I have been watching essential areas like semiconductors ($DJUSSC), software program ($DJUSSW), and web ($DJUSNS) underperform vs. the S&P 500 all through 2022. However the excellent news is that, since June, cash rotating out of the three aforementioned aggressive sectors is discovering a house in different trade teams. That is permitting the S&P 500 to stay afloat and considerably outperform the extra aggressive and growth-oriented NASDAQ 100. Three trade teams, in notably, are benefiting mightily from this rotation. In no specific order, right here they’re:

Aerospace

I do not know when you’ve been watching Boeing Co. (BA), however after a really troublesome interval from April by way of June, BA has soared greater than 50%, lifting aerospace shares ($DJUSAS) a lot increased within the course of. Take a look at this chart:

That DJUSAS relative breakout within the final two months corresponds inversely to the weak spot that we have seen in leaders like Apple, Inc. (AAPL), Tesla, Inc. (TSLA), and Alphabet, Inc. (GOOGL). When you’re questioning why the S&P 500 nonetheless stays properly above its lows from June and October, properly the above chart is one cause why. Cash is not leaving equities. It is rotating and conserving the hopes of a shorter-term cyclical bear market intact.

Business Automobiles & Vans

Business automobiles & vans ($DJUSHR) is one other trade inside the industrials sector (XLI) that’s flying excessive – a lot in order that it is not too long ago set an all-time excessive. Yep, that is proper. All-time excessive!

You may see the clear breakouts by way of each absolute and relative costs. At present, RSI is down at 53, so the DJUSHR is nowhere close to overbought and really probably has additional to run.

Medical Tools

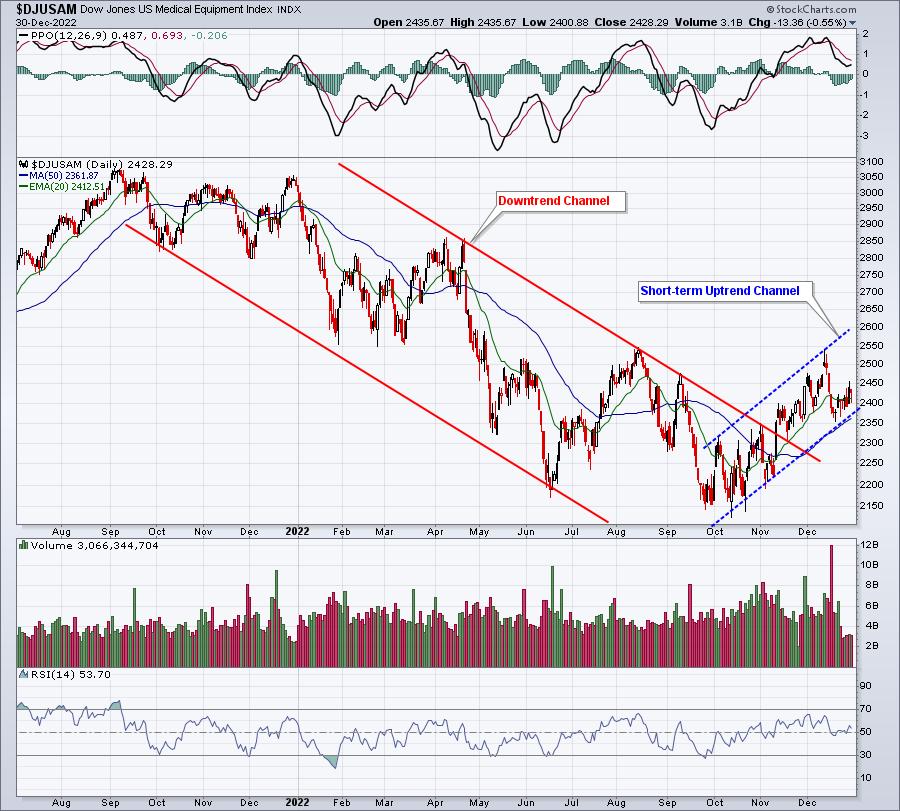

A variety of different industries, notably these in financials, industrials, and power, have been outperforming the medical gear group ($DJUSAM) over the lengthy haul, however I do not know if any are seeing the surge in bullish momentum that the DJUSAM is. The primary chart beneath is absolutely the value chart, exhibiting that the 2022 downtrend has now been damaged:

As a result of this uptrend is just not almost as established as the opposite two I confirmed above, it most likely is sensible to maintain a detailed eye on the rising 50-day SMA and the short-term up channel. If each are misplaced, then it will be essential to re-evaluate the group.

Subsequent is the relative value chart, exhibiting that the relative PPO has sailed by way of centerline resistance and continues to realize steam:

That is simply the tip of the iceberg by way of sector and trade rotation. It is extraordinarily vital to maintain observe of teams which are in favor, particularly when you prefer to commerce within the near-term. A number of people are penning this market off and anticipating large declines in 2023. I am not so certain and I might be dissecting various market indicators subsequent Saturday at our fourth annual Market Imaginative and prescient occasion. This might be a FREE digital occasion and also you’re invited. Seats might be restricted, nevertheless, so be sure to register NOW!

For extra info on MarketVision 2023 and to avoid wasting your seat, CLICK HERE. David Keller, Julius de Kempenaer, and Grayson Roze – all from StockCharts.com – might be becoming a member of me to ship well timed info as we sit up for a model new 12 months. I hope you be a part of us! And naturally…..

Blissful New Yr and completely happy buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person traders. Tom writes a complete Each day Market Report (DMR), offering steerage to EB.com members day by day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as properly, mixing a singular talent set to strategy the U.S. inventory market.