That is an absolute must-read for any severe dealer earlier than venturing to make use of any EA. You DON’T have to really do the beneath talked about calculations, however ensure to grasp the underlying ideas as a result of that method what needs to be included in each backtesting report, tips on how to correctly learn them and what crimson flags to look out for. I see many merchants shopping for costly EAs primarily based on the restricted and marginal capabilities of Metatrader’s backtesting instrument, however as a way to be a profitable dealer it’s worthwhile to step up your recreation and use the identical analysis strategies that skilled merchants within the banking and hedge fund business do.

Let’s begin with what for my part is crucial issue to think about earlier than even every other metric:

1. In-Pattern/Out-Of-Pattern testing

You will need to get this one proper, as a result of right here is the place a lot of the merchants delude themselves. In-Pattern information exists in two varieties: synthetic ticks created by Metatrader primarily based on hypothetical value motion, and historic information offered to you by your dealer. This In-Pattern method assumes that the markets are completely deterministic and is naively used to suit your mannequin. However in actuality this gained’t work in the long term. This complete matter is sophisticated by the truth that historic information varies from dealer to dealer as a result of the quantity of liquidity to which they’ve entry to differs, which in flip impacts the general value motion and can provide you wildly totally different take a look at outcomes. To make issues much more sophisticated, most non-prime brokerages don’t have entry to pre-2017 ticks and subsequently offer you synthetic ticks. The in-house backtester of MT sadly doesn’t account for any of these elements, which is usually the explanation why so many merchants lose capital in the long term despite the fact that the backtesting outcomes of MT regarded promising, or they miss out on a doubtlessly worthwhile EA just because the backtester gave a seemingly unhealthy outcome.

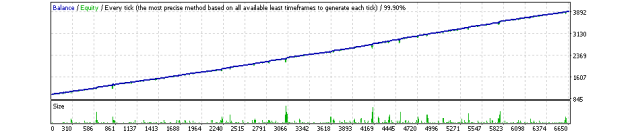

Be particularly cautious while you see graphs like this from MT backtesting:

Such near-straight steadiness strains are very misleading as a result of the enter parameters of an EA could be deliberately programmed to place out such a outcome, however as quickly because the EA is run for whereas in the true market atmosphere you’ll have a foul awakening. A dishonest programmer might very simply create an EA with such unbelievable outputs, just by extracting the ticks from the csv information, arrange them in a number of „value motion classes“, calculating the median values of these classes and code his EA in such a method that it executes and closes out trades primarily based on these outputs. Such good steadiness strains with no variance are actually unattainable to realize within the precise markets as a result of this assumes that the sample of the CURRENT market stays an identical to future patterns and thus the enter by no means has to vary.

Give it some thought this fashion: the place have you ever ever seen dwell steadiness strains corresponding to these in any dealer’s portfolio, be they retail or institutional? In all of the years that I’ve been working within the funding banking and hedge fund business, I haven’t seen a single occasion the place any dealer, regardless of how skilled and insightful, has been in a position to present such outcomes to his consumer base or himself. I problem you to seek out me only one dwell portfolio with such an ideal line and I’ll promise you to place all my funds into it and name it a day. That is eye sweet, however has nothing to do with actuality.

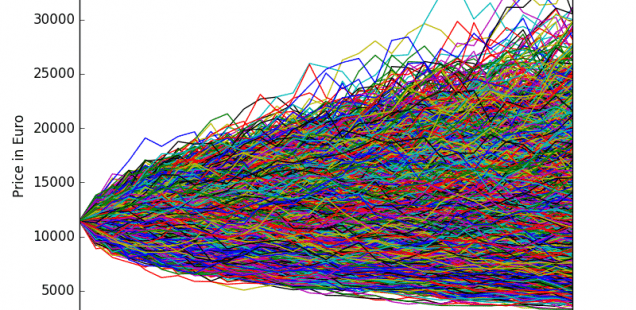

Actual-world steadiness/fairness strains look extra like this:

As you may see within the instance above, the invested capital experiences some ups and downs, however is general growing. It seems way more natural and pure, and is way nearer to precise buying and selling performances of institutional funds. Why is that, you ask? Nicely, this occurs as a result of even the technique that (skilled) merchants use, should adapt to altering market circumstances regardless of how dependable the technique is (and it takes time to adapt), however till then the steadiness line would possibly expertise some hickups.

You’re most likely questioning at this level what the precise use of the MT backtester is, if the outcomes could be manipulated so simply?

To reply this query in the most straightforward method: the ticks of Metatrader and all the non-prime brokers that you simply use, offer you In-Pattern datasets so as so that you can 1) take a look at if the EA reveals any potential bugs in commerce execution or has some incompatibility with this system itself (verify error logs) and a couple of) take a look at if the EA really executes trades primarily based on the indicator inputs and general technique of the EA (activate visible mode). In that respect it’s really a useful gizmo that MetaQuotes gives and that’s the place the power of it shines.

However if you wish to take a look at the precise profitability of the EA you may’t get round Out-Of-Pattern testing (OOS). Once I labored within the buying and selling division of an funding financial institution, my supervising managers by no means accredited of a brand new and upcoming buying and selling bot till they’ve seen OOS take a look at outcomes, and for good motive: big sums of consumer funds had been and nonetheless are at stake. If you wish to be like good cash then you must assume and act like they do.

This leads us to the query of how OOS really works and what makes it a lot extra dependable in backtesting. As you’ve already realized, In-Pattern refers to deterministic synthetic/historic information that you have already got, however the issue with counting on it’s that previous efficiency doesn’t, in any form or type, point out future efficiency, particularly when it’s synthetic information. So, how will we mathematically remedy this downside? Easy, by utilizing randomized computational statistics. The identical method the markets are primarily based on future value uncertainty, whereas counting on a set of repeating patterns, we implement that uncertainty into the backtesting process, by taking a portion of the information of these previous patterns and let it run by way of an algorithm that randomizes these samples as a way to receive outcomes which are a lot nearer to precise actuality than In-Pattern datasets. The EA then executes trades primarily based on that randomized pattern the place you may see how it will really carry out within the markets. Backtesting thus turns into a way more correct illustration of the dwell efficiency of the EA in query.

For my part each financially considered one who takes buying and selling as a severe career ought to first have a look at OOS outcomes earlier than passing a last judgement of the supposed profitability of the EA itself.

2. Monte Carlo Simulation (MCS)

MCS straight ties in with OOS. It was invented by John von Neumann and Stanislaw Ulam throughout World Battle II to enhance resolution making below unsure circumstances. It was named after a widely known on line casino city, known as Monaco, because the factor of probability is core to the modeling method, just like a recreation of roulette. It’s extensively used immediately by many casinos to enhance their successful possibilities in opposition to the gamers.

MCS applies the outcomes of an OOS take a look at in a graph, the place every increment of randomization is expressed as „confidence“ in share (the place 100% confidence displays a market that deviates essentially the most along with your technique). Every confidence degree is visualized by a unique coloured line. The broader the hole between every of these strains, the more serious the proposed system will carry out in real-world circumstances.

The instance above reveals a MCS with outcomes that might be thought of catastrophic. The uppermost strains are growing and a standard backtest with out MCS would subsequently present you a take a look at outcome that provides you a false sense of safety, however as quickly as you run the commerce by way of the MCS you’ll see visually what would occur if the markets deviate out of your technique in a roughly drastic method (indicated by the arrogance ranges as I’ll present beneath). In our instance above, a confidence of roughly 50% will give us flat outcomes (no vital revenue) and something above that may really eat away your invested capital and ultimately blow up your account!

That is how Monte Carlo Simulation is meant to appear to be:

The boldness degree „Unique“ stands for 0%, and as you may see, even a confidence of 100% nonetheless provides you very worthwhile outcomes. The distinction in complete internet revenue is just 12.61% in a market atmosphere marked by full unpredictability, which proves the robustness of the EA. That’s how a stable, institutional-grade system is meant to appear to be.

3. System High quality Quantity

Earlier than understanding SQN it’s worthwhile to just remember to grasp the underlying rules of it that drive the ensuing ratio. In different phrases it’s worthwhile to perceive R-expectancy and R-multiples.

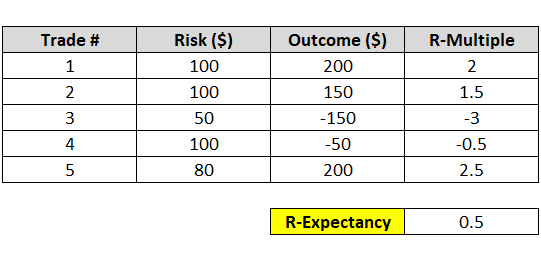

The R stands on your preliminary commerce threat and all of your earnings and losses ought to relate to it. As an example, if you happen to determine to threat $100, however find yourself shedding $200, your commerce’s R-multiple is -2R. In the event you threat the identical quantity however as an alternative rake in a pleasant $500 revenue, your R-multiple is +5R. Ideally, your losses needs to be not more than -1R. In the event you commerce an illiquid market, slippage can typically make you lose greater than anticipated.

With the R-multiple of every commerce calculated, you may then calculate your system’s R-expectancy. That is the typical R-multiple throughout all of the trades in your backtest. Under is a hypothetical system with 5 trades to compute the R-expectancy:

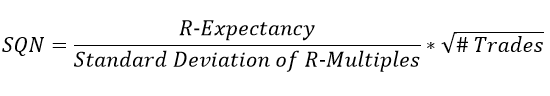

And now you’re able to calculate the precise SQN:

This offers you the ratio between the R-expectancy and its normal deviation, multiplied by the sq. root of the variety of trades. The expectancy measures your system’s profitability, whereas the normal deviation measures consistency.

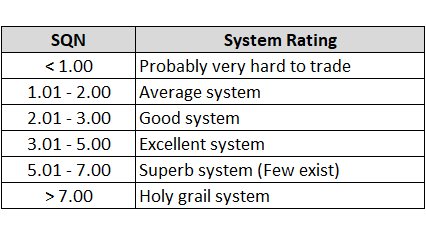

In case your particular person R-multiples are intently clustered across the expectancy, your normal deviation will probably be low, enhancing your SQN. Equally, a big backtest pattern measurement improves the statistical significance of your metrics, giving a better SQN. Dr. Tharp gives the next benchmarks, primarily based on a pattern measurement of 100 trades:

There’s something to notice right here: though Dr. Tharp classifies something above 7.00 as a holy grail system, that is solely true in a possible sense. It’s crucial to take different metrics into consideration earlier than lastly judging the system, corresponding to Return/Drawdown, Sharpe Ratio, Place revenue by place holding time, and so forth.

4. Place Revenue By Place Holding Time

This one shouldn’t be an absolute must-know to guage the profitability of an EA, but it surely nonetheless provides you distinctive perception into when essentially the most earnings are realized.

As could be seen from the above screenshot, essentially the most worthwhile trades with this particular EA occur with a Place Holding Time of not more than 60 minutes. As time passes by, the quantity and frequency of worthwhile trades decreases whereas the potential losses enhance, with most losses occuring throughout a holding time of 300 minutes or 5 hours. My EA MarketMaster® for instance has this as a part of its acceptance profile earlier than getting into a commerce and subsequently holds its place for a mean of 2h to chop losses quick. Any future EA that I’m going to publish could have this characteristic as a part of its acceptance profile to cut back the chance as a lot as doable whereas maximizing the potential return. It has at all times confirmed to be helpful to see such a info earlier than utilizing an EA, as a result of it provides you a extra full and clear image of the EA’s profitability and threat.

I hope you discovered my weblog submit informative and useful. Please go away a remark and let me know whether or not something wants clarification. Any contribution is welcome too! Completely happy buying and selling!