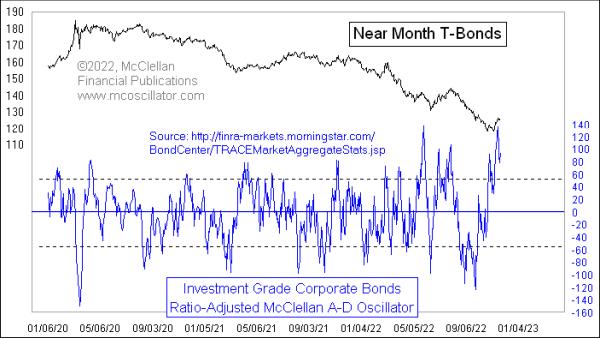

After trending downward for the reason that summer time of 2020, T-Bond costs have seen a small upturn right here in November 2022. That value rise for T-Bonds had coattails, serving to to spice up the costs of investment-grade company bonds. One impact of these company bonds shifting larger is that the Advance-Decline (A-D) information for them has additionally seen a pointy upturn, which has resulted in a extremely excessive studying for the McClellan Oscillator on this week’s chart.

The traditional McClellan A-D Oscillator, which my mother and father created again in 1969, was for the A-D information of the NYSE and AMEX exchanges, the 2 main inventory exchanges at the moment. However the identical math will be utilized to any kind of A-D information. On this case, I’m displaying a “Ratio-Adjusted” McClellan Oscillator (RAMO), that means that I’ve adjusted the uncooked day by day A-D information to replicate the adjustments within the variety of points traded over time. See this text for a proof of the maths.

What the McClellan Oscillator measures is the acceleration going down within the uncooked A-D information. So, when there’s a massive optimistic studying just like the one we have now simply seen, meaning there has simply been a extremely sturdy upward acceleration. Within the inventory market, a super-high McClellan Oscillator studying generally is a signal of sturdy new initiation of an uptrend, in addition to a promise of extra upward motion to come back. However it doesn’t appear to work that manner for the company bond A-D information.

Very excessive readings on this explicit RAMO are related to topping occasions for T-Bond costs. That won’t imply they high on the very same day, however the level is that these are markers of value exhaustion. Why the bond market works otherwise from the inventory market on this respect is an fascinating query, however not an important one. Totally different markets do have completely different personalities in how their value actions occur. Simply ask any commodities dealer. We shouldn’t have to know why these variations happen so as to acknowledge that they’re actual.

The purpose we should always take from this chart is that the slight upturn in bond costs has exhausted itself, and we usually tend to see the downtrend in bond costs resume, versus this being the beginning of a brand new value uptrend for bonds.