Hey Chartwatchers! Have you ever ever thought of how dividends could impression the worth of your dividend-paying shares or funds?

Dividends are just like the cherry on the cake. They provide you a bit extra cash for investing in an organization. Not all shares pay dividends, however for those who do, there are some things it’s best to know.

Until you depend on these dividends in your on a regular basis bills and have opted to obtain the dividends as money funds, your dividends most certainly mechanically get reinvested. Which means extra shares for you, which is nice, however you might not be conscious of how a lot these dividends impression the worth of your funding.

Typically, when a dividend is paid out, the inventory worth falls by that dividend quantity. As a result of the inventory worth is adjusted downward, you might not discover the worth change while you take a look at a chart of the inventory.

Discover the Dividend Instruments in StockCharts

Once you pull up a chart, it is in all probability been adjusted for dividends. However possibly you are curious to search out out if the dividends you obtain are well worth the funding. Or maybe you are considering of promoting a dividend-paying inventory and need to decide if the dividends you obtain make the inventory price holding onto for a bit longer. Perhaps you simply need to know the way a lot the dividends you obtain assist your funding. It is kind of like how a lot better a cake tastes with the cherry on high.

To assist make these selections, think about evaluating an adjusted chart with an unadjusted one.

How To View an Unadjusted Chart

That is fairly easy. All you need to do is add an underscore earlier than the image and hit “enter”. This can carry up an unadjusted chart. Keep in mind, it is adjusted just for dividends; not inventory splits. An unadjusted chart by itself could not reveal a lot, however, while you examine it towards an adjusted chart, you may see how dividends impression worth (see chart 1).

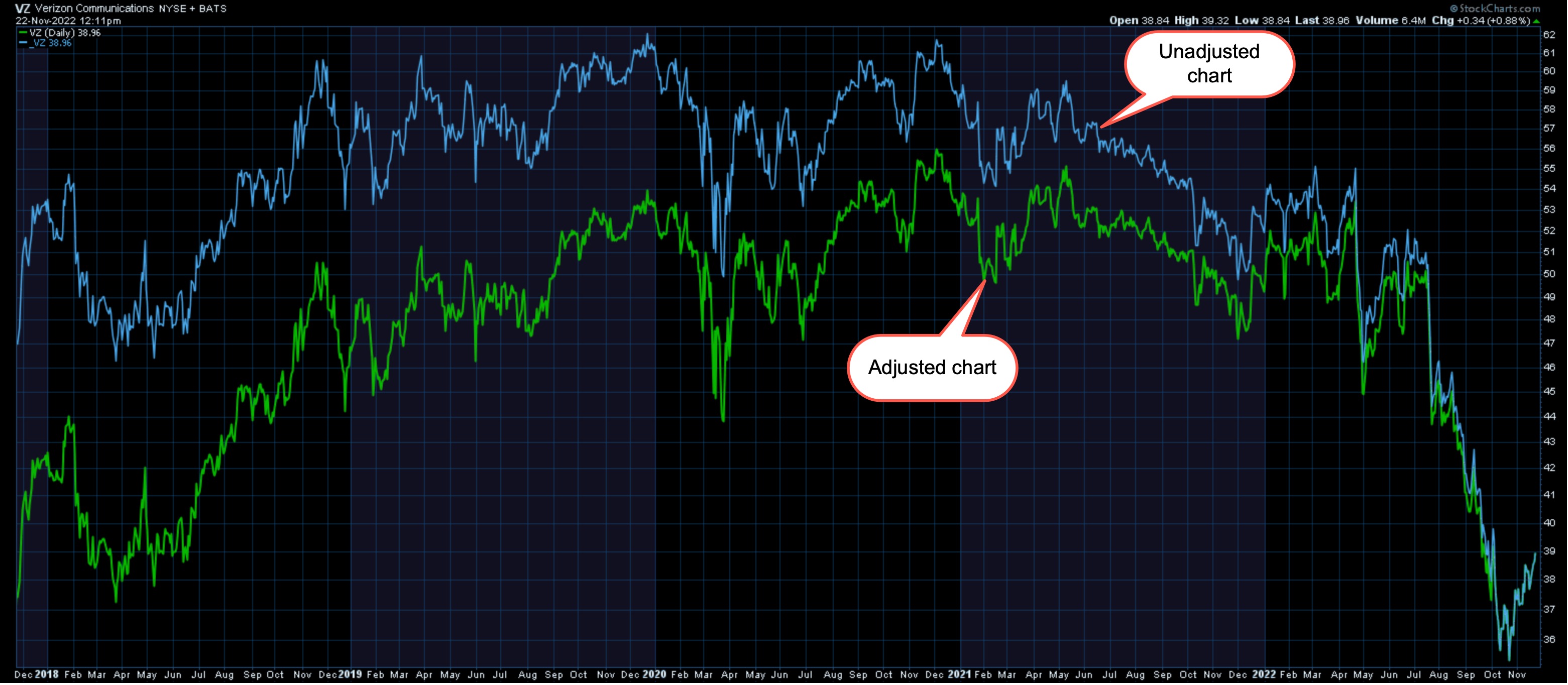

CHART 1: ADJUSTED VS. UNADJUSTED. One is just not essentially higher than the opposite, however evaluating the 2 offers you an concept of how dividends impression the worth of the inventory. Chart supply: SharpCharts from StockCharts.com

CHART 1: ADJUSTED VS. UNADJUSTED. One is just not essentially higher than the opposite, however evaluating the 2 offers you an concept of how dividends impression the worth of the inventory. Chart supply: SharpCharts from StockCharts.com

Chart 1 compares an adjusted and unadjusted chart of Verizon Communications (VZ). Here is how one can carry up the chart.

- Enter VZ within the image field and from Chart Attributes, choose Sort. This chart makes use of a Strong Line sort, which appears to be like at pure worth motion. In the event you choose to view the chart when it comes to % efficiency, choose Efficiency from the dropdown menu.

- Choose Worth (similar scale) from the Overlays and, within the Parameter field, enter _VZ. Click on on Replace and you may see the adjusted and unadjusted charts overlaid. This lets you examine the 2. Be sure you select to show the charts in numerous colours so you may simply see the distinction between the 2.

- Return a couple of years to see the impression of dividends. The chart on this instance goes again 5 years.

The unadjusted chart (blue line), for essentially the most half, is at the next worth, which is predicted. In the newest quarter, the 2 strains are extremely correlated, in all probability as a result of the dividend hasn’t been paid out but.

Evaluating worth motion or worth efficiency of adjusted and unadjusted charts is just one piece of the puzzle. It is also useful to know when corporations pay out dividends and the way a lot they pay out.

3 Extra Dividend Instruments in SharpCharts

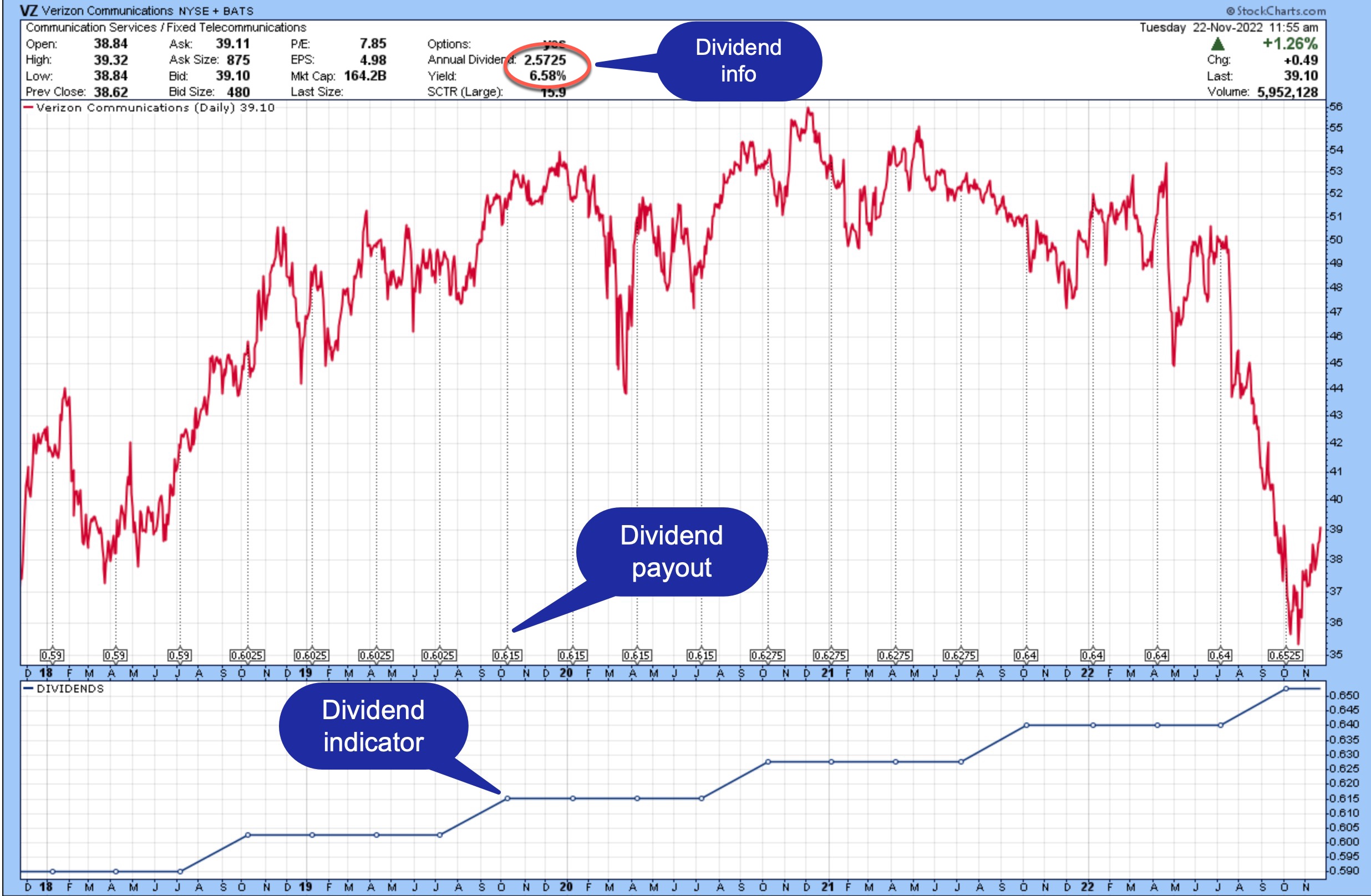

There are another instruments you may use to sharpen your dividend data. For instance, utilizing the identical chart of VZ, take away all indicators and overlays (see chart 2).

CHART 2: FULL QUOTE, EVENTS, AND DIVIDEND INDICATOR. These further instruments can present additional perception into any dividend-paying shares or funds. Chart supply: SharpCharts from StockCharts.com.

CHART 2: FULL QUOTE, EVENTS, AND DIVIDEND INDICATOR. These further instruments can present additional perception into any dividend-paying shares or funds. Chart supply: SharpCharts from StockCharts.com.

- Test the Full Quote field below Chart Attributes. This brings up the complete quote space throughout the highest of the chart. If the inventory pays a dividend, you may see the annual dividend and the dividend yield displayed. Word that these are 12-month trailing values.

- Within the Overlays part, choose Occasions from the dropdown menu and click on on Replace. Alongside the time axis, you may see the dividend payout quantities.

- Within the Indicators part, choose Dividends. The dividend indicator plots dividend values over time. You possibly can place the indicator both above or under the worth chart. This lets you line up the dividend payout and the indicator, so you may see if dividends grew and by how a lot.

You possibly can examine adjusted and unadjusted dividend charts in StockChartsACP as effectively. Make sure to watch the StockCharts in Focus video under to discover extra dividend instruments.

How To Use Dividend Data

Just like the way you construct bond ladders or CD ladders, you may ladder your dividends. By utilizing the dividend instruments mentioned on this article, you may see when the shares or funds you personal, or are contemplating investing in, pay dividends. Based mostly on the data you gathered, you may strategize investing in shares so that you obtain dividends regularly, comparable to each month or each two months. However since dividends aren’t assured they usually differ, so you may’t plan on receiving a specific amount.

If that train proves to be too time-consuming, you may think about mutual funds or exchange-traded funds. However keep in mind, dividends from funds can differ much more than with shares because the shopping for and promoting of shares in these funds are determined by the fund administration staff.

One other issue to remember is that dividends are taxable. So, when you obtain dividends, make sure you seek the advice of along with your tax advisor.

The Backside Line

Just like the cherry on the cake, dividends is usually a “good to have” profit, particularly when you’re a long-term investor. In the event you choose to reinvest them, you may personal extra shares, which in flip may doubtlessly assist enhance your total returns. In the event you select to obtain a dividend test, it will possibly assist usher in further revenue. Both means, it helps to know the way a lot these dividends are going to be. That is the place adjusted-versus-unadjusted dividend charts will help. Add within the different dividend instruments, and you’re in a greater place to make funding selections on these dividend-paying shares or funds.

Discover the dividend instruments in StockCharts

Jayanthi Gopalakrishnan

Director, Web site Content material

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

Blissful charting!

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Earlier than that, she was Managing Editor of Shares & Commodities journal .

Study Extra