FAN PRINCIPLE

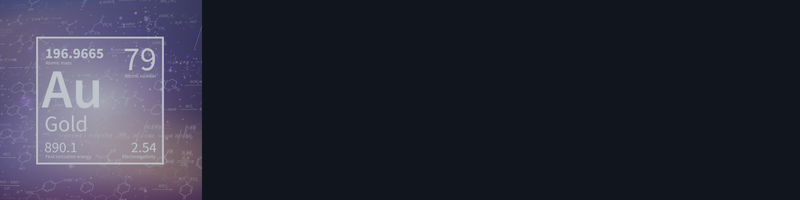

Right here we encounter one other fascinating technique of making use of the development line is the fan precept (see Fig. 4.11a-c). Generally costs fall barely after breaking an upward development line, and on the following rise they attain this outdated development line from beneath (now it turns into a resistance line). In Fig. 4. You’ll be able to clearly see how costs on the rise attain this line 1, however they by no means handle to beat it. Now we are able to draw the second development line (line 2 within the image), however additionally it is damaged. After an unsuccessful try of costs to beat it, a 3rd line (line 3) is drawn because it rises. A break of this third development line normally signifies that the development goes downward.

An instance of the fan precept. A breakout of the third development line is a sign of a development reversal. Be aware that development traces 1 and a couple of turn into resistance traces after breakouts.

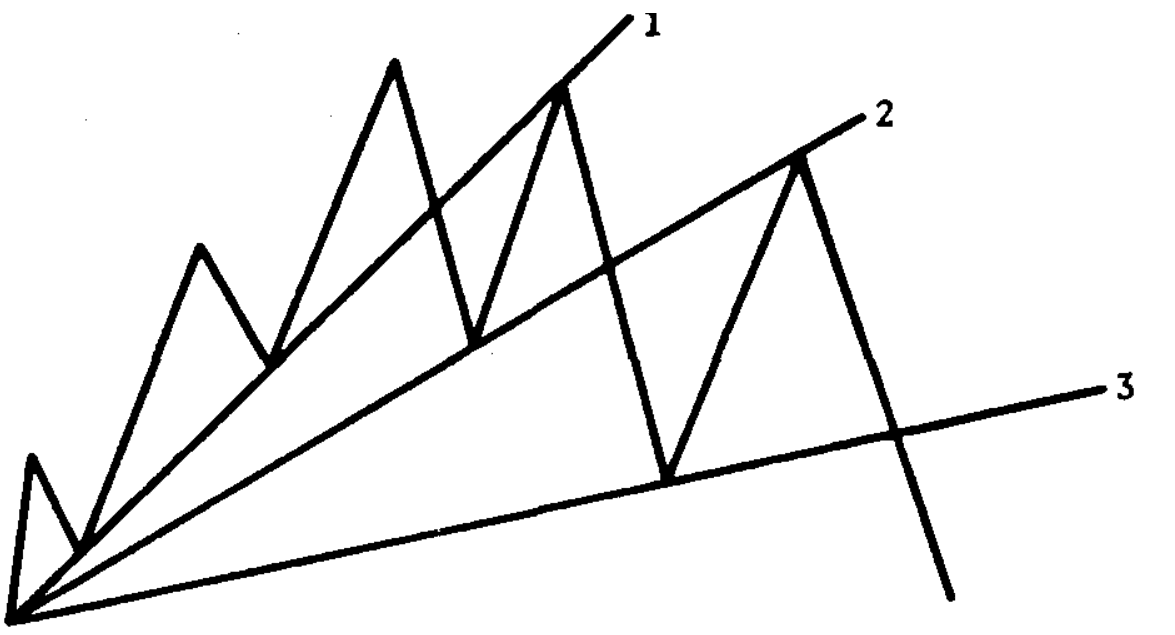

Fig. 4.116 The fan precept on the base of the market. A breakout of the third development line provides a sign that the development goes up. Be aware that development traces 1 and a couple of turn into help ranges after breakouts.

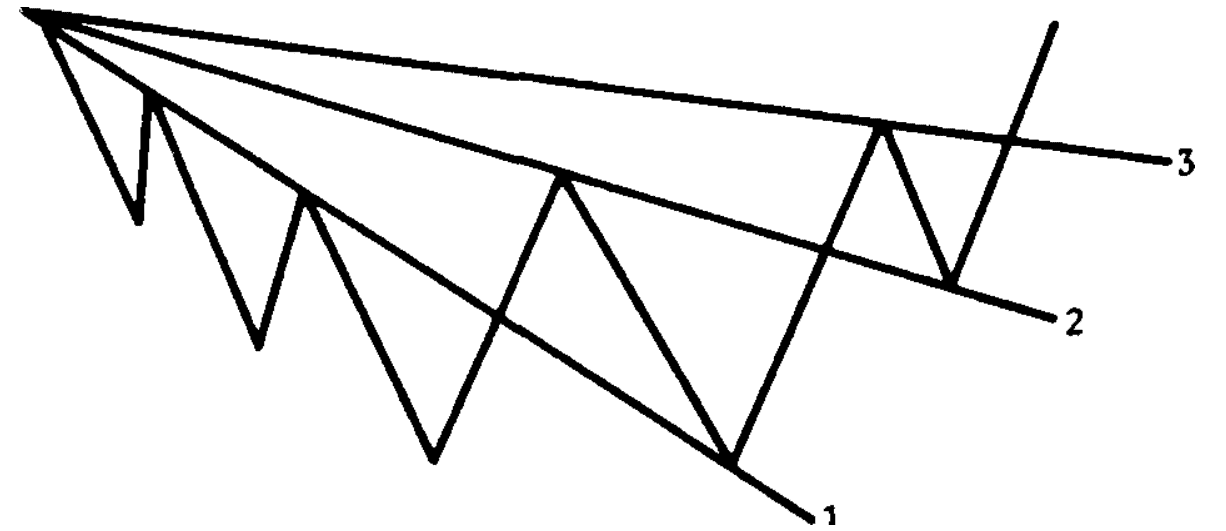

The fan precept is in motion. The intermediate drop in costs from the April peak varieties three consecutive fan traces. An upward breakout of line 3 is a sign of the resumption of the upward development. Discover how all three traces turned help traces after an upward breakout. It’s also fascinating how precisely the downtrend line from the November peak displays the bearish development. That is completely seen on the left half of the chart. The uptrend line, which originated on the base of the market in February-March, can also be a really correct reflection of the upward development.

In Determine 4.116, a break of the third downtrend line (line 3) alerts a renewed upward development. Discover in these examples that after a breakout, the help traces turn into resistance traces, and conversely, the resistance traces turn into help traces. The time period “fan precept” clearly comes from the truth that the development traces diverging at a better and better angle start to resemble an open fan. The primary factor on this precept is that the break of the third development line is a vital sign of the break within the development.

THE IMPORTANCE OF THE NUMBER 3

In case you begin wanting on the three traces we used within the fan precept, you’ll instantly discover a curious sample. The quantity “three” seems so usually in technical evaluation that it makes you marvel why. Choose for your self: the fan precept makes use of three development traces; in response to Dow and Elliott Wave Concept, the primary up development and the primary down development have three phases; there are three forms of “gaps” (this will likely be mentioned later), most of the most well-known break patterns, reminiscent of “head and shoulders” or “triple tops,” have three principal peaks; there are three forms of development (main, intermediate and minor), three development instructions (upward, downward and horizontal); among the many most well known development continuation patterns are three forms of triangles: symmetrical, ascending, and descending; and there are additionally three principal sources of data for the technical analyst: value, buying and selling quantity, and open curiosity. Regardless of the motive, the quantity “three,” as we are able to see, performs a really important function in any discipline of technical evaluation.

RELATIVE STEEPNESS OF THE TREND LINE

The relative steepness of the development line can also be essential. As a rule, crucial ascending development traces go at an angle of roughly 45°. Some technical analysts merely draw a line from a transparent peak or decline at a forty five° angle and use it as a principal development line. The road at an angle of 45° was one of many favourite strategies of W. D. Gann. Such a line is a mirrored image of a state of affairs wherein costs are rising or falling at such a charge that value and time are in good stability. (Gann made in depth use of assorted geometric angles and hooked up explicit significance to the 45° angle.