It’s necessary to have a optimistic cash mindset as a result of it might assist lower stress and enhance your general well-being. It’s additionally step one to turning into financially safe right now and sooner or later.

Making a wholesome mindset begins while you set targets, develop higher cash habits and outline the place you need to go financially.

Listed below are 9 steps you may take to develop good monetary habits beginning right now.

1. Visualize Success

What works for athletes and different extremely profitable individuals can even give you the results you want and your cash habits.

Visualizing accomplishments is step one in making a optimistic cash mindset and reaching monetary well-being.

Listed below are some issues you may envision earlier than actualizing:

- There’s a four-figure steadiness in your financial savings account … and it’s rising!

- Your highest-interest bank card is paid off — that zero steadiness goes to really feel superb!

- You may have more money on the finish of every month to be charitable.

- A snug retirement will likely be a actuality as a result of your 401(okay) steadiness is rising along with your contributions and the utmost employer match out there.

- There’s cash every month for self-care so that you could get your nails achieved, play a spherical of golf, and even purchase easy issues like a brand new bathtub bomb or scented candle to get pleasure from at residence.

- You’re on trip at an attractive resort that you simply saved and paid for in full.

2. Be Hungry to Study

Regardless of the way you study — by doing, listening or studying — there are plain-talking monetary consultants who share their knowledge free of charge. Absorbing this sort of data frequently may also help you develop higher cash habits.

From private finance web sites and budgeting worksheets for good cash habits to the Prosper weblog and money-themed podcasts, a wealth of data is obtainable to reinforce your budding optimistic cash mindset.

Another assets you may take into account embody:

3. Eat Out Much less

Is it previous trend? Sure, however consuming breakfast at residence, making your individual espresso, and packing a lunch and snacks are some issues that profitable individuals with good cash habits do frequently.

This doesn’t imply you may by no means exit to eat with buddies or coworkers. Nonetheless, while you make your meals at residence and brew your individual espresso (or tea), you’ll save some huge cash and be extra financially well-off than ever earlier than.

4. Log Into Your Monetary Accounts Each Morning

It’s a small step whereas the espresso is brewing, however as they are saying, data is energy. Each morning, convey your self in control in your checking account, private mortgage, and bank card balances.

Maintain observe of incoming earnings, bills and payments in a spreadsheet. Doing so will eradicate surprises, cut back stress and provide you with a transparent monetary image to begin every day.

This fast and simple routine will go a great distance that can assist you make higher selections and develop a optimistic cash mindset.

5. Weigh Each Choice

It could appear obsessive, however when you consider it, practically each determination can have an effect on your monetary life. This is among the causes setting a rolling three-month finances might be useful.

When that sticking to your finances means you’ll have a specific amount to place into your financial savings account, you’ll begin questioning whether or not you want to spend more money on pointless gadgets.

6. Save First, Spend Later

Folks with optimistic cash mindsets and higher cash habits don’t make financial savings the final merchandise on their finances. As an alternative, put your financial savings targets at the beginning, and regulate the remainder of your life accordingly.

Do you need to purchase a home or automobile, take that dream trip or construct an emergency fund? Dedicate cash month-to-month to these financial savings targets first, then listing all of your mounted debt obligations (lease, automobile cost, groceries, utilities, web and telephone invoice, and many others.) earlier than lastly seeing how a lot you’ve left for takeout and extraneous spending.

7. Spend and Store Smarter

One of many higher cash habits you may have is to buy and spend smarter for every little thing you need and wish.

This implies utilizing coupons on the grocery retailer, comparability buying on-line for greater ticket gadgets, and checking the cashback out there by means of websites like Rakuten before you purchase.

Not solely will this additional ‘effort’ whereas buying saves you cash, however it might additionally assist cut back emotional and impulse purchases, which is able to prevent much more cash!

8. Pay Down Your Credit score Playing cards Each Month

Monetary stresses most individuals face are their bank card payments. If you’ll use bank cards, which might be useful to maximise cashback bonuses or journey rewards, it’s essential that you simply study the best way to handle bank card debt.

Most significantly, meaning spending solely what you may afford to pay. Paying on time won’t solely enhance your credit score, however it’ll additionally maintain late charges away, prevent cash and cut back your monetary stress.

9. Consolidate Your Debt

Studying higher cash habits right now is essential to a happier life. Nevertheless, you should still be reckoning with errors out of your previous.

When you’ve got previous debt unfold over a number of bank cards, medical payments and different debt, consolidating that debt into one mortgage with one month-to-month cost at a decrease rate of interest might have substantial monetary and emotional advantages.

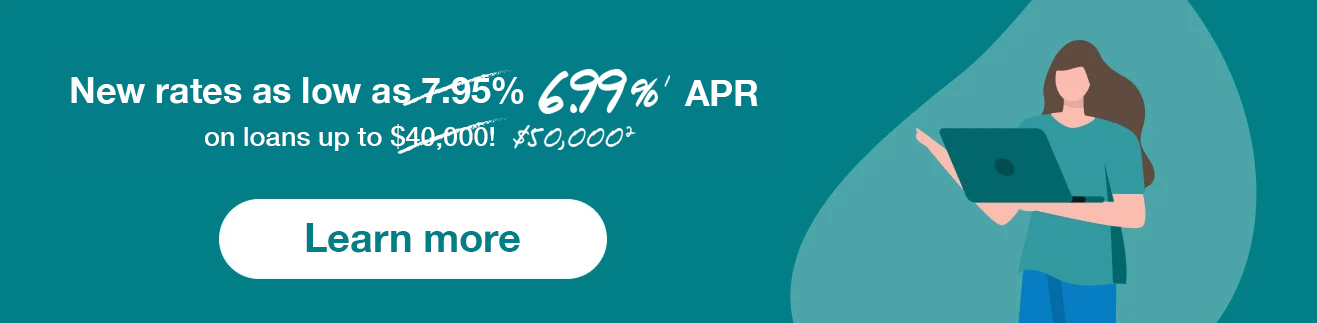

Learn extra

1 For instance, a three-year $10,000 private mortgage would have an rate of interest of 11.74% and a 5.00% origination payment for an annual share charge (APR) of 15.34% APR. You’d obtain $9,500 and make 36 scheduled month-to-month funds of $330.90. A five-year $10,000 private mortgage would have an rate of interest of 11.99% and a 5.00% origination payment with a 14.27% APR. You’d obtain $9,500 and make 60 scheduled month-to-month funds of $222.39. Origination charges differ between 1% and 5%. Private mortgage APRs by means of Prosper vary from 6.99% to 35.99%, with the bottom charges for essentially the most creditworthy debtors.

2 Eligibility for private loans as much as $50,000 relies on the data supplied by the applicant within the software type. Eligibility for private loans just isn’t assured, and requires {that a} ample variety of buyers commit funds to your account and that you simply meet credit score and different circumstances. Check with Borrower Registration Settlement for particulars and all phrases and circumstances. All private loans made by WebBank.