The parade of commentators continues week in and week out to speak in regards to the recession in 2023. You will need to think about whether or not, in late 2021, any of them noticed a recession or a inventory market decline in 2022.

Then there was the inversion by the bond market in March/April, and everybody mentioned don’t be concerned because the recession will not be right here for not less than a yr. Even when that will have been true, the market will not anticipate it to indicate up within the knowledge after the actual fact. When you see two adverse quarters of GDP, we’re already in a single. The market seems to be ahead.

So now the brilliance is exhibiting via to name a continuation of the downtrend. I do not actually care when the recession ends. I suppose I do, however what I actually care about is when the inventory market suggests it isn’t going to worsen and begins rising based mostly on issues getting higher sooner or later.

Will these economists have a technique of discovering a backside near the inventory market backside? Will they wait till the 200-day transferring common is tilted up and worth has been above it for 3 months, they usually’ll nonetheless be on the lookout for the financial knowledge to start out enhancing? A pleasant 3-6 month lag or one thing? What’s the sign?

We are able to all focus on the totally different strategies for locating a backside and the way correct they have been. One whipsaw sign one time does not invalidate a system. You continue to want stops when investing if you would like your winners to outrun the losers. But it surely definitely helps to understand when the draw back danger is lower than the upside return and to be able to journey a pattern increased.

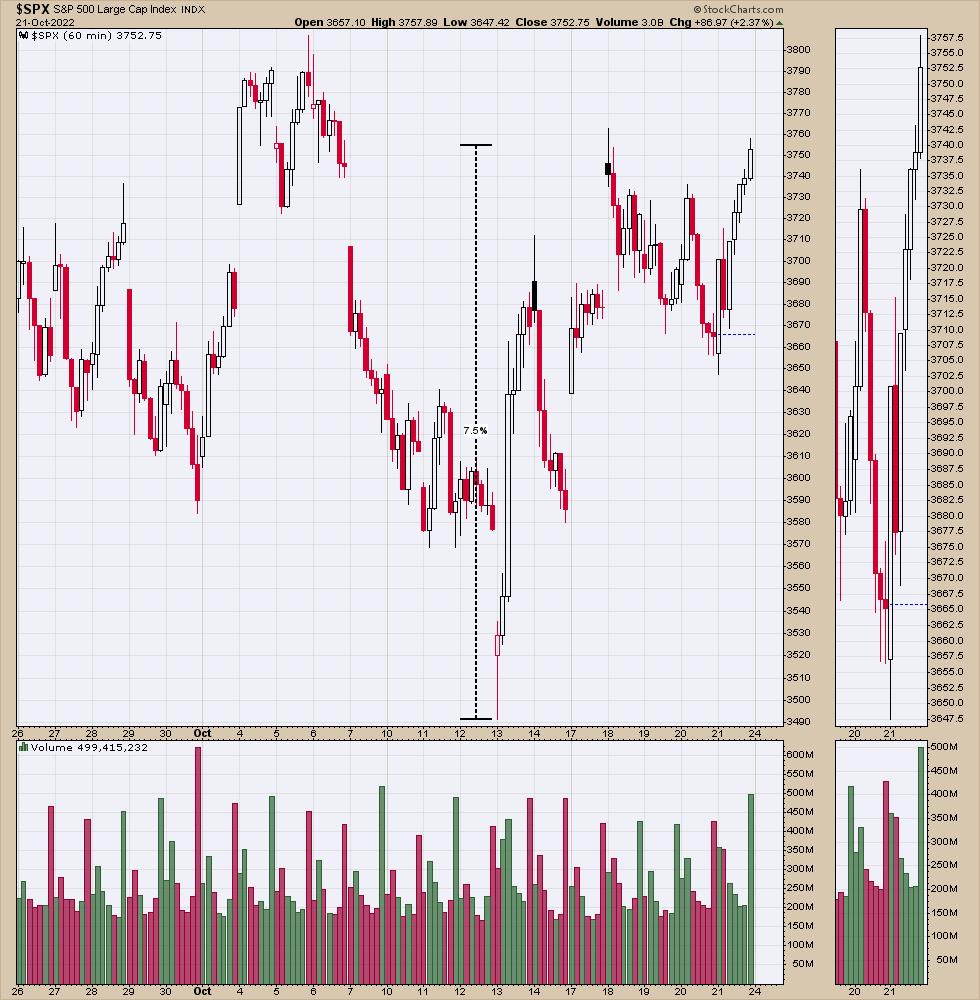

All that to say, my inner knowledge has been turning extra bullish for weeks, getting us prepared for this low. The Friday, October twenty first robust shut turned numerous different methods onto a purchase sign. Apparently, we’re already 7.5% off the lows. Good bounce up to now. The $SPX Index was down 28% on the lows of final Thursday, if my math is appropriate.

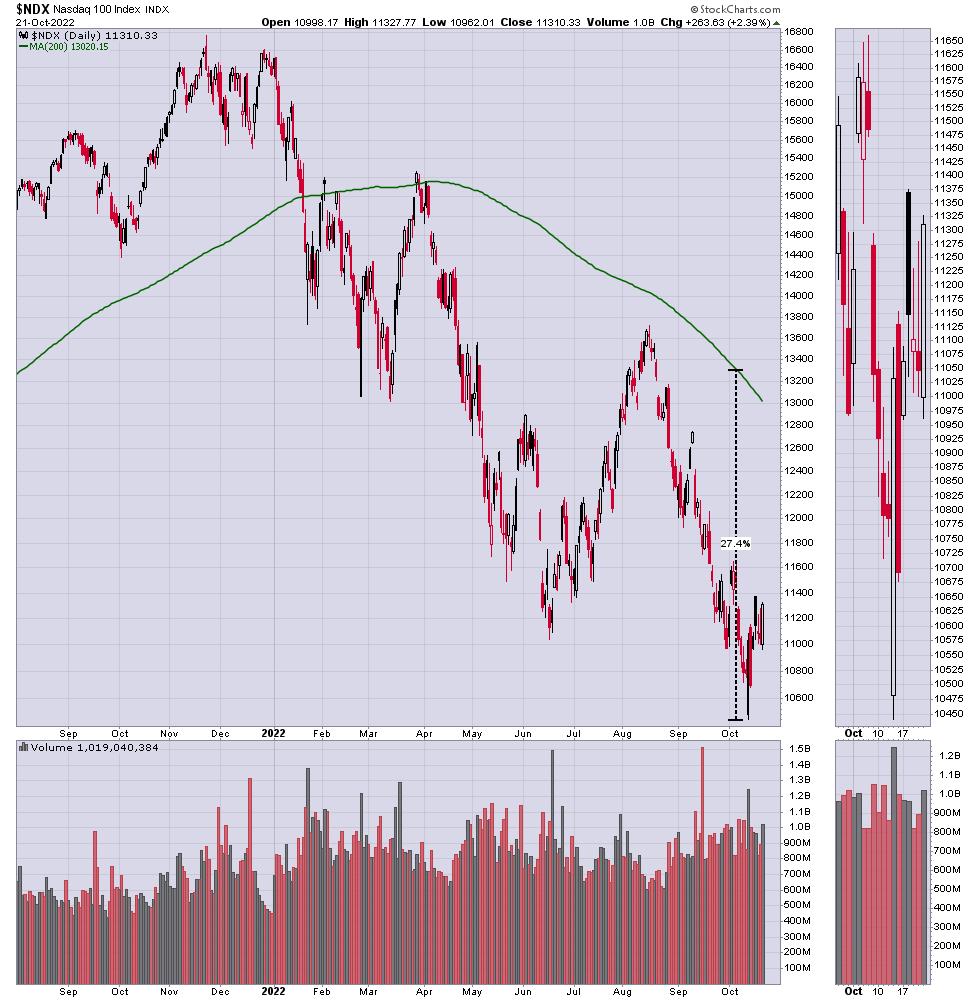

I observed that the Nasdaq every day chart wanted a 25% rally to succeed in the 200 DMA. That is an incredible yr for anybody, however the bears proceed to hammer on the draw back perspective. Sooner or later, even a reversion-to-the-mean commerce could make you some huge cash!

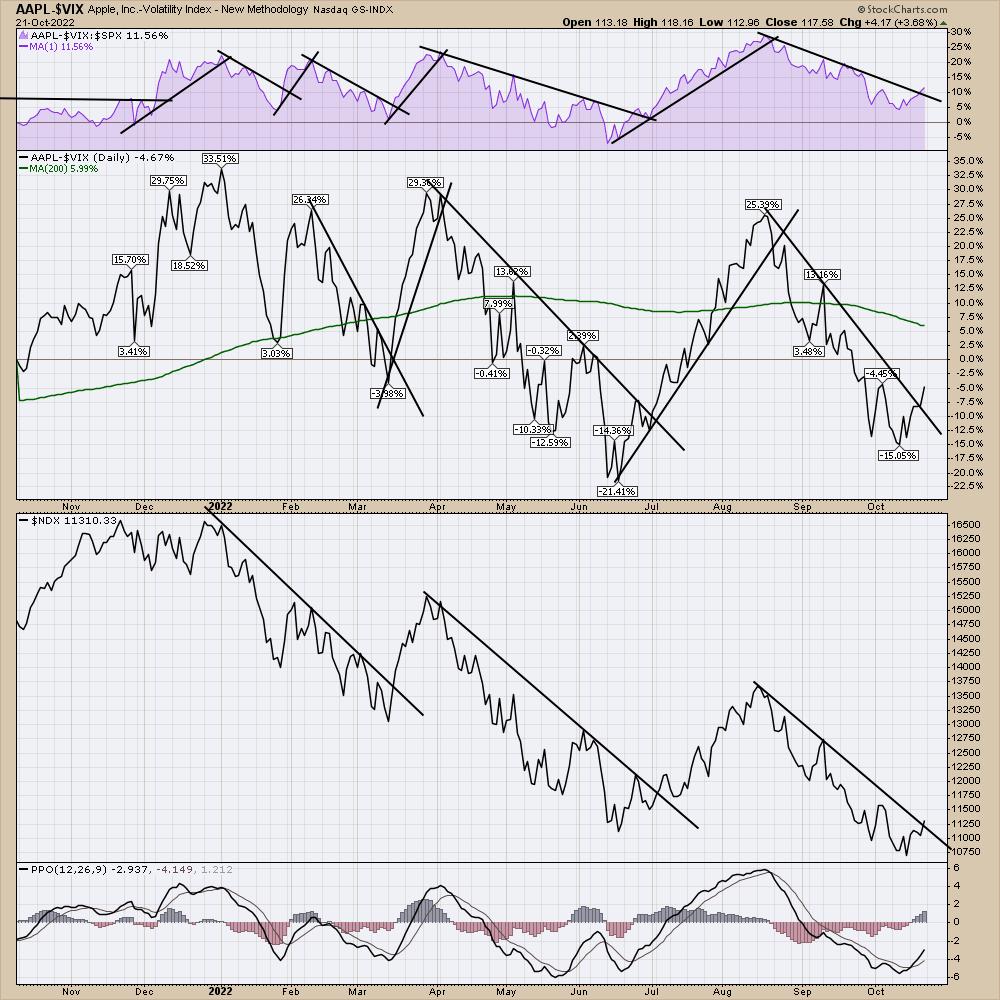

I produced this chart the opposite day, and located it fairly fascinating. As Apple is among the largest firms, I plotted Apple minus the $VIX. Two issues from this chart.

1) Because the VIX drops and Apple turns up for every rally, this unfold will change rapidly.

2) As a result of this distinction strikes quicker than only a worth transfer by Apple, I questioned if it might assist alert us when Apple is about to start out outperforming the $SPX by giving us an early sign. This might be the purple space. I just like the affirmation on all three charts. (With out deeply diving in, there’s a place on the 2 decrease charts that might have a shorter tighter pattern line being damaged in late Might, but it surely would not have confirmed on the highest panel.)

The rally in early June rolled over on the $SPX (decrease panel) and made decrease lows, trapping individuals lengthy if you happen to simply used these charts. Nothing is ideal, however a couple of distinctive charts can assist us see the adjustments in a brand new mild.

It is a totally different chart, however I like the way it’s a singular technique to monitor an essential know-how identify from a brand new view. Apple continues to be one of the vital dominant firms on the inventory trade.

I’ve a number of different charts I like to make use of, having constructed my library of charts on the StockCharts platform during the last twelve years. I will be sharing a few of them at an informational webinar subsequent week. The no-cost presentation will likely be on Tuesday, discussing the instruments for a way I spot lows and highs available in the market, for people who may be . Comply with this hyperlink to register. Nothing unsuitable with a bit of training for these inquiring minds; I would be grateful if you happen to select to affix in.

I do know the information is bearish, however a few of the charts are downright bullish. Have an excellent weekend and maybe we’ll share some optimism by month-end! Proper now, I really feel a bit of alone.

Greg Schnell, CMT, is a Senior Technical Analyst at StockCharts.com specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Primarily based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an lively member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).