Immediately we noticed a big decline in mega cap names Microsoft (MSFT) and Alphabet (GOOGL) after each corporations reported earnings and gross sales that have been nicely beneath estimates. Citing a powerful greenback and excessive inflation amongst different components, each corporations warned of slower development going ahead amid a troublesome atmosphere.

Including to the woes amongst Giant Cap tech, Meta Platforms (META) got here in with earnings and gross sales beneath estimates after the market’s shut at the moment, and the inventory is getting clobbered after hours.

Giant Cap Know-how shares have led the final a number of bull market cycles and a lack of this management could also be tough to beat.

That stated, there are vivid spots rising inside the markets this week. I exploit a service that breaks the market down into 197 Business Teams and of these, 85% outperformed the markets at the moment.

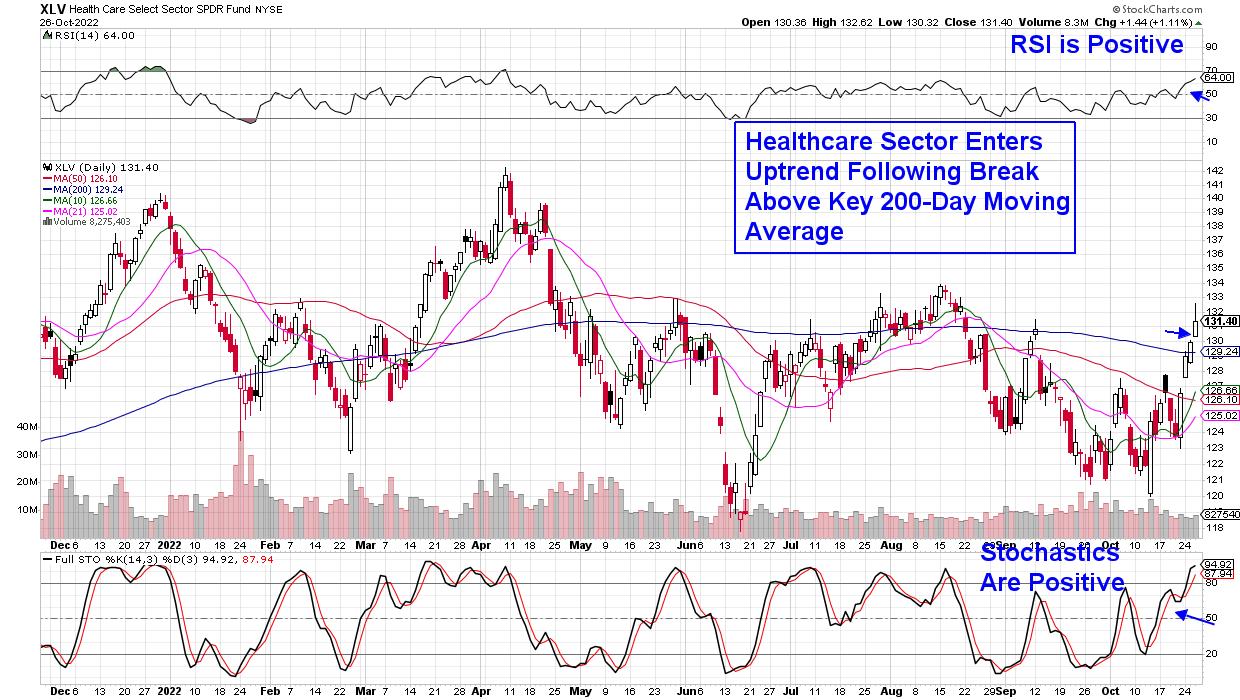

Among the many outperformers have been Vitality, Healthcare and choose areas of Retail to call just a few, and the positive factors have been pushed by earnings that have been above estimates. As well as, Actual Property and Utility shares are coming again to life as nicely, with positive factors which can be setting them as much as reverse their downtrends.

DAILY CHART OF HEALTH CARE SECTOR (XLV)

The positive factors in these non-Tech areas are serving to to strengthen breadth within the markets, with the % of shares above their 50-day shifting averages steadily rising. Whereas that is excellent news, it is necessary to notice that the rally stage that started within the markets final Friday is a part of a bear market. In different phrases, now we have not seen the traits essential to name a market backside.

I define these wanted traits recurrently in my twice weekly MEM Edge Report, and a slowdown of inflation is amongst them. With that, I am collaborating on this rally with choose Vitality and Retail shares which can be outperforming nevertheless, it is with warning. If you would like entry to this choose Record of purchase concepts, use the hyperlink beneath. You may even be alerted to new names as they’re added in addition to being supplied with exit methods.

I’ve actively suggested skilled cash managers by means of a number of bear markets and with the present difficult interval, I hope you will make the most of my particular trial supply beneath.

Warmly,

Mary Ellen McGonagle, MEM Funding Analysis

Mary Ellen McGonagle is an expert investing guide and the president of MEM Funding Analysis. After eight years of engaged on Wall Avenue, Ms. McGonagle left to turn into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with huge names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Study Extra