The PCE Worth Index Excluding Meals and Power, also referred to as the Core PCE Worth Index, makes it simpler to see the underlying inflation development by excluding two classes – meals and power – the place costs are likely to swing up and down extra dramatically. The Core PCE Worth Index is carefully watched by the Federal Reserve because it conducts financial coverage.

The PCE Worth Index Excluding Meals and Power, also referred to as the Core PCE Worth Index, makes it simpler to see the underlying inflation development by excluding two classes – meals and power – the place costs are likely to swing up and down extra dramatically. The Core PCE Worth Index is carefully watched by the Federal Reserve because it conducts financial coverage.

It’s essential to organize for changes in Fed coverage and the credit score markets, and regulate your buying and selling accordingly, given the persistence of excessive inflation.

As seen above, The Fed-preferred inflation gauge (core PCE) remained elevated at 4.9% in August, as knowledge launched Friday stays far above the Fed’s purpose of two%. It’s worthwhile to consider how distinctive the selloff has been, why some anticipated it, and the way may all of us commerce higher sooner or later.

I’ve one particular car that I look at day by day, which tells me quite a bit about danger urge for food and future fairness returns. Anybody can have a look at this car and shortly see the place the market is headed.

In response to excessive inflation, central banks have aggressively raised charges shortly. The pace of those hikes will affect our economic system, and the present inventory market carnage is a aspect impact.

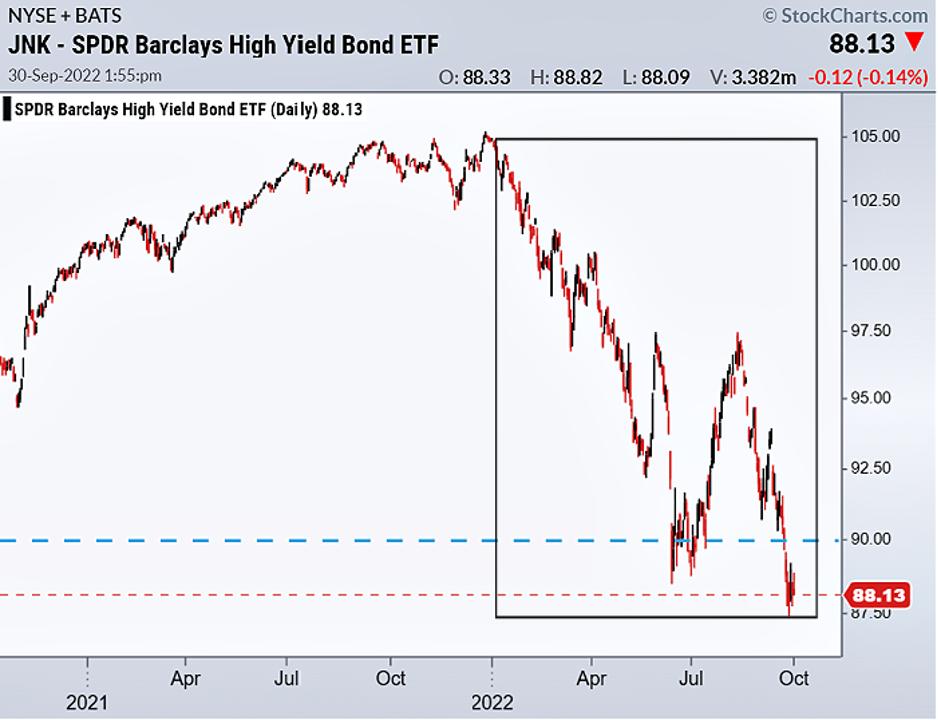

One of many many areas we watch are varied credit score markets and spreads. I comply with the junk bond market. It normally leads the inventory market, for the reason that credit score market is cyclical and tends to be inter-correlated with the economic system. Please discover the Bloomberg Excessive Yield Bond ETF (JNK) excessive yield company bond fund has taken out its earlier low in the summertime. The value tells us one thing essential concerning the inventory market’s route.

On new yearly lows, except we see that reverse, take it as a harbinger that the promoting in the entire market shouldn’t be over.

Please take a second to look at Mish’s newest media clips the place she outlines the macro all the way down to the micro. We additionally invite you to grow to be a MarketGauge subscriber for extra common evaluation. You’ll be able to join a free session with Rob Quinn, our Chief Technique Advisor, by clicking right here. He’ll enable you be taught extra about my top-rated danger administration buying and selling service.

Mish’s Upcoming Seminars

ChartCon 2022: October 7-Eighth, Seattle (FULLY VIRTUAL EVENT). Be part of me and 16 different elite market specialists for stay buying and selling rooms, hearth chats, and panel discussions. Study extra right here.

The Cash Present: Be part of me and lots of great audio system on the Cash Present in Orlando, starting October thirtieth operating through November 1st; spend Halloween with us!

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for day by day morning movies. To see up to date media clips, click on right here.

Mish talks hedges and inventory picks underneath the present atmosphere on this look on BNN Bloomberg.

Mish says sure to Palantir, no to Mattress, Tub and Past in this look on CNBC Asia.

Mish talks about just a few of her picks, going brief and why metals are in focus on this look on TD Ameritrade.

Mish talks placing your money to work in this look on Enterprise First AM.

Mish and Neil Cavuto talk about Central Financial institution credibility, US coverage and extra inflation to return on Fox Enterprise’s Coast to Coast. Until this can be a spectacular backside, preserving money is wise.

Learn Mish’s newest article for CMC Markets, titled “When to Put Money Again to Work“.

Mish talks about key averages, yields and commodities on this look on Bloomberg TV.

- S&P 500 (SPY): 353 assist, 358 resistance.

- Russell 2000 (IWM): 162 assist now, 168 resistance.

- Dow (DIA): 285 assist, 289 resistance.

- Nasdaq (QQQ): 262 assist, 268 resistance.

- KRE (Regional Banks): 57 assist, 60 resistance.

- SMH (Semiconductors): 182 assist, 188 resistance.

- IYT (Transportation): 194 assist, 198 resistance.

- IBB (Biotechnology): 114 assist, 119 resistance.

- XRT (Retail): 55.55 assist, 58.56 resistance.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Wade Dawson

MarketGauge.com

Portfolio Supervisor

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For almost 20 years, MarketGauge.com has supplied monetary info and schooling to hundreds of people, in addition to to massive monetary establishments and publications akin to Barron’s, Constancy, ILX Programs, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary individuals to comply with on Twitter. In 2018, Mish was the winner of the Prime Inventory Choose of the 12 months for RealVision.

Get your copy of Plant Your Cash Tree: A Information to Rising Your Wealth and a particular bonus right here

Get your copy of Plant Your Cash Tree: A Information to Rising Your Wealth and a particular bonus right here