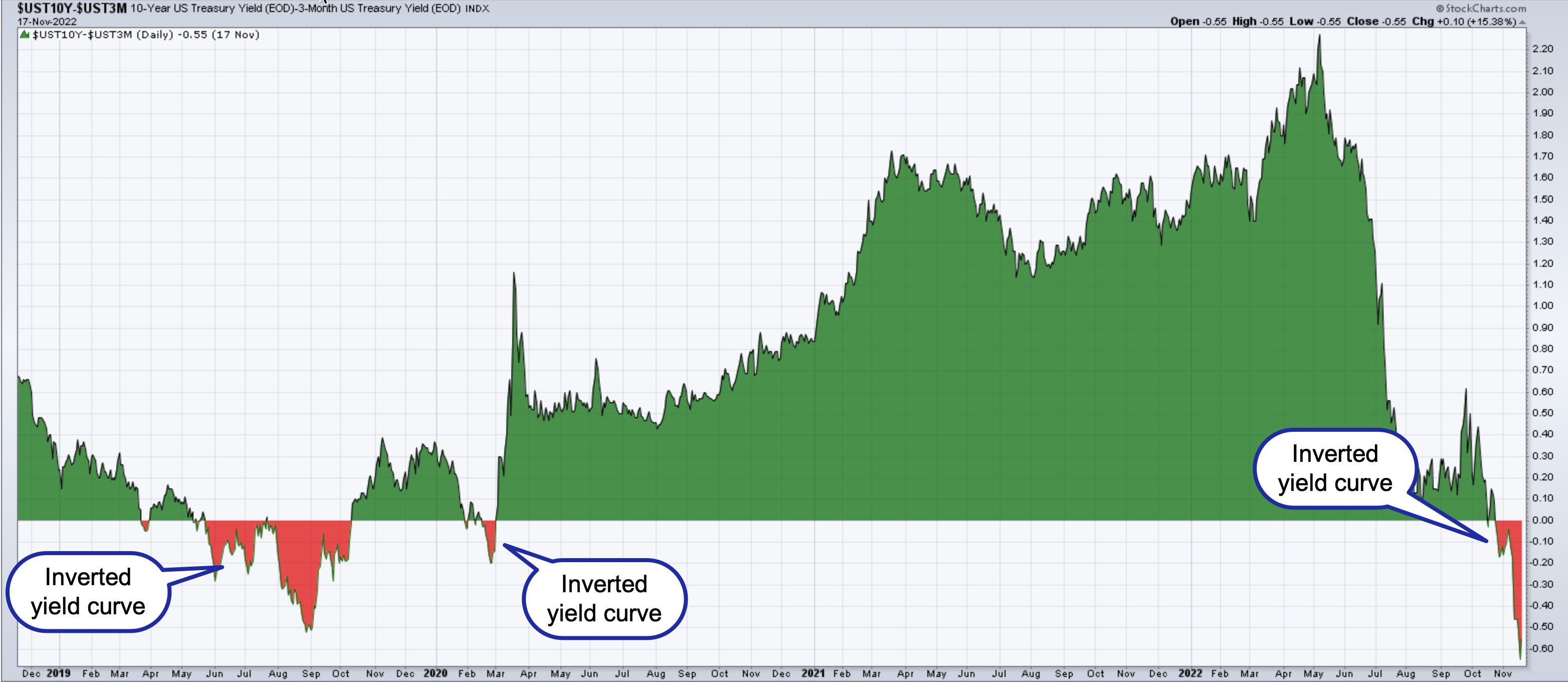

Economists typically take a look at the unfold between the ten-year Treasury be aware price and the three-month Treasury invoice price (see chart under) as a recession predictor.

CHART 1: SPREAD BETWEEN 10-YEAR AND 3-MONTH U.S. TREASURIES. The unfold between the longer ten-year Treasury be aware and the three-month Treasury invoice is in unfavourable territory, implying the yield curve is inverted. The final time we noticed a yield curve inversion was again in 2019 and briefly in 2020 earlier than the COVID-19 outbreak. Supply: StockCharts.com

From the chart above, you’ll be able to see the yield curve has inverted. The overall considering is that, when the Fed tightens rates of interest an excessive amount of, the yield curve inverts. We’re seeing that play out. As we heard from the final Fed press convention, the Fed is frightened about excessive inflation and can preserve tightening till inflation comes all the way down to a suitable stage. Nevertheless it takes time to really feel the total results of the Fed’s tightening, which is why the yield curve can act as a number one indicator.

There are different methods to have a look at the yield curve. You’ll be able to take a look at the unfold between the ten-year and two-year Treasury charges. Julius de Kempenaer, chief technical analyst at StockCharts, acknowledged, in a current StockCharts TV phase of his present Sector Highlight, “When the 10-year yield is decrease than the two-year yield, it signifies that giving your cash to the federal government for 2 years will get you a better yield than giving your cash to the federal government for ten years.” Yield curve inversions might not occur typically, however they don’t seem to be unimaginable.

Does an Inverted Yield Curve = Recession?

Not at all times. In case you return 40 years, each time the 10-year price fell under the three-month one, as a rule, a recession adopted. Nevertheless it did not occur each time. For instance, the final time we noticed an inversion within the ten-year and three-month yield curve was in 2019. On the time, there have been fears that maybe the increasing economic system following The Nice Recession may very well be slowing down or coming to an finish. Nevertheless it did not actually pan out that method in the long term. There was a short while after the COVID-19 outbreak when issues rose in regards to the potential of a worldwide recession, however the inventory markets rallied after that.

It might probably take a number of months or a yr or two earlier than the consequences of financial coverage are felt. Generally, a recession might not even occur. So, as a substitute of wanting on the yield curve as a recession predictor, consider it as an indicator that paints an image of general financial situations.

Seeing the inventory market come off its lows is thrilling. Whereas it possibly tempting to undertake the “purchase the dip” mentality, at all times preserve the large image in thoughts. A inventory market that seems to be strengthening in a time of financial uncertainty is probably not sustainable. That is to not say you should not commerce; it simply signifies that, in case you do wish to add positions to your portfolio, accomplish that figuring out that financial fundamentals is probably not aligned with the inventory market.

We’re going by means of an inflationary interval, rates of interest are rising, and geopolitical tensions proceed. Rates of interest are in all probability going to rise extra. We received a touch of that from feedback made by St. Louis Fed President James Bullard, who prompt the Fed might have to boost charges to 7% earlier than we see a Fed pivot. That could be a good distance off.

Let’s hope that is not the case. Regardless, given present uncertainties, it is best to maintain the yield curve in your rearview mirror. Have a danger administration technique in place—shield your successful trades utilizing stops, acknowledge when your feelings affect your choices, and be disciplined. In the end, your aim is to guard your portfolio. Understanding relationships between macro components and making buying and selling choices based mostly on these relationships makes you a better dealer and investor.

The right way to Observe the Yield Curve on StockCharts

Probably the most direct approach to monitor the yield curve is:

- Login to your StockCharts account

- Choose your most popular chart sort—SharpCharts, StockChartsACP, and so forth

- Enter $UST10Y-$UST3M within the image field

- Check out completely different chart varieties from the Sort dropdown menu

- Choose overlays and indicators from the respective dropdown menus

- Save the chart to your ChartLists

For extra concepts, make sure you try the StockCharts in Focus video under.

Preserve an eye fixed out for our Cyber Monday sale, coming quickly.

For extra methods to trace yield curves and rates of interest, make sure you try the StockCharts in Focus video under.

Glad charting!

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Earlier than that, she was Managing Editor of Shares & Commodities journal .

Study Extra