Wish to uncover a inventory choosing technique that topped the S&P 500 (SPY) by a large margin in 2022? Then learn on to understand this revolutionary that ought to profit you enormously in 2023 and past. Learn on for the total story beneath.

shutterstock.com – StockNews

The bear market of 2022 was a severe wakeup name for traders.

The tough actuality is that lots of the strategies that appeared to work so effectively in earlier years…have been a downright loss of life sentence because the bear market got here out of hibernation.

Initially was the concept of shopping for “in vogue” development shares like Roku and Tesla no matter nose-bleed valuations. That get together got here to a really ugly finish this previous 12 months.

So, if these issues don’t work…then what does?

That would be the focus of this commentary the place I focus on a 3 step evolution in find out how to choose shares that has led many on a path to superior efficiency. Hopefully it illumines a technique that improves your odds of funding success within the new 12 months.

Inventory Choosing Methodology 1.0

As a way to let you know the answer, I first must level out the issue. And that’s the flawed means that the majority of us analysis shares. For that objective, I gives you a top level view on how the typical individual handles this important job…then I’ll level out a greater path.

Let’s say you learn an article the place some skilled is touting 3 shares they assume are terrific. From there we are going to possible surf your favourite funding web sites for added info which is a few mixture of the next:

- What does the corporate do? (Trade/Sector)

- Evaluate current value motion

- Discover a number of key metrics on development, worth or firm financials

- Learn extra articles that inform us a bit extra of the expansion story for the corporate that provides us assured it’s a gorgeous funding going ahead.

So what’s the issue with this strategy?

First, it’s fairly time consuming as you understand this guide technique will probably be utilized to each inventory underneath assessment.

Second, and most significantly, you might be actually not protecting that a lot floor. That means there are actually hundreds of knowledge factors that you possibly can examine for each inventory to understand how wholesome they’re…and the way they stack as much as the competitors.

But if we’re being sincere, this antiquated technique solely results in a assessment of 5-10 points of an organization earlier than we determine to position a commerce. It’s merely not a whole sufficient assessment to place the percentages in your favor which results in…

Inventory Choosing Methodology 2.0

The answer is to automate this strategy. Like utilizing pc fashions to scan extra elements of those firms in milliseconds. That is why so many traders have turned to quantitative rankings as a method to seek out the perfect shares.

In that realm our proprietary POWR Scores mannequin helps hundreds of traders do precisely that. To scan every inventory based mostly upon 118 various factors in a spread of areas from development to worth to sentiment to momentum to stability and basic energy (high quality).

Why these 118 elements?

As a result of the Information Scientist who created the POWR Scores proved that every of those particular person 118 elements results in shares extra more likely to outperform the market. So what we’re saying this mannequin provides you 118 benefits to seek out shares that ought to rise above the pack.

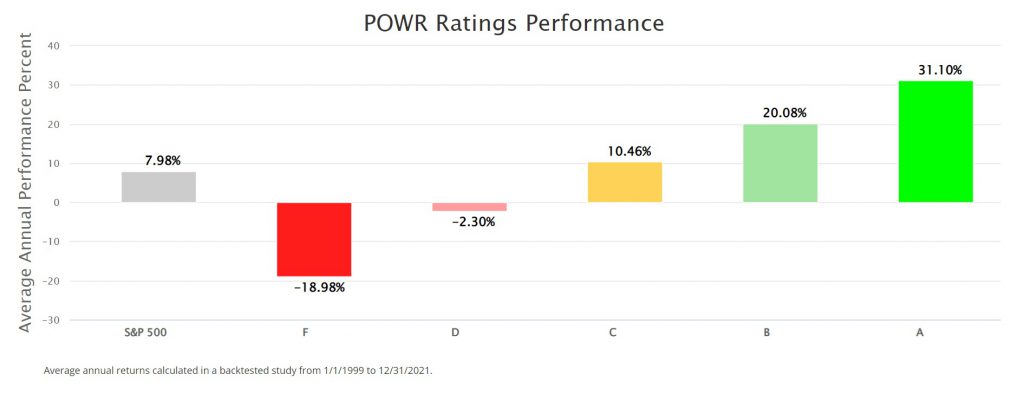

The proof of that assertion is clearly verified within the following efficiency chart the place our prime rated shares have outpaced the general market by a large margin:

Sure, I may finish the article right here. As a result of utilizing our POWR Scores will fulfill the promise of this text…that will help you discover shares to outperform within the 12 months forward.

Nonetheless, there’s nonetheless one obtrusive downside left to unravel. That’s as a result of utilizing the above technique will nonetheless go away you with about 1,300 Purchase rated shares to assessment. Simply too many for the typical individual to type in affordable timeframe. That’s the reason we created…

Inventory Choosing Methodology 3.0

I noticed because the CEO of StockNews.com that we wanted to go additional for shoppers. To breakdown these 1,300 shares right into a extra digestible type so traders can extra simply take pleasure in outperformance.

This got here collectively in creating an array of market beating newsletters that harness the POWR Scores for the principle types of inventory investing. See the listing of newsletters beneath and the present # of picks in every service to understand what I imply:

| E-newsletter |

# of Picks within the Portfolio |

| POWR Shares Underneath $10 |

8 |

| POWR Choices |

6 |

| POWR Development |

8 |

| Reitmeister Whole Return |

9 |

| POWR Worth |

6 |

| POWR Breakouts |

8 |

Every publication portfolio has a really manageable # of picks. And we’re simply speaking about 45 trades in complete.

Plus 3 extra trades are on the best way for Tuesday morning to kickstart the brand new 12 months.

All computed as winners by our confirmed quant mannequin.

All hand-picked by our Editors to be the perfect of the perfect.

Right here is 1 Extra Innovation

Traditionally we had prospects take 30 day trials to every publication individually as a result of that’s the usual trade observe.

However what if you’re curious in seeing all of the providers to understand that are the perfect ones for you sooner or later?

And that’s the reason we created POWR Platinum. It is a bundle that provides you entry to all of our energetic buying and selling newsletters at one time.

Not simply the 6 newsletters and their 45 trades famous above. POWR Platinum additionally contains 2 different well-liked providers:

- POWR Tendencies– In depth commentaries and prime picks from probably the most thrilling development tendencies from EV to House Exploration to Web of Issues to Genomics and extra.

- POWR Scores Premium – As an additional bonus you additionally get a subscription to this service giving full entry to our coveted POWR Scores for over 5,300 shares and a couple of,000 ETFs. That is the proper complement to the energetic buying and selling newsletters making POWR Platinum a whole funding useful resource.

There actually is one thing right here for each model of investor. Whether or not you need development, worth, technical evaluation, market timing and extra.

$1 for a 30 Day Trial of POWR Platinum

Sure, solely $1 for a 30 day trial to all our market beating providers. And whereas it’s not going to be $1 endlessly, you’ll be amazed by the low-cost choices after the trial concludes.

I really imagine POWR Platinum with all its market beating providers in complete is the last word investor toolkit and an actual recreation changer for particular person traders.

In truth, I imagine so strongly that POWR Platinum has the flexibility to considerably impression your investing outcomes, and enable you outperform the market the remainder of the 12 months, that I wish to take away all attainable boundaries so you possibly can expertise it first hand and risk-free.

When you selected to proceed after the 30 day trial (and we expect you’ll), I’m providing a 100% money-back assure after the trial converts to a paid subscription.

Put one other means, if 30 days doesn’t really feel like lengthy sufficient to decide on whether or not POWR Platinum is the perfect worth funding useful resource on the market, then take as much as 90 days longer to determine, at no-risk to you.

I feel the selection is obvious.

Get began together with your trial at this time and begin beating the market within the new 12 months!

Begin My No-Danger 30 Day Trial for Simply $1 >>

Wishing you a world of funding success!

Steve Reitmeister

…however everybody calls me Reity (pronounced “Righty”)

CEO, Inventory Information Community and Editor, Reitmeister Whole Return

SPY shares have been buying and selling at $380.35 per share on Friday morning, down $3.09 (-0.81%). Yr-to-date, SPY has declined -18.62%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is best recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish Beat the Market in 2023? appeared first on StockNews.com