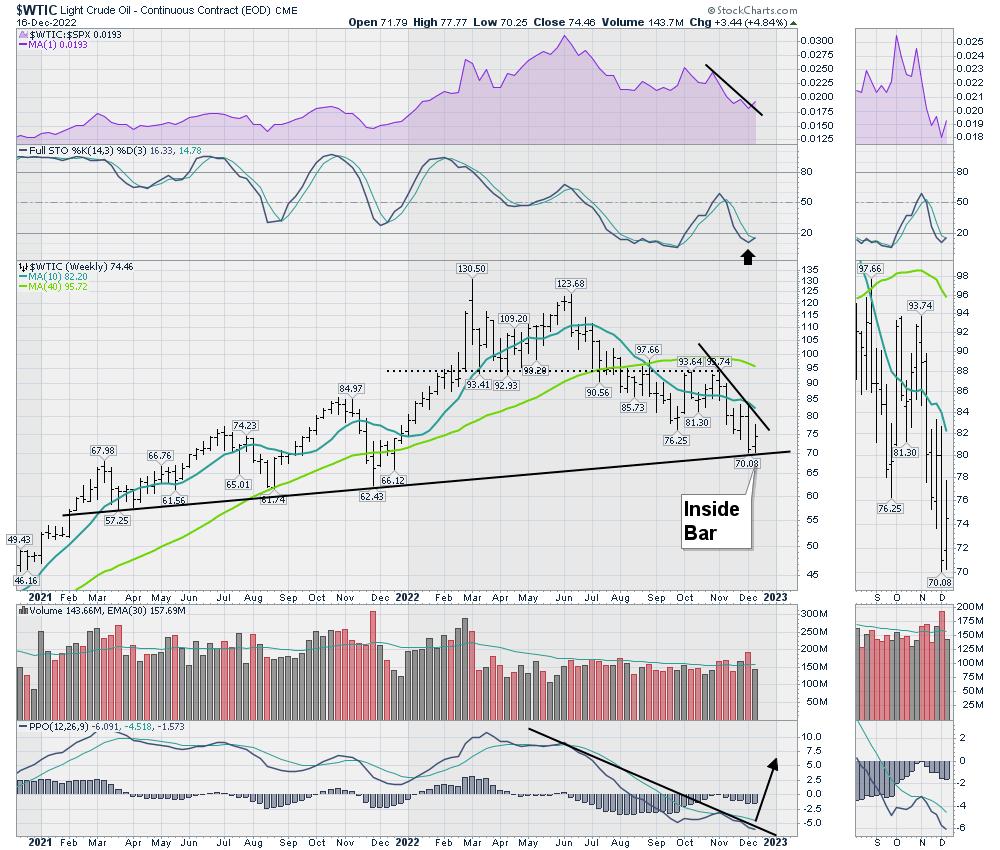

The oil sector has pulled again roughly 20% during the last 4 weeks. It has been an aggressive transfer down, and I used to be to listen to that Mark Fisher thinks the underside is in for oil. MBF buying and selling is an enormous deal. He is an excellent man, so I positively wish to test my work.

After I see the crude oil chart, it’s on what, for me, is a promote sign. However the worth motion this week was fairly sturdy in comparison with the remainder of the market. The relative energy downtrend in purple did attempt to tick up this week. The Full Sto is popping up onto a purchase sign.

Value is making an inside bar, which I like to think about as indecision. If we are able to begin to make larger highs right here, that may be a textbook bounce off the uptrend. The PPO is at probably the most fascinating factors the place I like to purchase. When it breaks above this lengthy 6-month PPO downtrend, I might slightly be lengthy.

$CRB

After I take a look at the $CRB chart, it’s damaged. But when it was to reverse larger right here, it might be a false break down. When a breakdown reverses, that could be very bullish.

I like to purchase commodities close to the lows. If these charts can enhance, that may be bullish. The inventory market final yr dropped via the primary quarter, however the oil markets stored rallying. The true query is, if that very same market motion is to be endured, whether or not oil can rally within the face of the gradual economic system.

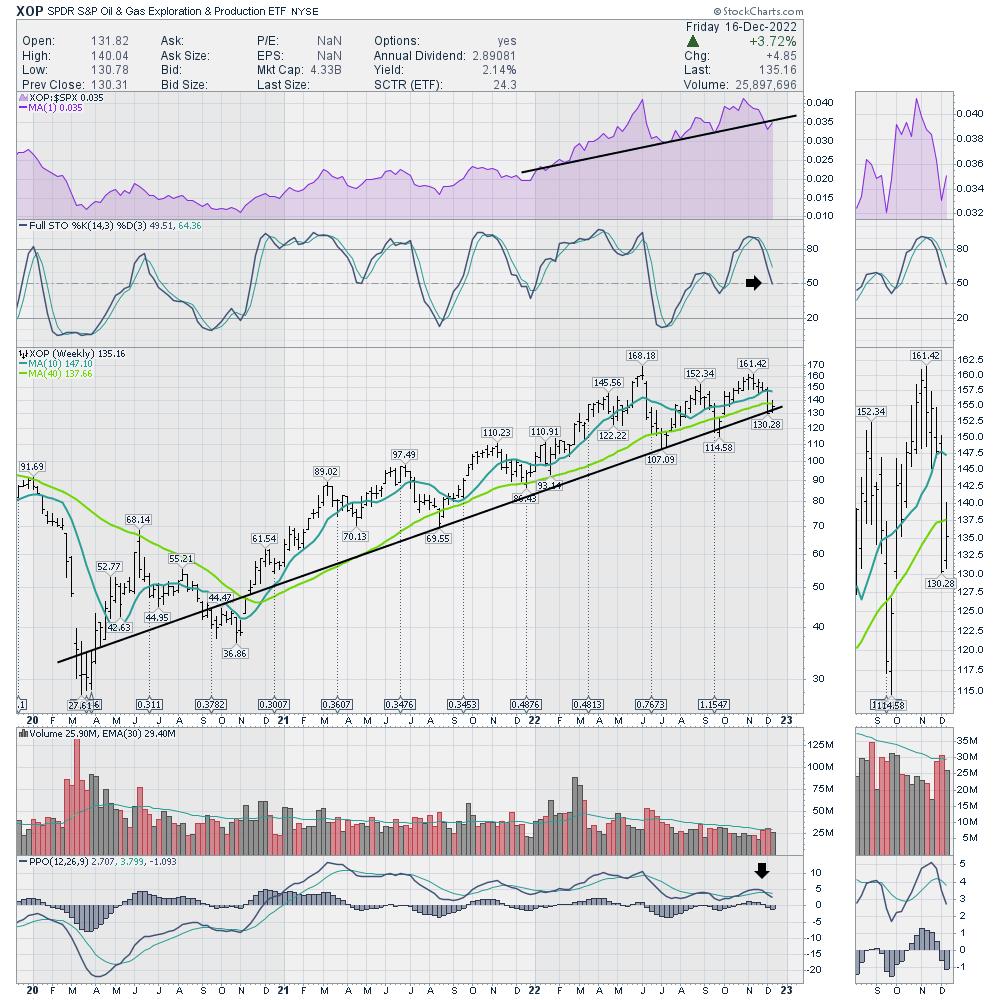

XOP

The Oil Exploration and Manufacturing ETF is hanging on the development line. Proper now, all the things on the chart is pointed down. The quick transfer from $160 to $130 may very well be a traditional pullback in an uptrend, however, if the value doesn’t maintain this development, it could possibly transfer down extraordinarily quick. Final December, the symptoms had been in an identical place, they usually all began to show up from there on a pleasant rally.

With the general inventory market failing, it truly is a troublesome name. However, for buyers that like to purchase on the development line with an in depth cease, this appears like a pleasant location. I believe the shut cease is vital. If this chart continued to make decrease lows, I might not be taking a look at it. It’s the indecision on the development line that means this is likely to be prepared to show larger.

Greg Schnell, CMT, is a Senior Technical Analyst at StockCharts.com specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Primarily based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an lively member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).