Expensive merchants, on this weblog I’ll attempt to clarify in easy language the idea and the entire level that I made in my advisor AU Gold.

What’s a cycle? A cycle is an interval of time for the whole passage of some periodic occasion.

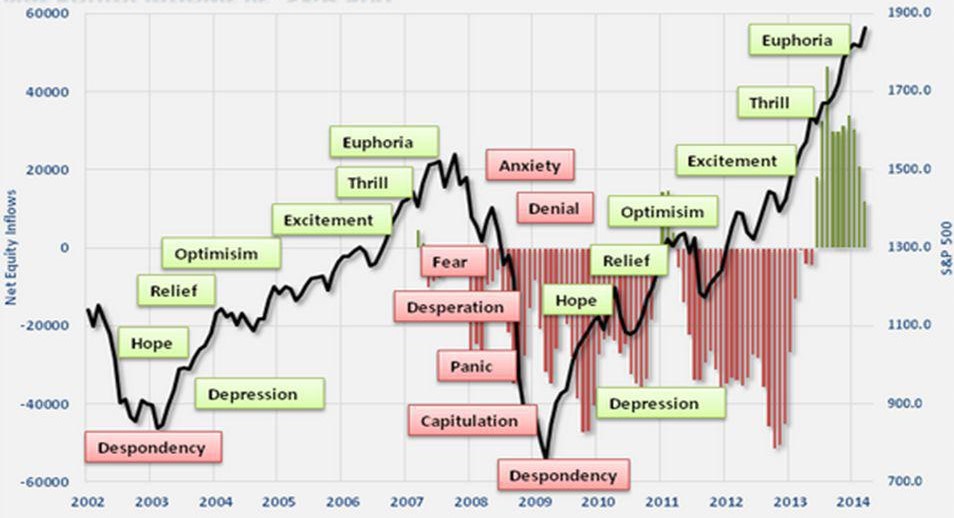

Cycles differ in length – that is their first attribute. Cycles may be very brief, measured in fractions of a second, and really lengthy, measured in…The only examples of cycles are a day, a calendar 12 months. Throughout every of those cycles, completely different periodic, repetitive occasions happen. For instance, inside a day, morning, afternoon, night and evening alternate. Over the course of the 12 months, spring replaces winter, then comes summer season, then comes fall, after which begins winter once more. Every interval of the 12 months has its personal peculiarities: it’s colder in winter and hotter in summer season. Due to this fact, the demand for ice cream is increased in summer season than in winter. The identical occurs in monetary markets: completely different monetary devices from 12 months to 12 months, from cycle to cycle (if we think about not solely the annual cycle as a particular case, however normally discuss cycles as such) have their seasonal intervals of development or decline, referred to as the energetic section of the cycle – that is the second attribute of cycles.

I want to elaborate on this level. Each cycle has an energetic section (or time frame) throughout which the market behaves just about the identical from cycle to cycle – predominantly rising or predominantly falling. And there’s an inactive (or passive) section of the cycle when the cycle “sleeps” and exerts minimal affect in the marketplace. Relying on a monetary instrument, it will likely be influenced by cycles of various power. The stronger is the cycle, the extra noticeably and for an extended time frame it is going to affect the quotes of a safety, i.e. the longer is its energetic section. There are cycles the energetic phases of which final a really very long time – a lot of the cycle. There are cycles with brief energetic phases.

As I discussed above, cycles both “fall asleep or “get up,” which is true not just for the energetic phases. When learning cycles in monetary markets, you encounter the phenomenon of an energetic and inactive cycle. What does it imply? An energetic or working cycle is a cycle that impacts the quotes on the present second in time. An energetic cycle can be energetic for a while – it may be very lengthy, or it could actually seem only a few occasions in a row after which “go to sleep”. After a while, the cycle could develop into energetic once more. Merely put, cycles that had an impression, for instance, 20-30 years in the past could not work right this moment, i.e. is not going to be energetic. And it is a query of easy methods to decide the present exercise of the cycle and the way lengthy it is going to have an effect on the quotes. Thus, when coping with cycles in monetary markets, we face irregular cycles. And that is their third attribute.

The power of the market to recollect previous cycles, i.e. to recollect its response to them previously, is known as market reminiscence. And it isn’t a relentless worth. It modifications from market to market, from instrument to instrument. And that is one other problem within the research of cycles in monetary markets.

By correctly understanding cycles and easy methods to work with them along with wave evaluation and Fibonacci ranges, you possibly can obtain nice leads to the long term.

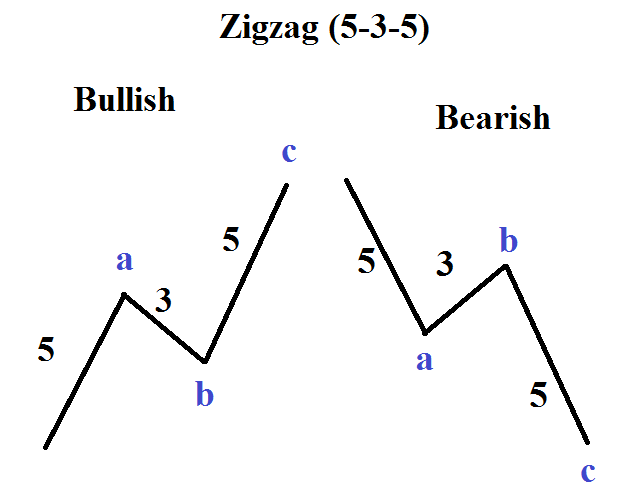

Buying and selling technique: “Elliott Waves”.

Wave evaluation is principally utilized by skilled merchants in buying and selling. Newbies desire a neater technique, and this is why. Fairly easy and easy wave evaluation, in observe seems to be very tough to use, as a result of it’s fairly tough to discern on an actual chart, in actual time, at what stage of the cycle the market is in. Be taught to commerce by this technique is worthy solely in case you are severe about buying and selling in the marketplace. Simply from myself I need to observe that commerce on the naked wave evaluation shouldn’t be value it, it’s best to mix this technique with some indicators. For instance: MACD. For my part, an excellent synergistic impact may be felt from the mixture of wave evaluation with the Fibonacci grid and extension

I’ve carried out all of those Commerce Parameters within the AU Gold Knowledgeable Advisor, you don’t want to discover ways to acknowledge what section of the wave we’re in or search for cyclicality, this course of can be totally accountable AU Gold EA. However I warn you, don’t count on to get a mountain of gold {dollars} immediately, the system is designed for the long run