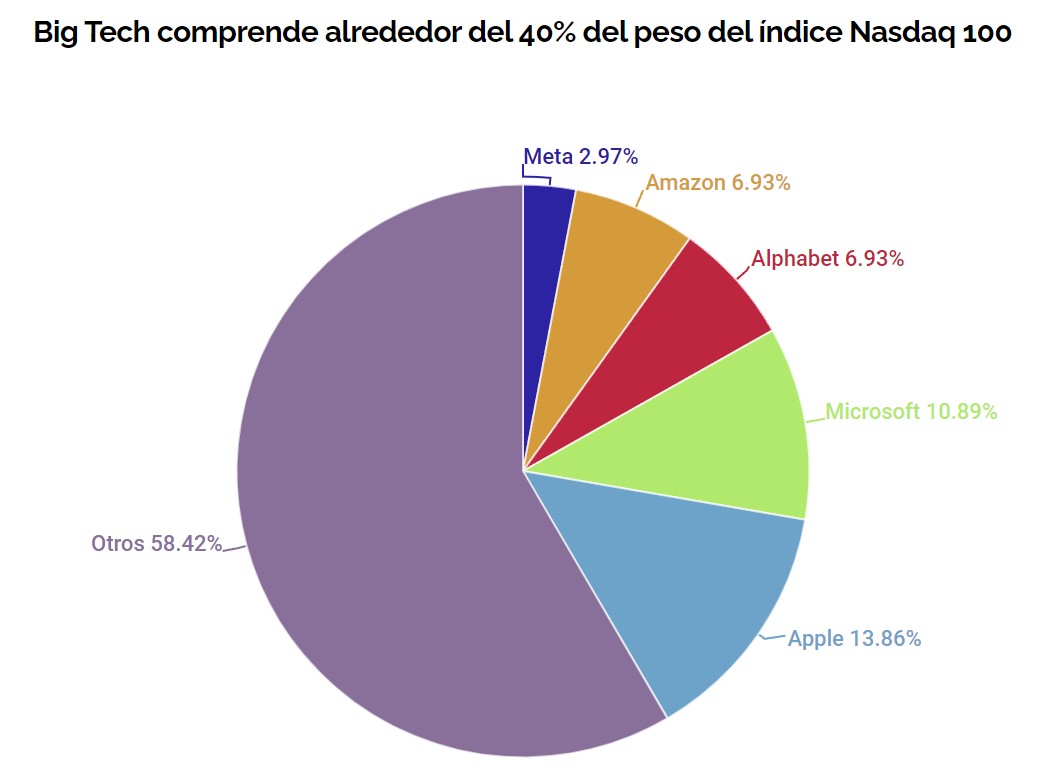

Amazon Inc., the titan of shopper merchandise and subscription retailing, which additionally makes and sells digital gadgets, has a market capitalization of $1215.58B. It expects to report the outcomes of the third fiscal quarter of 2022 ending in September on October 27 after the market shut. Amazon represents roughly 6.93% of the US100.

Amazon ranks second within the rating of the predominant cloud utility suppliers and with the best model worth in 2022 in accordance with its revenues worldwide with extra than $18,000 million and $350,273 million respectively, in accordance with Statista.

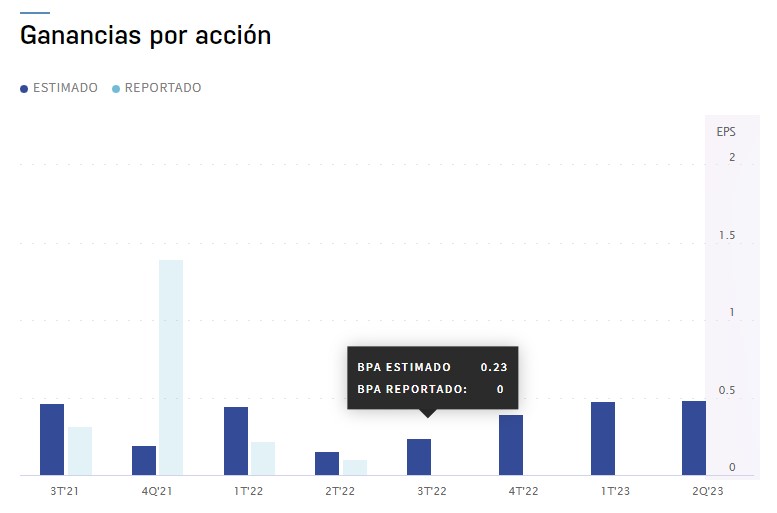

Zacks positions AMAZON Rank #4 (Promote) within the Prime 19% place (#49/252) of the Web and commerce business. For this report, an EPS of $0.24 is anticipated (though for Nasdaq it’s $0.23) with a -27.66% ESP, which might be a progress of -22.58% y/y in comparison with the identical quarter final 12 months. A revenue of $128.05B is anticipated, which might be a year-over-year progress of 15.56% in comparison with $110.81B final 12 months. The corporate has a P/E ratio of 666.59 and a PEG ratio of 29.57.

The estimate has had 1 upward revision and 0 downward revisions within the final 60 days. The corporate has exceeded expectations 7 instances within the final 10 stories, though the final two have been destructive.

Final quarter the corporate posted EPS of $0.10 and earnings of $121.23B.

Favorable Elements

The Amazon Internet Companies (AWS) cloudregistered a revenue improve of greater than 31% within the second quarter and is anticipated to proceed due to the expansion of the phase that carries a rise of 35% in what goes of the 12 months. AWS generalized the provision of its providers AWS Cloud WAN and AWS IoT FleetWise the place the latter helps to gather and switch knowledge from thousands and thousands of automobiles to the cloud in actual time with monetization. It additionally made obtainable three serverless analytics choices for Amazon EMR, Amazon MSK, and Amazon Redshift. These actions are anticipated to be favorable for the rise in clients and revenues this quarter.

The progress in promoting revenues which have grow to be a progress catalyst for the corporate, giving an 18% progress in gross sales within the final quarter, is anticipated to stay a optimistic issue with progress of 24%.

The Prime Day that passed off earlier this quarter on July 12 and 13 can be anticipated to be a key driver of earnings, giving a rise of 8.1% for its on-line commerce and 17% for income from providers for outdoor distributors. As well as, the event and strengthening in its grocery service and grocery retailing due to the growth of its Amazon Recent shops in the US have additionally supplied a very good tailwind.

The expansion and growth of Amazon in nations resembling India, Australia, the UK and Canada is anticipated to strengthen its place within the world market.

Its streaming providers like Amazon Prime Video and Amazon Music have seen robust momentum in latest quarters due to the growth in its content material portfolio, probably growing Prime subscribers and including to the record of favorable earnings elements as it’s anticipating a 13% improve, in accordance with Wall Road.

The expansion and growth of Amazon sensible gadgets with the introduction of the brand new technology of Echo gadgets (Echo Dot and Dot Children, Echo Auto and Echo Studio), Hearth TV Dice and the brand new Alexa Voice Distant Professional together with the expansion and introduction of the brand new Kindle tablets (Kindle, Kindle Children and Kindle Scribe) coupled with the growth of its Blink and Blink Mini Pan tilt sensible safety cameras (a few of these gadgets already bought out) additionally favor the corporate.

Gross sales of providers which are higher-margin and recurring have outpaced product gross sales for the primary time this 12 months. This implies elevated profitability and money move for the corporate and its shareholders.

Damaging Elements

The robust inflation that the world is experiencing has been the principle burden for the corporate, because it struggles with excessive transportation prices because of the improve in gas and power costs.

This coupled with interruptions within the provide chain (a mishap that Amazon is attempting to resolve with Amazon Warehousing & Distribution which permits sellers to resolve issues associated to it) and a potential continuation of the slowdown of 4% y/y within the final quarter in on-line procuring, which is Amazon’s predominant enterprise, will have an effect on the outcomes.

Technical Evaluation – Amazon D1 – $120.44

The Amazon worth fell to a low of 101.39 after its inventory break up in June. Following this, the value gave an upward impulse till leaving highs at 146.53. After failing to take care of the psychological degree of 140.00, the value fashioned a bearish channel that gave a reduction to the Fibo 88.6% at 106.54 (lows at 105.30), and with these final 2 lows they fashioned a bullish divergence on the RSI.

Presently the value has recovered the 110.00 degree and is above the 20-day SMA testing the psychological degree of 120.00 together with the bearish course of the channel on the time of this writing awaiting the outcomes.

Ought to the positive aspects show optimistic we might see a bullish push to drive the value in direction of the August highs within the 140.00-146.53 space. In any other case, and if the result’s worse than anticipated, the value might fall once more to the June lows at 101.39 and even to the psychological degree of 100.00 that we’ve not seen since October 2009.

Click on right here to entry our Financial Calendar

Aldo Zapien

Market Analyst – Academic Workplace – Mexico

Disclaimer: This materials is supplied as a normal advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.