It’s debatable which could possibly be thought-about the buzzword for the monetary sector of the 2020s, however “crypto” and “ESGs” are robust contenders.

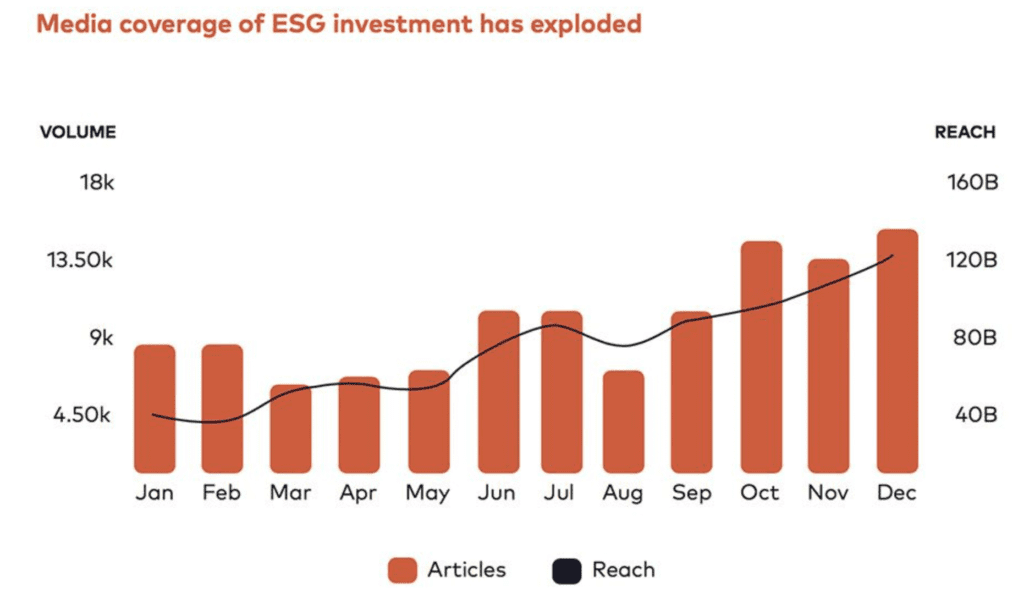

In 2020, media protection of ESG funding elevated by 75%. Though nothing in comparison with the wild, horny renegade within the crypto sector, consideration has been sparked, with the extended results of environmental degradation holding the general public eye.

This month the extremely publicized ethereum merge introduced the buzzwords collectively (they, too, merged). Many information retailers highlighted the environmental affect of the blockchain’s shift to Proof of Stake and in contrast bitcoin’s vitality consumption to entire international locations. The figures are surprising, and even regulatory our bodies are sitting up and beginning to take discover.

Nevertheless, there is not only “E” in “ESG” — the Social and Governance elements addressed by the crypto business are equally newsworthy. Cryptocurrency’s potential in addressing the S and the G elements of worldwide society, whereas not presently as noisy because the environmental issues, exhibits a promise of serious change.

Final week SEBA financial institution launched a report on cryptocurrencies’ compatibility with ESG funding, bringing the scope of the brand new know-how extensively into focus.

Environmental elements pose issues for widespread utilization

The environmental affect of cryptocurrencies is essentially the most talked about of late. With the ethereum merge reportedly wiping virtually 0.2% of worldwide vitality consumption off the map, the impact of the extremely scaled Proof of Work (PoW) consensus mechanism utilized in bitcoin, amongst others, has been introduced into focus.

As we transfer nearer towards the COP26 emissions objectives for 2030, the consequences of worldwide warming are ever-present (hiya, hurricane Fiona to call the latest). Environmental issues are of the utmost precedence for a lot of people and establishments. Europe has been one of the crucial vocal in its quest to turn into carbon impartial, which can clarify its publication of a damning report evaluating bitcoin’s vitality utilization to that of midsized international locations and hinting at a future ban on PoW.

Regardless of some inside the crypto house being skeptical of such a ban, the environmental affect of cryptocurrencies is plain.

SEBA Financial institution’s report cited a rise in bitcoin’s vitality utilization from 6.6 terawatt-hours in 2017 to 138 terawatt-hours in early 2022, equal to that of Norway. The overall carbon footprint is estimated at 114 million tonnes of carbon dioxide per 12 months.

With out going an excessive amount of into the ins and outs of why the vitality consumption is so excessive, which you could find right here, for the PoW mechanism (and subsequently bitcoin) to work, massive quantities of vitality are important.

Nevertheless, SEBA’s report famous that round 57% of the vitality consumption has shifted to renewable vitality sources.

“You may have two methods to have a look at the difficulty,” stated Yves Longchamp, Head of Analysis at SEBA financial institution. “First is the place the vitality comes from. And the second is, what is that this vitality used for? Truly, the vitality is not only wasted. It’s used to supply safety to the system.”

“Bitcoin is by far essentially the most safe crypto on the planet, it has by no means been hacked, and the price of hacking is proportional in a strategy to the vitality used. The extra vitality the blockchain expends, the extra expensive it’s to assault.”

“That’s the USP of bitcoin. It’s one thing exterior the monetary system which is peer-to-peer, censorship-resistant and virtually unattackable.”

A difficulty the cryptocurrency business appears to concentrate on

Regardless of this, the crypto group is conscious of the mechanism’s environmental drawback, and the SEBA Financial institution publication studies that, consequently, the Crypto Local weather Accord (CCA) has been based.

In accordance with SEBA, the CCA, a non-public sector-led initiative, has pledged to transition all blockchains to renewable vitality by 2030 and attain net-zero greenhouse gasoline emissions by 2040.

To achieve this purpose, the initiative has two targets:

- “Obtain net-zero emissions from electrical energy consumption for CCA Signatories by 2030

- Develop requirements, instruments, and applied sciences with CCA Supporters to speed up the adoption of and confirm progress towards 100% renewably-powered blockchains by the 2025 UNFCCC COP30 convention.”

This, together with the rise in PoS-based blockchains (SEBA financial institution reported that solely two of the highest 20 blockchains at the moment are PoW), may present an elevated consciousness of large-scale cryptocurrency adoption’s environmental issues may pose and a willingness to deal with them.

Potential for better international monetary inclusion

Maybe an element not so broadly reported is the potential for social inclusion cryptocurrencies can pose.

In accordance with the 2021 Chainalysis report cited in SEBA’s publication, rising economies are essentially the most vital adopters of cryptocurrencies. “Greater than 80% of the highest 15 customers of cryptocurrency are from growing international locations,” said the SEBA report. “This means that cryptocurrencies provide providers these individuals can not entry in any other case.”

“After you have extra tangible use instances that basically have an effect on individuals’s lives, individuals see the clear profit of companies organized round crypto,” stated Mike Castiglione, Director of Regulatory Affairs, Digital Property at Eventus.

“You’ll are inclined to see better adoption. There have been research about crypto adoption globally, and the populations that are typically extra favorable towards it are sometimes populations that don’t have trusted monetary intermediaries and endure below excessive inflation over a few years.”

Argentina and Venezuala are such populations. Affected by hovering inflation lengthy earlier than the present international financial downturn and excessive distrust in native monetary establishments, the 2 nations are ranked tenth and seventh for worldwide crypto adoption.

SEBA additionally famous that for entities that frequently ship and obtain cross-border funds, crypto affords a comparatively “handy” various. Normally confronted with settlement instances of a number of days within the conventional cross-border cost system, customers of cryptocurrencies can count on a major discount. Bitcoin and ethereum switch settlement can vary from 12 seconds to 60 minutes.

Nevertheless, the excessive volatility of cryptocurrencies is usually a deterrent on this use case, opening out the necessity for stablecoins. The adoption of USDC, for instance, has grown considerably prior to now two years at a report price. Specialists are responding to this development, providing monetary merchandise to help in monetary inclusion and entry to wealth creation instruments that beforehand would have been unprecedented in each the crypto and conventional monetary sector.

Illicit crypto-related actions are additionally reported to have diminished to decrease than the broader financial system (after rising considerably in 2021).

Web3 and crypto know-how has lengthy been a melting pot for governance experimentation.

To create a extra democratized monetary system, Satoshi Nakamoto, the alleged founder (or founding group) of bitcoin, has been upheld by the crypto group for the deal with decentralization that bitcoin posed.

With decentralization because the preliminary prime goal, governance techniques have been put below the microscope. The crypto world has continued to check mechanisms resembling quadratic voting, which may have real-world purposes.

RELATED: Soulbound Tokens: A brand new frontier for decentralization

Within the SEBA report, the deal with governance in Web3 is explored. The mechanisms of blockchain protocol governance are defined, breaking down the concerned entities, that are totally different in response to the blockchain.

The rise of DAOs, dApps, and instruments resembling good contracts have broadened the scope of adopting these governance mechanisms. Many deal with particular causes and the potential distribution of rather more than cash.

Associated:

Regardless of a willingness to discover a extra democratic and inclusive governance construction, the crypto group remains to be rocked by a gender divide. The SEBA report cited findings from Gemini, exhibiting ladies solely characterize 26% of crypto buyers. This mirrors a basic pattern within the monetary and tech sectors, additionally exhibiting low ranges of gender range.

In response to this, varied DAOs have been created, pushing a gender equality agenda inside the crypto group, once more exhibiting an consciousness of the difficulty inside the crypto communities.

ESG aligned by design?

Regardless of the latest media noise, crypto isn’t so misaligned with ESG. Nevertheless, SEBA Financial institution did notice that it might be tough to find out the extent of its alignment inside one publication. “In our view, a lot of them (cryptocurrencies) are, and the final pattern is in direction of extra ESG-friendly protocols,” the financial institution said.

Via their governance buildings, cryptocurrencies and the related blockchains, DAOs, dApps, and extra mechanisms that kind the crypto ecosystem could have public opinion etched into their DNA.

The deal with decentralization and democracy creates vital potential for alignment with the causes most vital to the final international public. In flip, this might imply a pure alignment with the three parts of ESG.