Almost a 12 months after precisely forecasting this 12 months’s meltdown in world markets, billionaire investor Chamath Palihapitiya says he’s positioned to capitalize on a significant market rally.

In a brand new episode of the All-In Podcast, Palihapitiya says he’s bullish on the S&P 500 as he believes the inventory market index has carved a short-term backside.

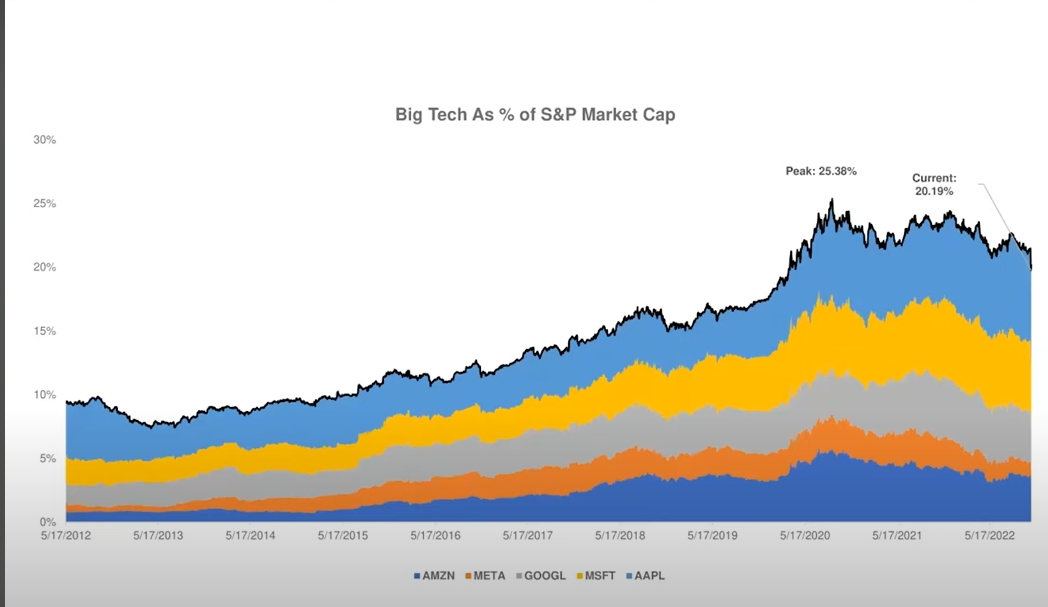

“What’s unbelievable on this chart is that when everyone talks about being lengthy on the S&P 500, it was all the time actually a proxy for being lengthy Amazon, Fb, Google and Apple. On the peak, in Might of this 12 months, $0.25 of each single greenback of the S&P 500 had been these 5 corporations.

We all the time mentioned the market backside might be when the ‘generals’ get shot… It seems to be just like the generals have been shot. What’s unbelievable is that this week each single a type of corporations apart from Apple actually reported fairly crappy earnings. They bought completely taken to the woodshed. The share of those corporations as a proportion of the S&P [500] is now off by 500 foundation factors. It’s down to twenty% but the markets are ripping greater as we speak…

I feel that is the purpose the place you must begin to get fairly constructive about the place issues are going as a result of if these things couldn’t deliver the market down, it’s arduous to see one thing apart from an exogenous occasion, most likely some Russia-Ukraine occasion, actually having a destructive influence. It appears fairly bullish for me.”

Crypto merchants usually hold an in depth eye on the S&P 500 as energy within the equities markets means that deep-pocketed buyers are allocating to risk-on property like shares and digital property.

Though Palihapitiya is bullish on the inventory market, he predicts the rally will probably be unsustainable. He says that he agrees with the feelings of fellow enterprise capitalist David Sacks who believes that the US will probably see an enormous recession subsequent 12 months as a result of influence of the Fed’s fast rate of interest hikes to the economic system.

“I feel the inventory market goes up. Then it’s going to return down as a result of what David mentioned is correct. However for the quick time period, this factor goes up. We’ve typically been positioned for it to go up and in some unspecified time in the future, we’ll reverse and place for it to return down, nevertheless it’s going up.”

I

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Test Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses chances are you’ll incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/Natalia Siiatovskaia/jdrv_art