Merchants have alternative ways of figuring out tendencies and development path. Some merchants determine development purely primarily based on the trajectory of worth motion. Some use transferring averages. Others use totally different technical indicators.

Pure worth motion merchants are very distinctive in figuring out tendencies as a result of most worth motion merchants rely solely on a unadorned chart. This lack of construction and concrete guidelines make figuring out tendencies and development path very tough for brand new aspiring worth motion merchants. Nevertheless, there are methods to objectively determine development path primarily based on worth motion.

First, allow us to look into how worth motion merchants determine development path. Value motion merchants determine tendencies primarily based on worth swings. The market is in an uptrend if worth swings are making larger swing highs and swing lows. Then again, the market is in a downtrend if worth swings are making decrease swing highs and swing lows.

This methodology makes figuring out development path a little bit bit extra concrete. Nevertheless, that is nonetheless very subjective and may nonetheless show to be tough for brand new merchants.

Right here we’ll look into how the Zig Zag indicator can be utilized to determine worth swings and development path, and the way the recognized worth swings will be built-in with Fibonacci retracements to determine excessive chance entry factors.

Zig Zag Indicator

The Zig Zag indicator is a technical indicator which was developed to assist merchants determine worth swings. It identifies swing factors on the value chart primarily based on worth reversals which might be a share larger than the preset components. These components embody depth, deviation and backstep. The indicator then connects these swing factors with a line making a zigzag like construction.

The reversal factors recognized by the Zig Zag indicator are principally the swing highs and swing lows of worth motion. Merchants can use this info to objectively determine swing factors with out second guessing themselves and subjectively adjusting what they’d contemplate as a sound swing level.

Merchants can use the swing factors to determine development path. That is primarily based on whether or not the swing factors recognized are creating larger or decrease swing highs and swing lows.

Merchants may also use the swing factors as a foundation for horizontal helps and resistances, in addition to a foundation for figuring out provide and demand zones.

Fibonacci Retracement Software

Fibonacci Retracement is a method in technical buying and selling whereby help and resistance ranges are recognized primarily based on a share of a worth swing. These percentages are primarily based on a sequence of ratios, that are known as the Fibonacci Ratio.

The Fibonacci Ratio is a sequence of ratios which was found by Fibonacci or Leonardo of Pisa as he was observing nature.

Surprisingly the identical ratio that he noticed in nature can be utilized in our modern-day technical buying and selling evaluation. Merchants have noticed that worth do are inclined to respect the Fibonacci ranges as a help or resistance stage. The preferred Fibonacci retracement ranges are 23.6%, 38.2%, 61.8% and 78.6%, with the extent 61.8% being the most well-liked. The truth is, the 61.8% stage is popularly known as because the golden ratio.

Fibonacci evaluation gave rise to the event of the Fibonacci Retracement software, which is a staple software in most buying and selling platforms. This software merely plots the degrees as merchants join swing factors. This eliminates the effort of getting to manually compute for the degrees.

Merchants can use these ranges as a foundation for help or resistance bounces and might be a buying and selling system in itself.

Buying and selling Technique

Fibonacci Value Swing Development Foreign exchange Buying and selling Technique is a development following technique primarily based on the identification of a development utilizing worth motion swing factors.

The technique makes use of the Zig Zag indicator as a software to objectively determine the swing factors. Traits are recognized primarily based on whether or not worth motion is plotting larger and better swing highs and swing lows or decrease and decrease swing highs and swing lows.

As quickly because the development is recognized, we might then join the swing factors within the path of the development utilizing the Fibonacci Retracement software.

Then, we set our pending restrict entry orders on the golden ratio, 61.8%. The cease loss is then positioned on the 78.6% Fibonacci Ratio stage whereas the take revenue goal worth is ready on the prior swing level.

Indicators:

- ZigZag (default setting)

- Fibonacci Retracement Software

Most well-liked Time Frames: 1-hour and 4-hour charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

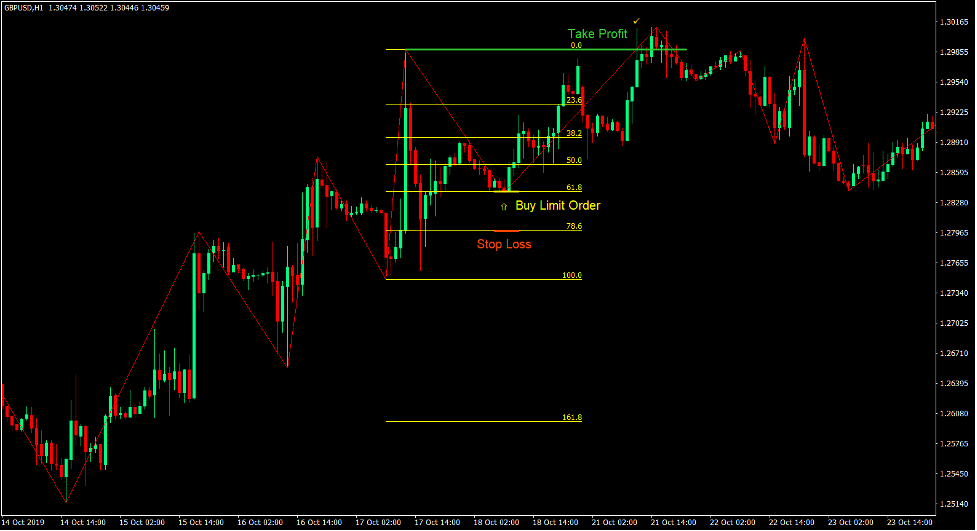

Purchase Commerce Setup

Entry

- The Zig Zag indicator ought to determine larger and better swing highs and swing lows indicating a bullish trending market.

- Use the Fibonacci Retracement software from toolbar and join the newest swing low to the swing excessive.

- Set a purchase restrict order on the 61.8% stage.

Cease Loss

- Set the cease loss on the 78.6% stage.

Exit

- Set the take revenue goal at the newest swing excessive.

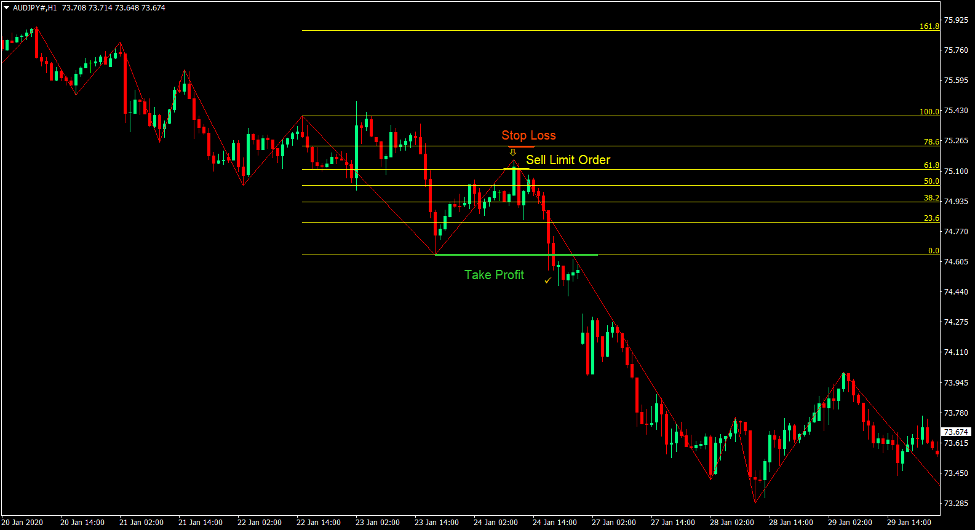

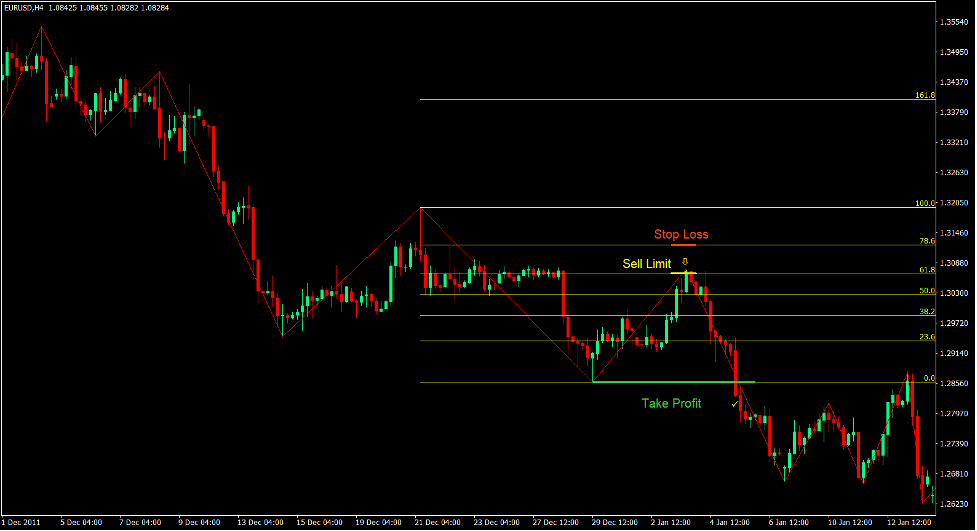

Promote Commerce Setup

Entry

- The Zig Zag indicator ought to determine decrease and decrease swing highs and swing lows indicating a bearish trending market.

- Use the Fibonacci Retracement software from toolbar and join the newest swing excessive to the swing low.

- Set a promote restrict order on the 61.8% stage.

Cease Loss

- Set the cease loss on the 78.6% stage.

Exit

- Set the take revenue goal at the newest swing low.

Conclusion

This methodology of buying and selling is a working buying and selling technique utilized by {many professional} merchants. Fibonacci evaluation is a confirmed methodology which many merchants use.

Nevertheless, figuring out the swing factors may be very subjective. Figuring out trending markets primarily based on swing factors proves to be much more tough for a brand new dealer.

Using the Zig Zag indicator helps merchants objectively determine the swing factors making the technique extra useable by new merchants.

This technique tends to have a really excessive chance. Nevertheless, at instances worth would bounce off the prior ranges of the Fibonacci Retracement software. Sticking to the golden ratio permits us to have extra accuracy and a better risk-reward ratio. Nevertheless, the variety of trades triggered could be lesser.

It is usually a viable choice to set the cease loss a little bit past the 78.6% stage as this stage can be a help or resistance stage which worth might additionally bounce off from and make a revenue.

Merchants who might get a really feel of trending markets and their swing factors utilizing the Zig Zag indicator and the Fibonacci Retracement software could make use of this technique to constantly revenue from the market.

Foreign exchange Buying and selling Methods Set up Directions

Fibonacci Value Swing Development Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the gathered historical past information and buying and selling alerts.

Fibonacci Value Swing Development Foreign exchange Buying and selling Technique offers a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional worth motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Advisable Choices Buying and selling Platform

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 General Ranking!

- Mechanically Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

How you can set up Fibonacci Value Swing Development Foreign exchange Buying and selling Technique?

- Obtain Fibonacci Value Swing Development Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you wish to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Fibonacci Value Swing Development Foreign exchange Buying and selling Technique

- You will note Fibonacci Value Swing Development Foreign exchange Buying and selling Technique is out there in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: