Australian SaaS fintech Nine25 at present launches its world-first Wage Streaming and budgeting platform that permits customers to handle their payments utilizing their wage tracked in real-time.

Australia is experiencing a expertise disaster, with one unemployed employee for each obtainable place, Nine25 goals to assist remedy retention and attraction issues, providing employers a brand new technique to compete in a aggressive market with its distinctive answer, which solves the issue of economic stress for its workers in a very significant method, for the primary time.

In contrast to different ‘budgeting’ platforms who declare to funds by creating dashboards and reporting, Nine25 is a primary of its sort software-as-a-service platform that really budgets for its customers by actively allocating funds to their payments utilizing authorisation to stay employment and banking knowledge.

Nine25 permits its customers to handle their payments, spend, and develop their wealth on a fixed-price subscription mannequin, which is the primary of its sort in a market that’s grow to be accustomed to outdated income fashions like transactional charges, reimbursement charges and late funds.

What differentiates Nine25 from payday lending and high-interest fashions is that we’re a first-to-market SaaS mannequin. Nine25 has developed a subscription mannequin particularly to disrupt each different mannequin that exists available on the market at present. Customers are usually not charged curiosity or late charges and have predictable price entry to the platform which incorporates the real-time wage.

Aussie startup Nine25 is the primary fintech globally to unravel budgeting and wage administration in a single app and is the brainchild of entrepreneur Leigh Dunsford who co-founded accounting software program platform Waddle, a number one international lending enterprise SaaS platform that was acquired by Xero in 2020 for $80 million.

Identified for his capacity to efficiently disrupt conventional monetary industries, Dunsford is looking on Aussies to interrupt up with their banking and budgeting apps, leaving unhealthy habits behind and needs to create a technology of financially impartial prospects. Dunsford believes that monetary independence is about being in charge of your bills and investments and step one in direction of monetary independence is controlling your wage and having it give you the results you want, one thing he feels isn’t being accomplished, until now.

Nine25 is fixing a real consumer downside that nobody else has managed to unravel, to handle and repay payments in actual time. Different apps and platforms have tried to create a digital model of the “envelope system”, creating totally different envelopes, accounts, buckets, jars for various payments. Nine25 is the primary and solely platform to make use of the know-how to allocate customers’ salaries in real-time making a model new product and answer.

“Each cash administration app out there proper now could be backward going through and unhelpful,” says Dunsford, “They give the impression of being again at your earlier spending habits and inform you the way you failed and missed your targets. Or they’ll repackage the identical outdated banking product, slap on a flowery identify, and discuss financial savings targets however the one factor they actually care about is getting you to deposit your wage with them relatively than the following financial institution,” he mentioned

“We’re not simply rewriting how Australia’s workforce receives and manages earned revenue; we’ve constructed a platform that permits a seamless real-time pay expertise,” says Dunsford. What Nine25 has accomplished is align a consumer’s payments and bills with their real-time earnings. “Wage Streaming™” is a primary of its sort know-how that integrates instantly with both your payroll system, or HR platform, or time and attendance system,” says Dunsford.

“Whether or not it’s the information from the tip of your shift, your supply price from the meals order you simply dropped off or your wage each hour, the cash you simply earned will Stream into your Nine25 App and be allotted in direction of your payments, financial savings and commitments in real-time,” says Dunsford.

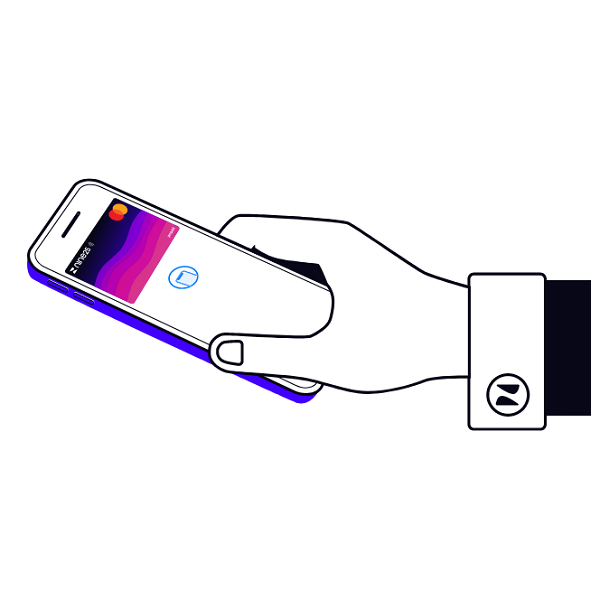

Nine25’s preliminary rollout will see the launch of its Wage Steaming service made obtainable to Australian prospects, and within the coming months will provide a first-of-its-kind Nine25 Card in partnership with Mastercard® that may allow prospects to spend cash they’ve earned instantly from their Nine25 Account in real-time.

“Think about you’re ready within the queue at a espresso store. You refresh the App, faucet the telephone and use the $3.50 that you simply simply earned to pay on your espresso. Otherwise you’re a supply driver that simply accomplished a supply. Your price simply streamed into your Account and you employ the funds to gas up your automobile” explains Dunsford, “no switch to financial institution, no checking your financial institution stability, no debit card. That is genuinely real-time wage streaming.” The enterprise has partnered with a Investing-as-a-Service platform to supply first to market invest-as-you-earn providers in 2023. “Folks discuss in regards to the worth of dollar-cost-averaging by investing often each month,” says Dunsford, “think about the compounding impact and wealth creation that comes from investing as you earn, on daily basis.”

Nine25 has no intention in getting an Authorised deposit-taking establishment (ADI) licence of its personal, as an alternative it’s underpinned by banking know-how, each consumer is issued a Nine25 Account that has its personal BSB, Account Quantity and PayID, that’s related on to their wage and Nine25 Account monitored by means of the app’s integrations.

“Nine25’s digital pockets and funds know-how is facilitated by Zai, a worldwide monetary know-how firm delivering embedded finance orchestration. Zai companions with Customary Chartered Financial institution primarily based in London, a number one worldwide financial institution that serves prospects in virtually 150 markets worldwide, using 85,000 folks.”

Nine25 integrates instantly into payroll techniques which is the one supply of fact for an individual’s employment standing and wage. By sending their wage to their Nine25 Account, their wage will get working from the minute it’s earned. Customers who subscribe and use the Nine25 App received’t be stung with massive curiosity charges or late funds like payday lending options or BNPL, as an alternative they’re charged a 0.33 cents a day price for utilizing the app, a plan to scale back the subscription nearer to nil because it continues to ship worth added merchandise is already underway.

Nine25’s streaming mannequin is powered by integrations which are constructed into numerous payroll techniques that enables Nine25 to confirm a consumer’s wage and revenue, then grant them entry to stream their wage as they earn it with a direct funds facility that helps customers handle their payments and funds in a single app.

Backed by Fairness Seed who invested $3.2 million in late 2021, Nine25 is pioneering wage and monetary independence and will probably be releasing over 50 integrations within the subsequent 3 months overlaying an estimated 80% of the payroll and gig economic system market. By means of these integrations and partnerships, Nine25 goals to make its Wage Streaming know-how obtainable to three million customers within the subsequent 6 months. As soon as these partnerships are stay, it can place Nine25 because the quickest rising Australian fintech with the biggest buyer acquisition development within the market.