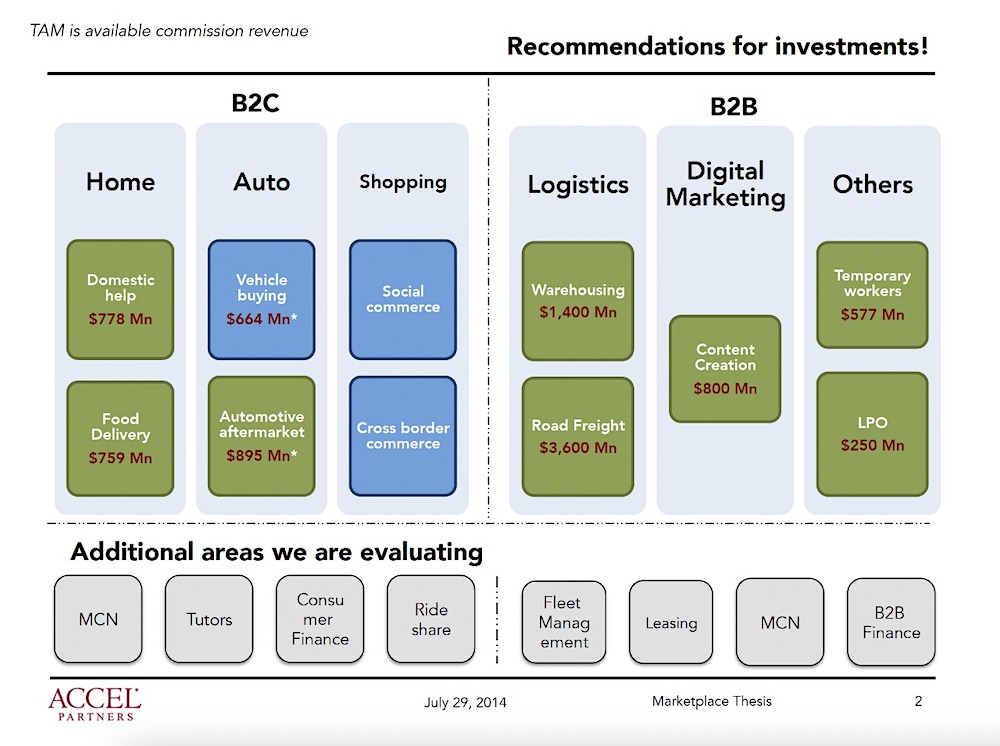

In 2014, Prayank Swaroop made a pitch to the storied enterprise agency Accel, the place he labored as an affiliate, about future marketplaces in India.

On the time, Flipkart and Snapdeal have been the one two e-commerce startups in India that had proven a semblance of scale. Swaroop made a case that as extra Indians come on-line, alternatives will emerge in meals supply, automotive aftermarket, warehousing, street freight, and social commerce amongst many different market areas.

Swaroop, now a associate on the agency, turned out to be proper. City Firm, which operates within the home assist sector, is valued at over $2 billion; Zomato and Swiggy are delivering meals to hundreds of thousands of consumers every month; Spinny and Cars24 are promoting lots of of 1000’s of vehicles every quarter; social commerce startup DealShare is valued at over $2 billion and Meesho simply in need of $5 billion.

A whole bunch of hundreds of thousands of Indians have come on-line up to now decade and over 100 million are making on-line transactions and purchases every month. India, which has doubled its pool of unicorns to over 100 up to now two years, has attracted over $75 billion in investments from tech giants Google, Meta and Amazon and enterprise funds Sequoia, Tiger World, SoftBank, Alpha Wave, Lightspeed and Accel up to now half decade.

Swaroop’s presentation from 2014. (Picture credit: Accel)

However because the native startup ecosystem closes one in every of its hardest years, it’s now watching one other query that it has lengthy been capable of brush off as benign: exits.

About half a dozen client tech Indian startups have gone public up to now 12 months and a half and all of them are performing poorly on the native inventory exchanges. Paytm is down 60% this 12 months, Zomato 58%, Nykaa 56%, Coverage Bazaar 52%, and Delhivery 38%.

That is regardless of the Indian shares outperforming the S&P 500 Index and China’s CSI 300 this 12 months. India’s Sensex — the native inventory benchmark — stays up 3.4% this 12 months, in comparison with fall of 19.75% in S&P 500 and 21% in China’s CSI 300.

Because the market modified its course this 12 months, many Indian startups together with MobiKwik and Snapdeal have delayed their itemizing plans. Oyo, which deliberate to record in January subsequent 12 months, is unlikely to maneuver ahead with that plan, in line with two folks conversant in the matter.

Flipkart, valued at $37.6 billion and majority owned by Walmart, doesn’t plan to record till no less than 2024, in line with an individual conversant in the matter. Byju’s, India’s Most worthy startup, doesn’t plan to record in 2023 and is as an alternative shifting forward with a plan to record one in every of its subsidiaries, Aakash, subsequent 12 months, TechCrunch beforehand reported.

These seeking to push forward with their plans to go public will face one other impediment: A number of international public funds together with Invesco that ardently finance the pre-IPO rounds are retreating from the Indian market after getting hammered in China and different rising markets this 12 months, in line with folks conversant in the matter.

LPs have lengthy expressed issues about India not delivering exits and the early-attempts up to now two years from the trade appear nothing to write down house about.

Indian enterprise funds have traditionally gotten most exits by the best way of mergers and acquisitions. However even these exits are getting more durable to come back by.

An analyst at one of many prime enterprise funds in India stated that for a very long time VCs who backed early-stage SaaS startups at sub-$25 million valuation stood an opportunity of creating good exits. However as we now have seen in some circumstances in current months, the exit itself values the startup at sub-$25 million, making it tough for SaaS traders to show a revenue.

II.

On a current night at a personal gathering of some dozen trade figures at a 5 star lodge in Bengaluru, many traders have been exchanging notes concerning the offers they’d been evaluating. The companions complained that the standard of startups has dropped whilst the quantity of pitches has surged.

Two outstanding enterprise funds that run well-regarded accelerators or cohort programmes of early stage investments are struggling to search out sufficient good candidates for his or her subsequent batches, folks conversant in the matter stated.

I’ll argue that it’s not simply that the standard of latest startups has taken successful, it’s additionally traders’ urge for food and psychological fashions for what they assume may go sooner or later.

Take crypto, for example. The overwhelming majority of Indian traders have been too late to make investments within the web3 area. (One can find only a few Indian names within the cap tables of native exchanges CoinSwitch Kuber and CoinDCX and till not too long ago, blockchain scaling agency Polygon, as a outstanding VC at one of many world’s largest crypto VC funds not too long ago pointed to me.)

Now many corporations in India that had employed quite a few crypto analysts and associates final 12 months are retreating from the web3 market and have requested employees to concentrate on totally different sectors, in line with folks conversant in the matter.

Fintech is one other space of concern for traders. India’s central financial institution this 12 months pushed a collection of stringent modifications to how fintechs lend to debtors. The Reserve Financial institution of India can be more and more scrutinizing who will get the license to function non-banking monetary firms within the nation in strikes that has despatched a shockwave to traders.

Many enterprise traders are actually more and more chasing alternatives to again banks as an alternative. Accel and Quona not too long ago backed Shivalik Small Finance Financial institution. Many are deliberating an funding in SBM Financial institution India, one of many banks that has aggressively partnered with fintechs within the South Asian market, TechCrunch reported earlier this month.

An investor described the pattern as a “hedge” in opposition to fintech publicity.

Traders’ enthusiasm within the edtech market has additionally cooled off after re-opening of colleges toppled the giants Byju’s, Unacademy and Vedantu.

Indian startups raised $24.7 billion this 12 months, down from $37 billion final 12 months, in line with market intelligence agency Tracxn. The funding crunch and the market dynamics prompted startups to let go of as many as 20,000 workers this 12 months.

Over a dozen traders I spoke with imagine that the funding crunch received’t go away till no less than Q3 of subsequent 12 months regardless of most traders chasing India sitting on report quantities of dry powder.

As we enter the brand new 12 months, some traders can be re-evaluating their convictions and plenty of are satisfied that a number of down rounds for main startups are on the horizon. However many star unicorn founders are unwilling to take a haircut of their valuations, partially as a result of they imagine that can drive some expertise away. PharmEasy, valued at $5.6 billion, was supplied new capital at a decrease than $3 billion valuation this 12 months, in line with two folks conversant in the matter. (PharmEasy didn’t reply to a request for remark.)

“2022 began off strongly, and it appeared for some time that the Indian enterprise funding market can be topic to totally different gravitational forces than U.S. and China, which have been seeing dramatic declines, however this was to not be. The Indian market ultimately turned out to be topic to the identical macro headwinds because the U.S. and China enterprise market,” stated Sajith Pai, an investor at Blume Ventures.

Pai stated that growth-stage offers accounted for almost all of funding final 12 months and noticed anyplace from a 40-50% drop this 12 months. “The decline was led primarily by development funds pausing investments as a result of the multiples in non-public markets have been wealthy in comparison with their public friends, and the weak unit economics of the expansion stage firms.”